US stock index futures are trading in positive territory while the US dollar is losing ground. At the same time, the yield on US Treasury bonds has also declined. All of this is happening in anticipation that a slowdown in US inflation will make further interest rate hikes less likely this autumn. However, the Fed has given no signals yet that it is planning to abandon a rate hike in July and is unlikely to do so.

The US dollar index has fallen to a three-month low, and demand for risk assets such as the euro and the dollar has increased ahead of the US consumer price data, which will be published soon. All attention is focused on core inflation, the reduction of which in the face of pressure from the Federal Reserve's monetary policy will allow investors to breathe a sigh of relief and continue the summer rally in the stock market. Futures on the S&P 500 and Nasdaq 100 have risen by approximately 0.3% each. The Stoxx Europe 600 index has also been rising for the fourth consecutive session.

As we mentioned earlier, slowing inflation in the United States may be crucial for policymakers in the coming months. In recent weeks, officials have warned that higher rates will be required to slow the growth of the consumer price index to the Federal Reserve's target level of 2%. However, there have also been talks about a high risk of a recession if the central bank does not halt its tightening policy. The markets have already priced in a 25-basis-point increase at the meeting on July 26, but it is still hard to predict the outcome.

In Asia, stock indexes were trading mixed, with a decline in Japan and a rise in Australia and India. The Chinese stock market has risen on data showing strong credit expansion in the world's second-largest economy. Chinese technology companies have also been rising for the third consecutive day. The rise of the yen above the key level of 140 is also in focus, partly due to speculation that the Bank of Japan will change its policy at the end of this month.

As for commodities, oil prices stabilized on Wednesday after a rise due to signs that oil production in Russia is declining, signaling that the market's supply glut may be coming to an end. Iron ore and industrial metals have also gained value.

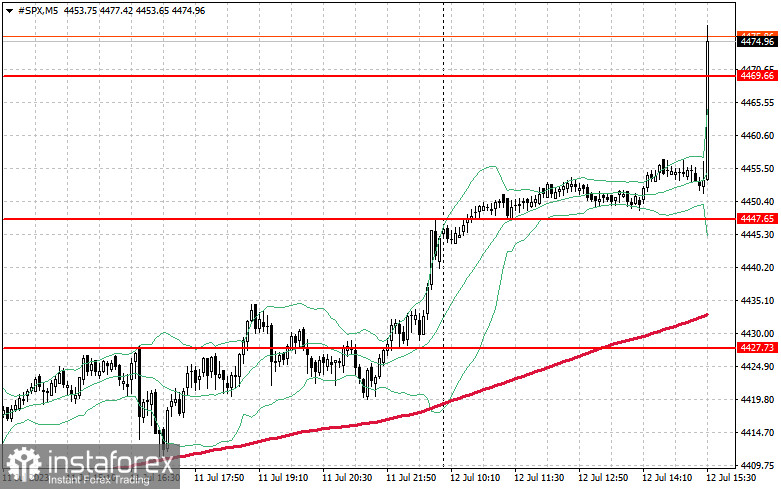

As for the technical outlook for the S&P 500, the index is still in demand. Buyers have a chance to continue the upward trend but they need to do their best to push the price above $4,469. From here, the price may surge towards $4,488. Another important task for the bulls would be to maintain control above $4,515, which would strengthen the bullish market. If the index declines amid lower risk appetite caused by high inflation, buyers must assert their strength around $4,447. Its breakout will quickly push the price back to $4,427 and pave the way to $4,405.