Analysis of Thursday trades:

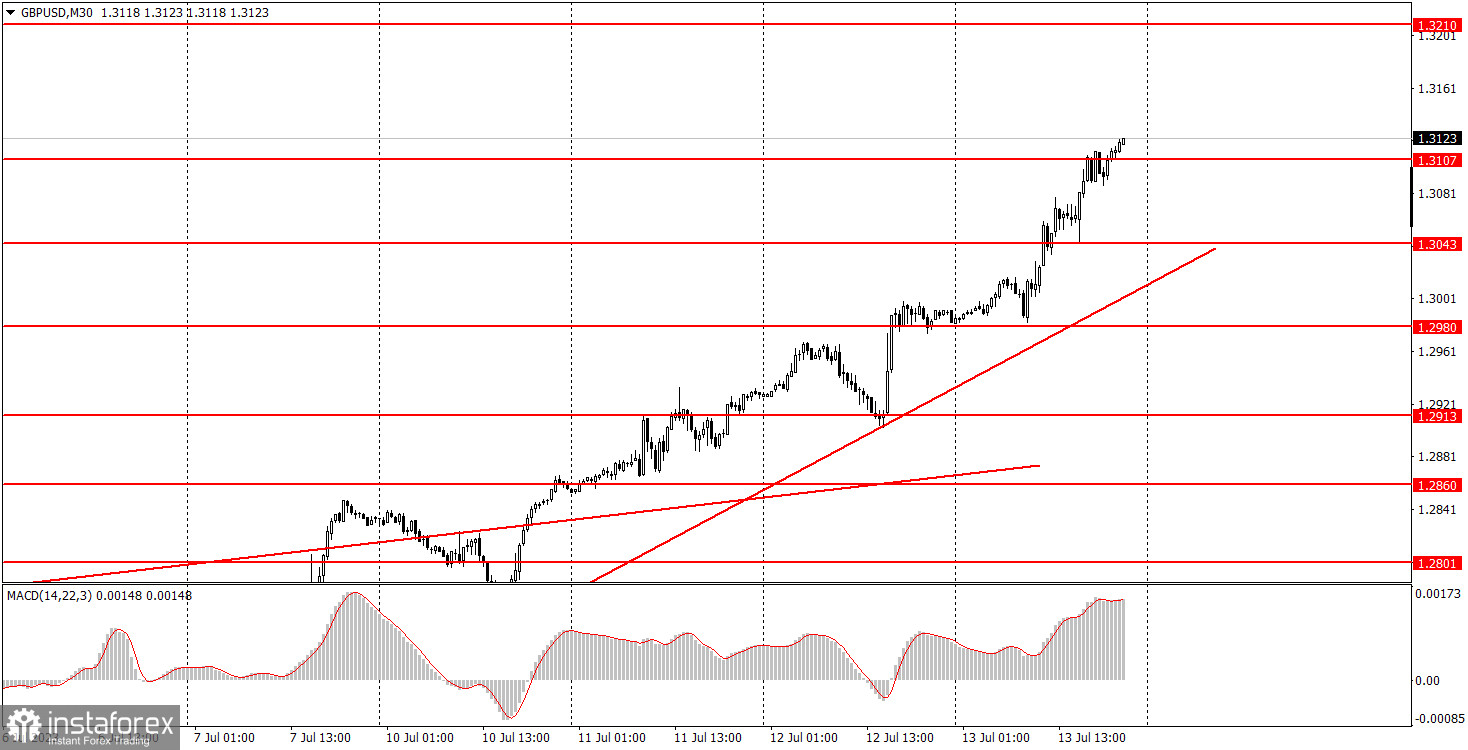

GBP/USD 30M chart

On Thursday, the GBP/USD pair continued its upward movement, seemingly unaffected by the macroeconomic backdrop. However, today there were notable developments to take into account. While the statistics in the United States were of no importance, with report values not deviating significantly from the forecasts, the UK released a disappointing report on industrial production and a weak GDP report for May. In fact, even the GDP report could be considered of secondary importance. If the pair had remained stagnant throughout the day, it would have been justified. But the pound kept rising. It begs the question: what was the basis for its upward momentum when both reports indicated negative values?

Nonetheless, a new ascending trend line has emerged, signaling intensification of the upward trend. The ascending channel remains well below. The British currency is seen rising every other day, and while the movement presents favorable trading opportunities, it is neither logical nor justified.

