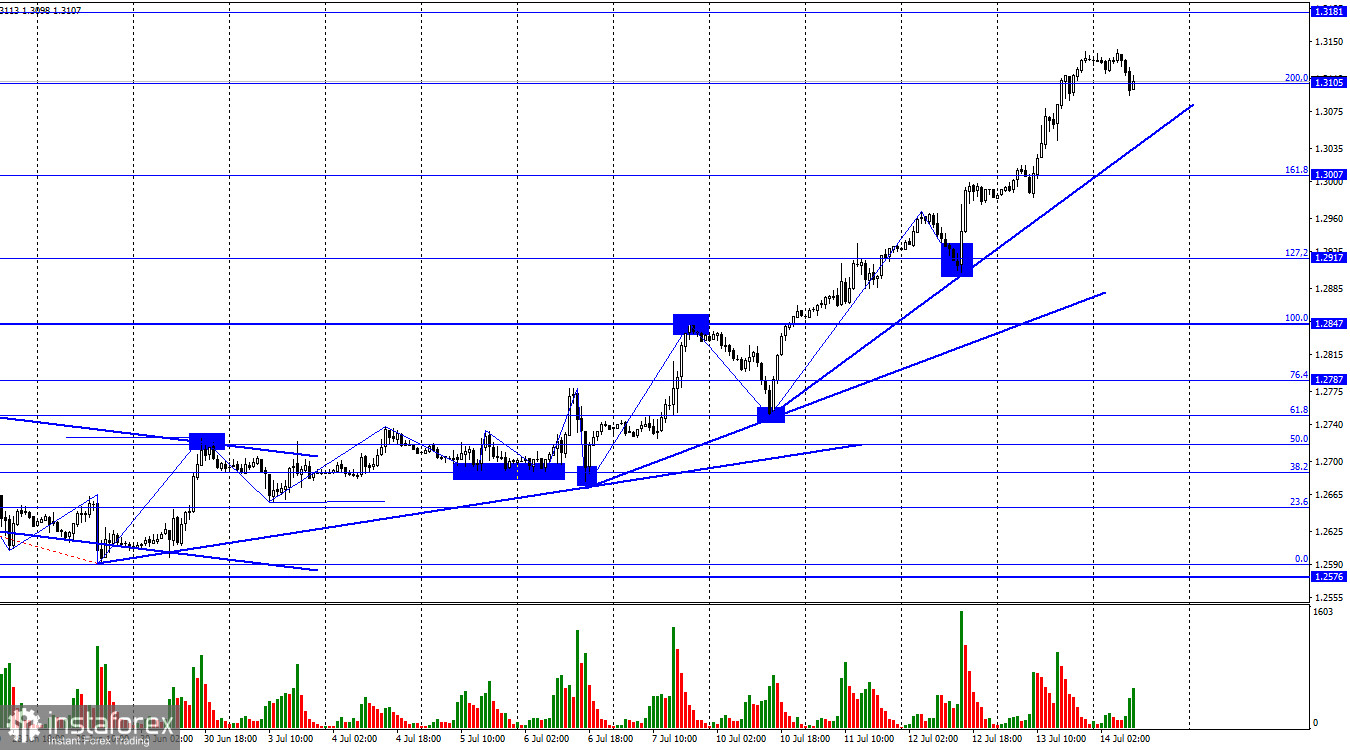

On the hourly chart, the GBP/USD pair on Thursday continued the growth process and secured above the corrective level of 200.0% (1.3105). Thus, new growth prospects are opening up for it towards the level of 1.3181. The movement is getting stronger day by day, and the reasons why the British pound is growing are becoming increasingly difficult to define.

I remember about American inflation, which turned out to be even lower than traders calculated, but didn't we see too much of a dollar drop because of one report? I remind you that traders expected a slowdown of 0.9%, because of which the dollar came under pressure from the beginning of the week. The actual value was 3.0%, and after the report, traders continued to sell the dollar merely due to a 0.1% discrepancy. In my opinion, the reason lies in the market's strong "bullish" mood, and the report on American inflation could have caused growth only on Wednesday.

I have already formed three trend lines, each increasing the slope and intensifying the "bullish" trend. It is not possible to count waves now, as there are no waves down or they are extremely weak. There are no signs of the end of the "bullish" trend. Traders do not have valid reasons to continue buying the pound either. This week, only the report on GDP in the UK can be counted as a small plus for the pound, and even that is a stretch. The British economy contracted less than expected in May, but it is unlikely that this is why we have been seeing growth for the fifth day in a row. The other reports from Britain were weaker than traders' expectations, but there is no such concept as a "fall of the pound" this week.

