Futures on US stock indices are trading at new annual highs amid a rise in market participants' risk appetite. Yesterday's inflation data in the US contributed to this. S&P 500 futures rose by 0.3%, while the tech-heavy NASDAQ showed a 0.4% increase.

European indices also continued their rally on Wednesday, with the Stoxx 600 index rising by 1.5%. Shares of Swatch Group AG, the maker of Omega and Longines watches, jumped by more than 6% as the opening of China contributed to profit growth.

Investors are returning to stocks, no longer fearing higher interest rates from the US Federal Reserve. However, one should remember the potential problem of a recession, although the risk of its occurrence has significantly decreased. It is worth noting that the inflation rate in the US has fallen to a two-year low, and today traders are awaiting the Producer Price Index report, which is expected to show a decline compared to last year.

The main question is whether the market will continue to rely on new data on weak inflation in the US or if everything is already priced in and further upside potential will be limited. The answer will come with the earnings season for major global companies, which is expected to begin soon.

The MSCI Asia Pacific index reached its highest closing level in over three weeks, with stocks in Hong Kong recording one of the largest upward surges. Chinese Premier Li Keqiang met with top executives of firms such as Alibaba Group Holding Ltd. and ByteDance Ltd., indicating that the government is easing its crackdown on the technology sector.

As for the currency market, the dollar is poised for further losses as the era of high-interest rates in the US is ending. According to data from the Commodity Futures Trading Commission collected by Bloomberg, hedge funds have become net sellers of the dollar for the first time since March.

The British pound extended its rally for the sixth consecutive day, remaining above the $1.30 level it reached on Thursday for the first time since April 2022 after data showed that the UK economy contracted less than expected in May.

On the whole, bond yields declined as investors abandoned bets that the Federal Reserve would raise borrowing costs again this autumn. The yield on two-year Treasury bonds, more sensitive to inevitable policy changes, fell by around six basis points to 4.68% after dropping 13 basis points on Wednesday. The yield on 10-year German bonds dropped by eight basis points to 2.49%.

Crude oil remained stable in other markets even after the International Energy Agency lowered its demand growth forecast. Iron ore prices rose as hopes increased that Beijing would provide additional economic support to the besieged real estate sector.

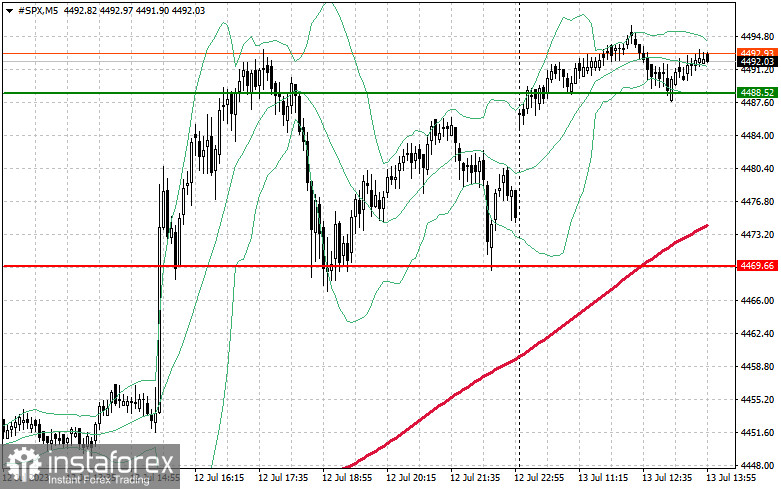

As for the technical outlook for the S&P 500, demand for the index persists. Buyers have a chance to continue the uptrend, but bulls need to push above $4488 with all their might. From this level, a jump to $4515 could occur. An equally important task for the bulls will be maintaining control above $4539, strengthening the bull market. In the event of a downward movement due to decreased risk appetite, buyers must assert themselves around $4488. A breakout will quickly push the trading instrument back to $4469 and pave the way to $4447.