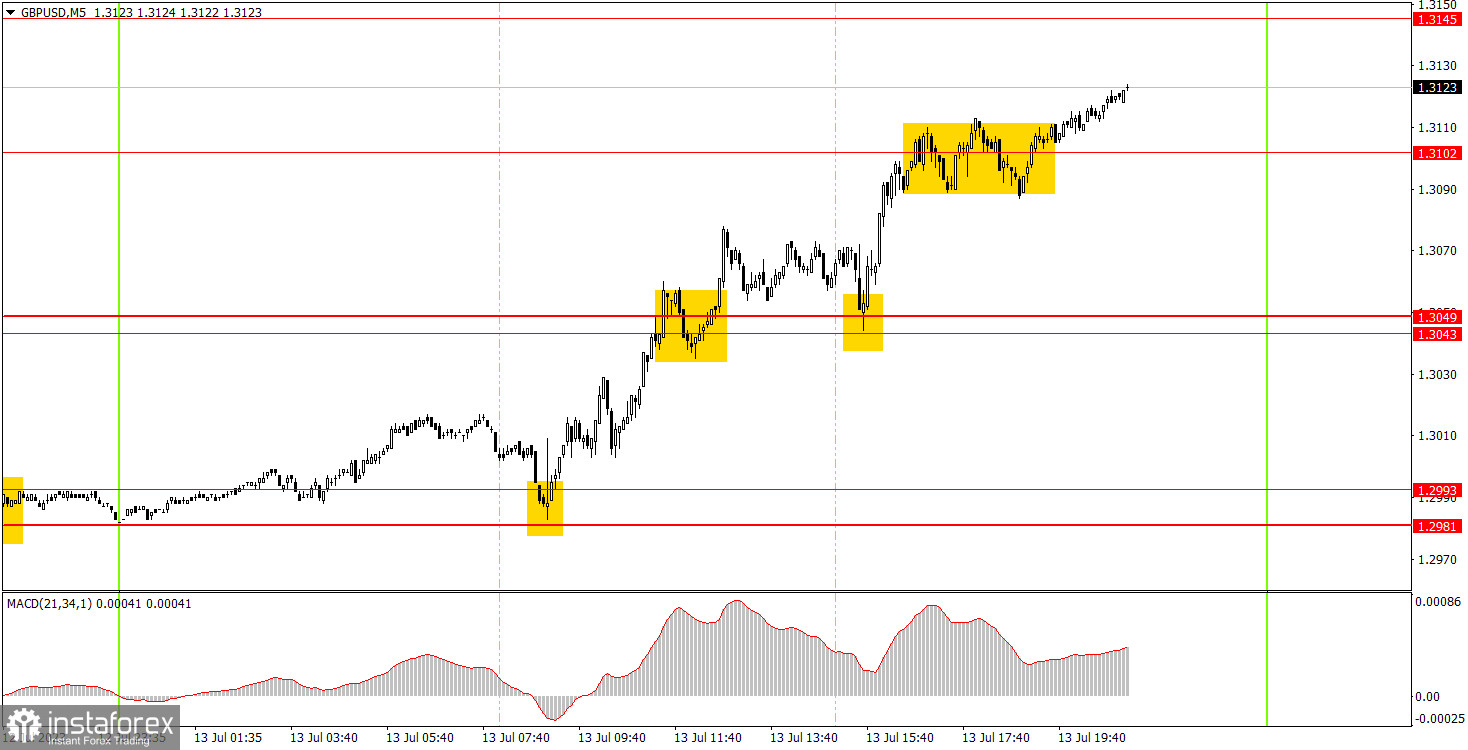

GBP/USD 5M chart

On Thursday, the pair started rising overnight, but at the beginning of the European trading session, it retraced to the area of 1.2981-1.2993 before bouncing off, forming the first buy signal. This presented an opportunity for novice traders to enter long positions. Subsequently, two more buy signals emerged near the area of 1.3043-1.3049. Ultimately, the pair climbed to the level of 1.3102, where long positions could be closed with a profit of 100 pips. Meanwhile, the pair continues its upward movement.

A trading strategy for Friday:

On the 30-minute timeframe, the GBP/USD pair continues to form an ascending trend. Even when there is no fundamental background, or it is negative, the pound can show (and has shown!) growth. Therefore, from a purely technical perspective, the upward movement of the British currency can persist indefinitely. However, the fundamental factors remain highly questionable (except for yesterday). On the 5-minute timeframe, the key levels for tomorrow are: 1.2779-1.2801, 1.2848-1.2860, 1.2913, 1.2981-1.2993, 1.3043-1.3049, 1.3102, 1.3145, 1.3210, 1.3241, and 1.3272. Once the price moves 20 pips in the correct direction after entering a trade, the stop-loss can be set to breakeven. On Friday, there are no important releases planned in the UK. In the US, only the University of Michigan's consumer sentiment index is scheduled. But what difference does it make if important events are planned or not when the pair continues its uninterrupted upward movement.

The basic principles of a trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.