"Sell everything against the dollar!" This is the strategy leading asset managers are sticking to. And it must be acknowledged that it works! The USD index crashed to a 15-month low amidst slowing American inflation to its lowest points in the last two years. Its growth in 2021–2022 agitated politicians, the public, and financial markets. Now it seems that the worst is already behind. For the American currency, on the contrary, the best times are in the past. And this is great news for EUR/USD bulls.

Everything new is well-forgotten old. In July, the classic has returned to Forex. The increase of the federal funds rate by 500 bps from the beginning of the cycle will lead the economy to recession. This will force the Fed to make a "dovish" pivot. The chances of this happening in 2023 have risen to 24%, while the probability of borrowing costs rising to 5.75% has decreased to 16%. If we consider the current interest rate levels, assuming it will rise to 5.5% in July, the risks of a monetary policy easing will soar to 84%! Against this backdrop, the U.S. dollar simply has to decline. It is no wonder that hedge funds have become net sellers of the dollar for the first time since March.

The dynamics of the USD index and speculative positions on the U.S. dollar

The EUR/USD rally is due not only to market belief in the end of the Fed's monetary restriction cycle and the return of talks about a "dovish" pivot. American exceptionalism is at stake. For most of the year, the U.S. economy outpaced its European and Chinese counterparts. However, sooner or later, the aggressive increase in the federal funds rate will begin to affect GDP. As a result, assets nominated in the States will no longer look attractive in the eyes of non-residents. Capital outflow from the U.S. will accelerate the fall of the USD index.

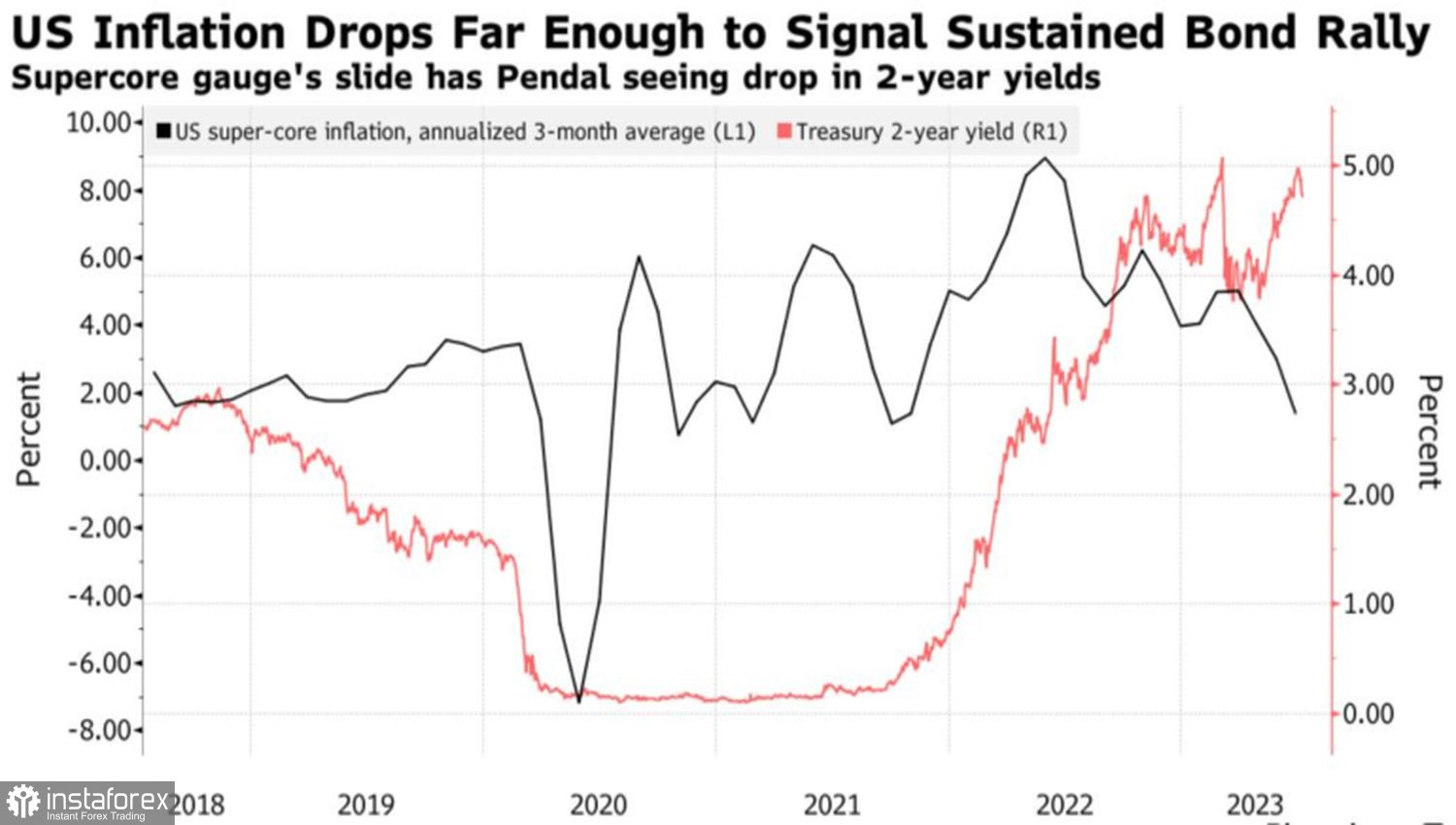

A typical example is Treasury bonds. According to investment company Pendal, the yield of 2-year debt securities will fall from the current 4.7% to 4% in the medium term. The rapid return of inflation to the 2% target and the market's underestimation of the prospects for the Fed's "dovish" pivot are the main reasons. Lower bond rates will reduce their appeal and will contribute to the further weakening of the U.S. dollar.