A fall in the pair can be expected at least when a consolidation under the trend line is completed.

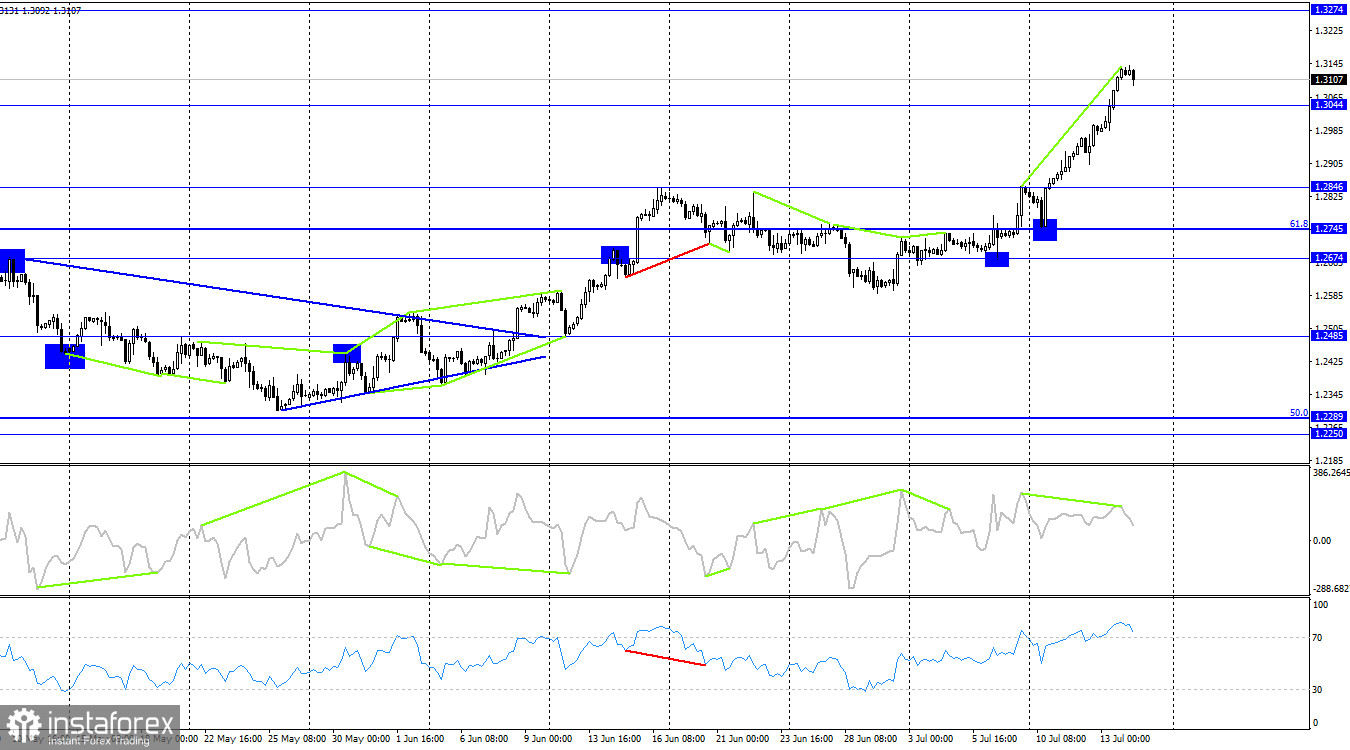

On the 4-hour chart, the pair rebounded from the 1.2745 level and secured above the 1.3044 level. Thus, the growth of quotes can be continued in the direction of the next level of 1.3274. A "bearish" divergence is looming on the CCI indicator, which may indicate the beginning of forming a "bearish" wave on the hourly chart. But this divergence can still be canceled. The securing of quotes from the level of 1.3044 will also allow counting on at least a small drop.

