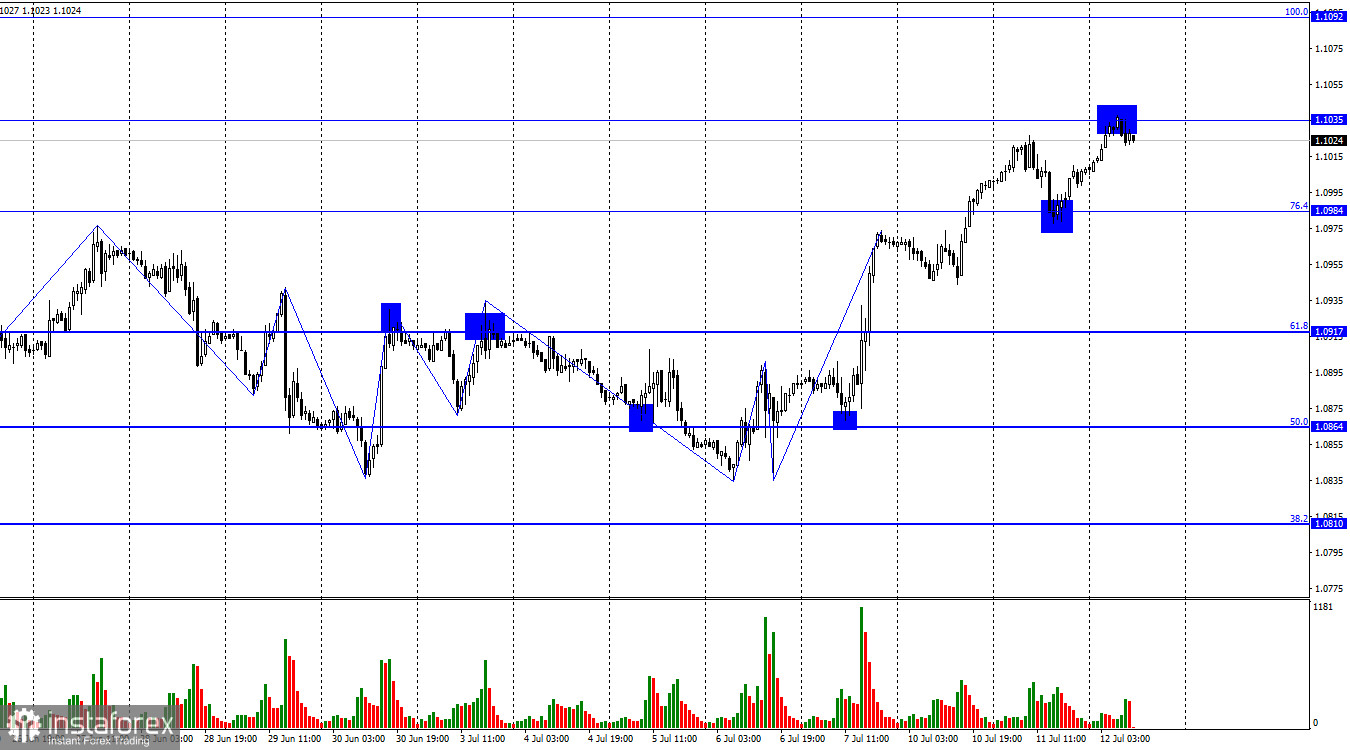

On Tuesday, the EUR/USD pair returned to the corrective level of 76.4% (1.0984), which it had previously surpassed, rebounded from it, reversed in favor of the euro, and rose to 1.1035. A rebound from this level will favor the US currency and another return of the pair to the 1.0984 level. Consolidating above the 1.1035 level will increase the likelihood of growth continuing towards the next Fibonacci level of 100.0% (1.1092).

The waves currently indicate one thing - a "bullish" trend. Each subsequent peak is higher than the previous one, and each subsequent low is higher than the last. There is no reason to expect the end of the "bullish" impulse. We need a break of the last low or at least no breaking of the last peak to predict that. Thus, the 1.1035 level is likely to be overcome.

However, the information background will be strong today, although traders' attention will be drawn to only one report - inflation in the US. Therefore, during the release of this report, any movement of the pair can be expected.

Meanwhile, opinions within the ECB are diverging. Christine Lagarde and the hawkish wing of the Monetary Policy Committee insist on continuing policy tightening. Villeroy de Galhau and the dovish wing anticipate the end of the rate hike process. The European economy continues to teeter on the brink of recession, with the last two-quarters of GDP being negative. Historically, the ECB has not been used to raising rates to the levels of the Fed or the Bank of England, so there is reason to believe that the tightening will be completed after 1-2 hikes. The European currency may lose trader support soon. It may fall today due to the US inflation report.