The dynamics of inflation and yield of U.S. bonds

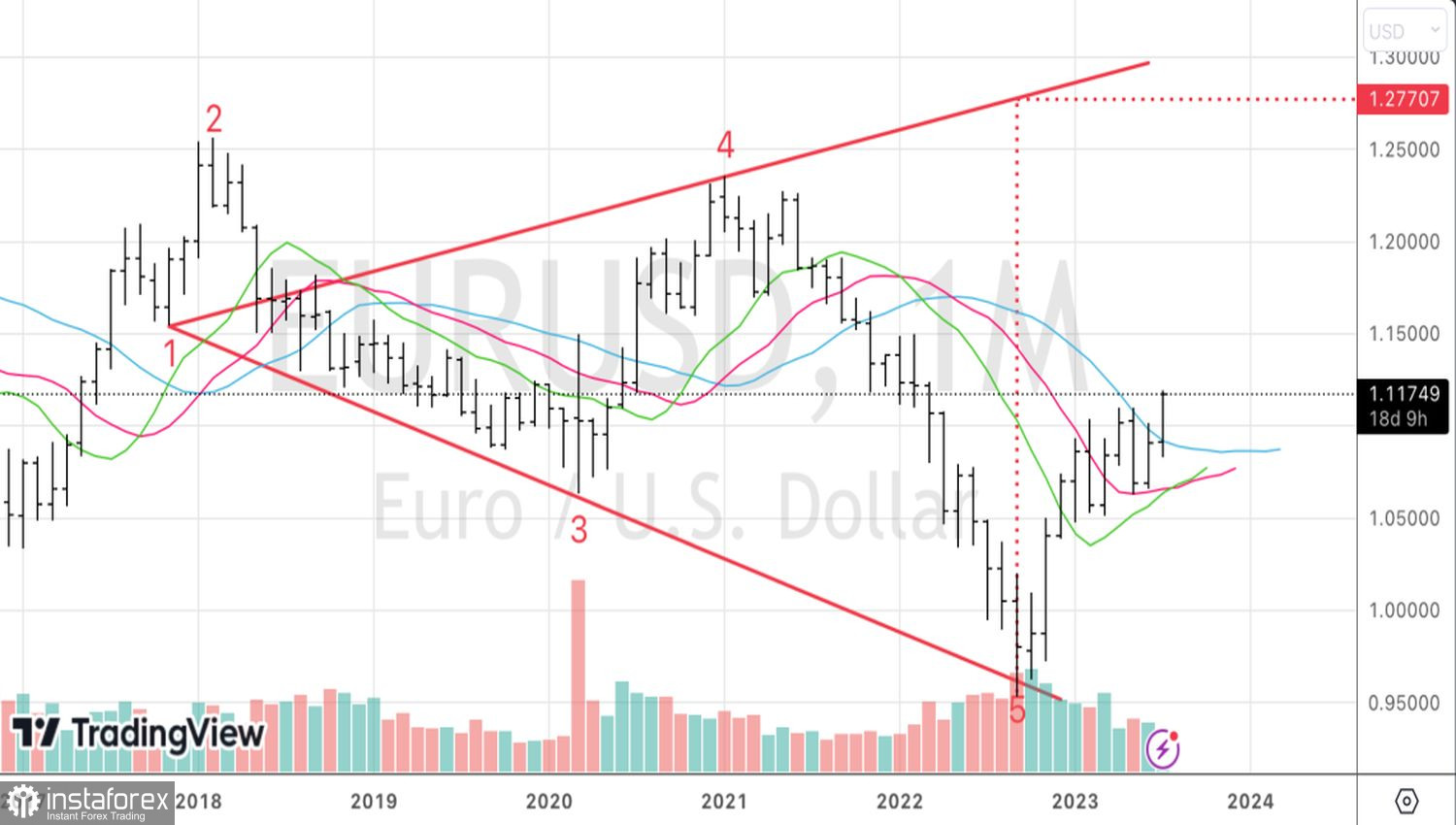

Thus, the drivers of the current EUR/USD rally are in the United States. The loss of American exceptionalism, capital outflow, the end of the Fed's monetary tightening cycle with a subsequent transition to its loosening faithfully serve the bulls of the main currency pair. It grows even against the background of the weakness of the Eurozone economy and modest expectations for the ECB's deposit rate.

Technically, the upward trend for EUR/USD has recovered and is gaining momentum. Meanwhile, on the weekly chart of the analyzed pair, the Wolfe Wave reversal pattern continues to be implemented. Its target in the form of a projection from point 5 to line 1-4 is located near the mark of 1.277. The potential for the rally is enormous. We continue to buy the euro.