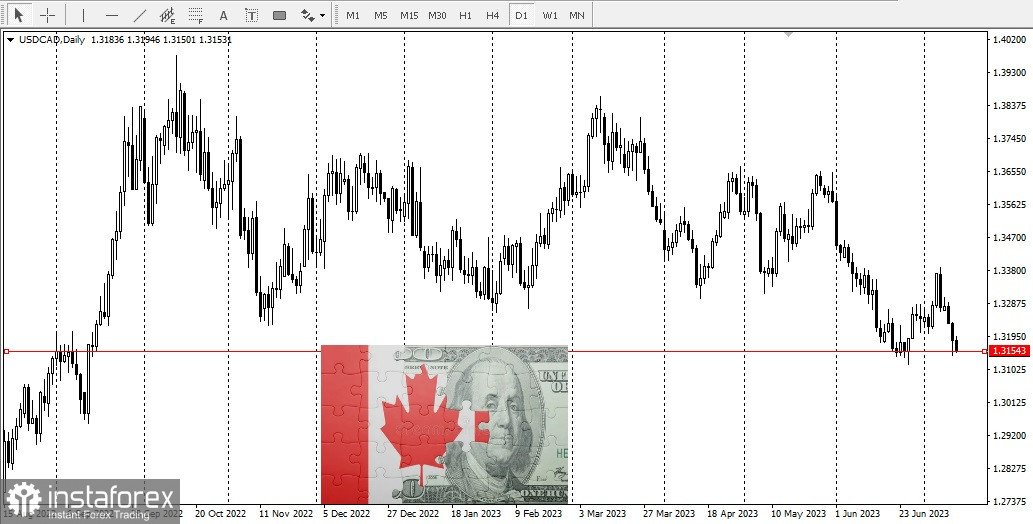

One reason could be pointed to the Bank of Canada's 0.25% rate hike yesterday, which brought interest rates to a 22-year high of 5%. The central bank also stated that such an aggressive policy may continue in the future, as there remains a threat that inflation will not reach the 2% target level.

Crude oil prices, hitting their highest level since the beginning of May, also boosted the Canadian dollar, while prevailing sales and weakening of US dollar exerted downward pressure on the pair. Accordingly, the US dollar index dipped to its lowest level today, returning to the levels of April 2022. Many investors and traders, relying on inflation indicators, believe that the Federal Reserve will soon end its rate hike cycle, which will lead to the further reduction of US Treasury yields, thereby putting pressure on dollar. But the Federal Reserve plans at least two more rate hikes, one of which could be as early as during the July FOMC meeting.

Therefore, the current situation with dollar will not last long, since rate hikes always lead to the strengthening of the currency. Upcoming statistics on the US economy, including the Producer Price Index (PPI) and weekly jobless claims, which will be published today, may give off a similar effect.