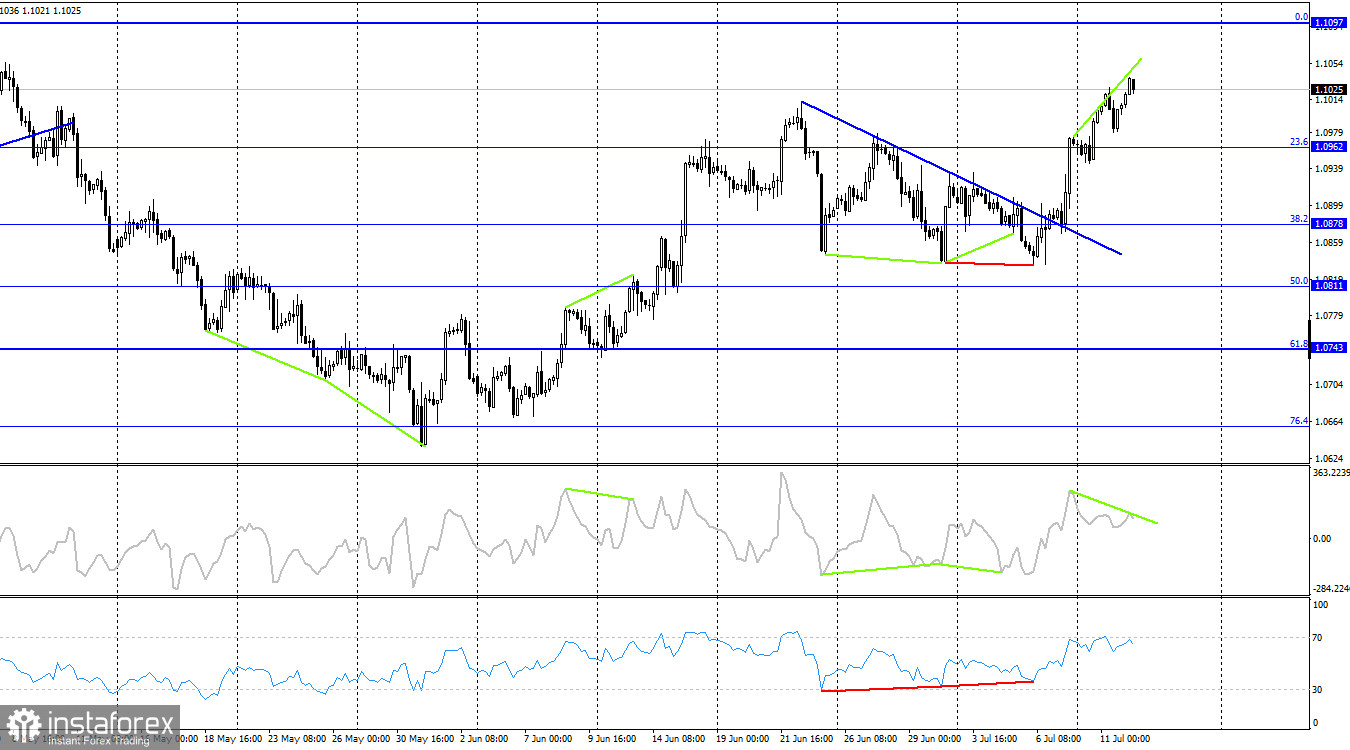

On the 4-hour chart, the pair has consolidated above the Fibonacci level of 23.6% (1.0962). Thus, the growth process may continue toward the next corrective level of 0.0% (1.1097). As I mentioned, traders ignored the Fed's hawkish rhetoric and didn't pay attention to the ZEW indices in the European Union yesterday, either. The CCI indicator is currently on the verge of a bearish divergence, which could coincide with the release of the US inflation report and trigger a pair fall.