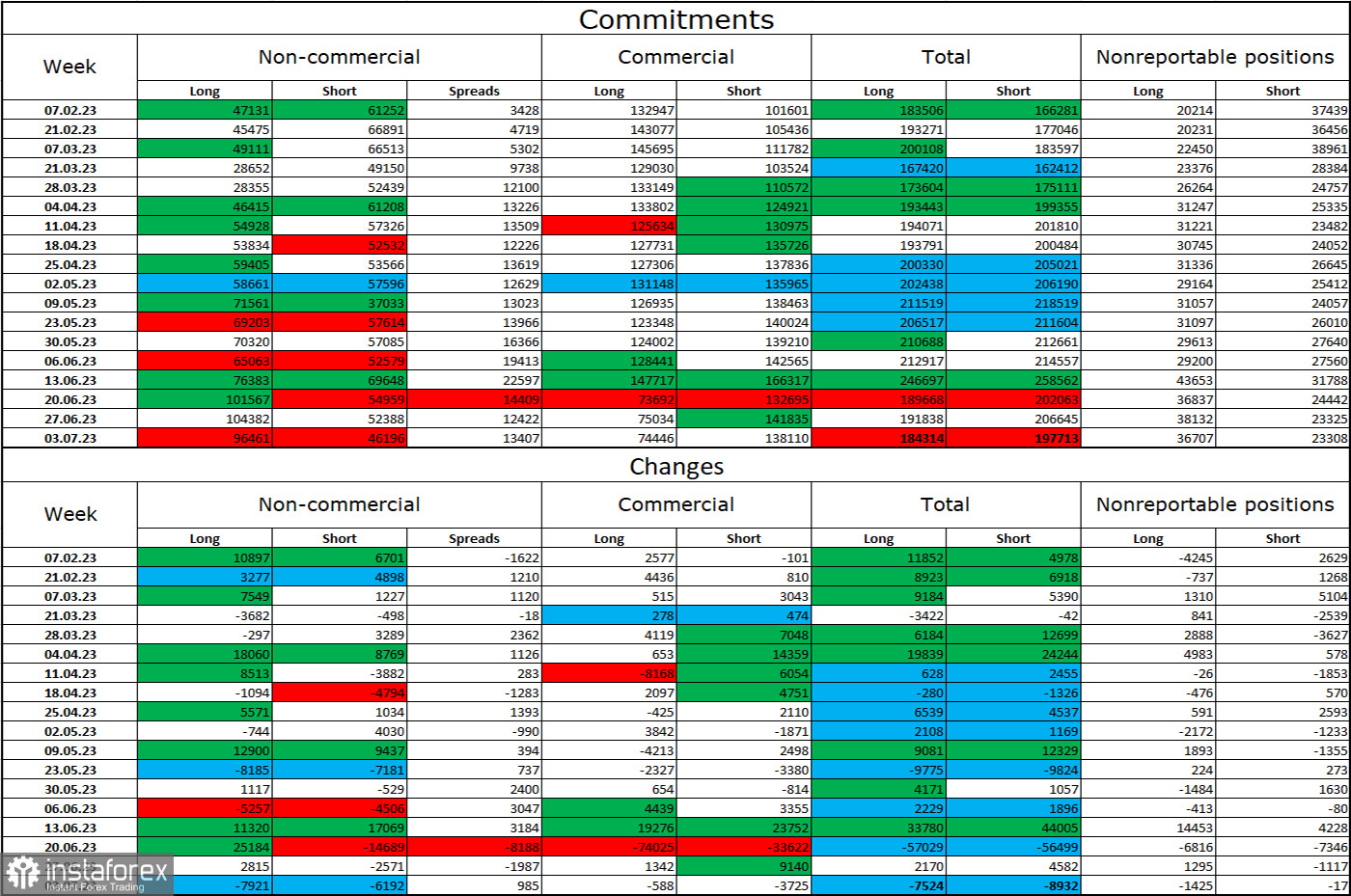

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders became less "bullish" over the past reporting week. The number of long contracts held by speculators decreased by 7,921 units, but the number of short contracts also decreased by 6,192. The overall sentiment of major players remains fully "bullish," and a double gap has formed between the number of long and short contracts: 96,000 versus 46,000. The British pound has good prospects for continued growth, and the current information background supports it more than the dollar. However, counting on a strong rise in the pound is becoming more and more difficult. The market does not consider many factors supporting the dollar, and the pound is growing only on the expectations of more and more rate increases by the Bank of England.

News calendar for the USA and the UK:

USA - Michigan University Consumer Sentiment Index (14:00 UTC).

On Friday, the economic events calendar contains only one index in the US, which will be of little importance to traders. For the remainder of the day, the influence of the information background may be weak.

GBP/USD forecast and trading tips:

Only very small pound sales are possible on a "bullish" trend. For example, in case of consolidation under the level of 1.3105 on the hourly chart. Other signals can be considered if there are prerequisites for a reversal on the hourly chart (consolidation under the trend line). I advised purchases on a rebound from the level of 1.2917 on the hourly chart with a target of 1.3007. The target has been met. The growth continues, but further purchases are risky.