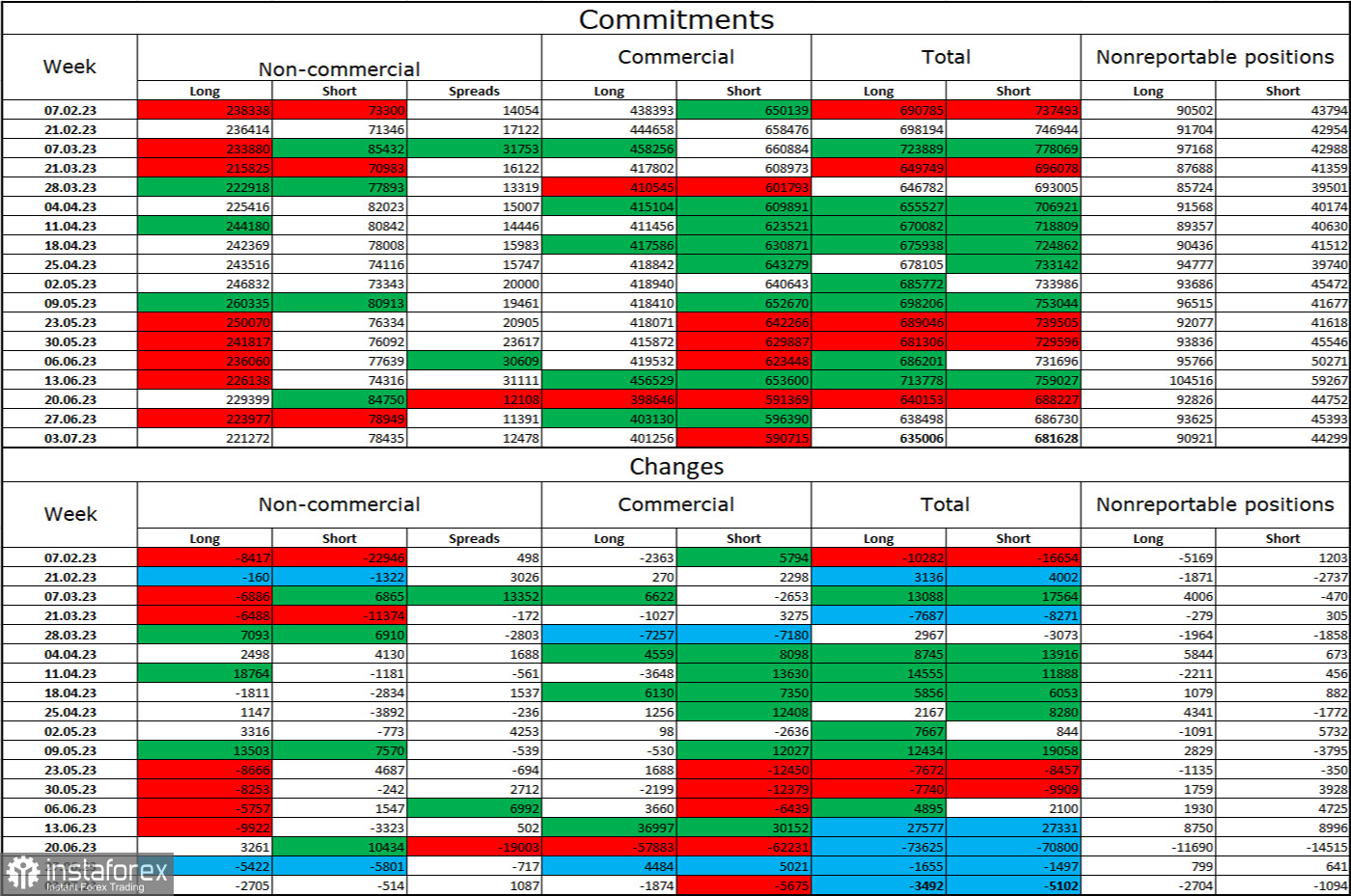

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 2705 long and 514 short contracts. The sentiment among large traders remains "bullish," but it is slowly weakening. The total number of long contracts speculators hold is now 221,000, and short contracts are just 78,000. The "bullish" sentiment is maintained, but I think the situation will continue to change in the opposite direction soon. The European currency has been declining slightly more often than rising in the past two months. The high number of open long contracts suggests that buyers might start closing them soon (or have already started, as indicated by recent COT reports) - there is currently a strong bias toward bulls. These numbers allow for a new decline in the euro soon.

News calendar for the USA and the European Union:

USA - Consumer Price Index (CPI) (12:30 UTC).

USA - "Beige Book" (18:00 UTC).

The economic event calendar for July 12th contains only two entries. However, the inflation report in the US is extremely important, so the impact of the news background on traders' sentiment for the rest of the day could be strong.

EUR/USD forecast and trading advice:

Minor sales may occur when rebounding from the 1.1035 level on the hourly chart with the target of 1.0984. The trend is currently "bullish," so a strong decline in the pair should not be expected. But today, the situation is somewhat different. The inflation report could cause a sharp decline. I advised buying the pair after closing above the trend line on the 4-hour chart and when closing above the 1.0962 level with targets of 1.1035 and 1.1097. New purchases are possible when closing above 1.1035.