The demand for the US currency is decreasing almost every day, and many analysts and economists make various guesses and assumptions about the possible reasons. I must say that personally, it makes me cautious. If the problem lies in inflation or monetary policy, then why did we see such a sharp decline in demand for the US dollar the week before last? If the market factors in certain future events into current prices, then why did the dollar experience such a significant decline last week?

The US inflation report only partially answers this question. As I mentioned before, the demand for the dollar began to decline on Monday, two days before the report was released, and continued to fall on Thursday. On Friday, we didn't even see a bearish correction. Thus, inflation could only have had a slight impact on the overall weakening of the US currency.

A more likely reason is market expectations. If inflation in the US falls to 3%, it not only implies a possible end to aggressive measures as early as this month but also a faster transition to a more accommodative policy. At the same time, the European Central Bank and the Bank of England may raise rates several more times and maintain them at peak levels much longer than the Federal Reserve, as inflation is significantly higher in the eurozone and the UK. Perhaps this is what is causing the dollar's decline.

But then another question remains unanswered. How much does the market intend to play out this factor? It is unlikely that the demand for the US currency will decline until inflation in the EU and the UK drops to 3%. I would like to remind you that the US currency has been declining for almost a year. If inflation had been rising in the EU and Britain throughout this year while falling in the US, it would have made sense. However, the Fed raised rates just like the ECB and the BoE, while inflation has been slowing down worldwide over the past six months. I mean to say that the dollar may be in a less favorable position compared to the euro or the pound, but not to the extent that it is declining.

It seems to me that the market, as it loves to do, is preemptively playing out its assumptions. This means that we can expect new difficulties in interpreting the news background in the future. When the FOMC starts lowering rates, the dollar may unexpectedly begin to rise, as by that time, the ECB and the BoE may have finished monetary tightening. The dollar cannot keep falling in response to any actions by central banks!

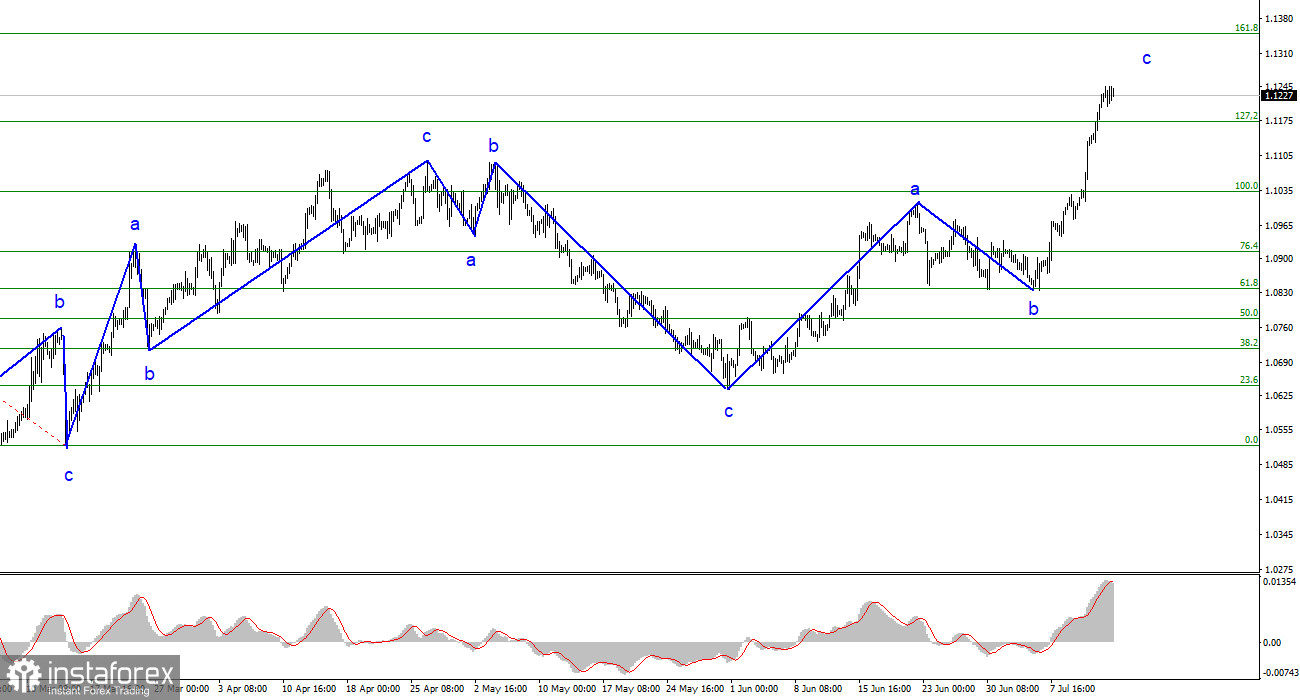

Based on the analysis conducted, I conclude that the uptrend build-up is still in progress, but it can end at any moment. I believe that targets around 1.0500-1.0600 are quite realistic, and I advise selling the instrument with these targets. However, now we need to wait for the completion of the a-b-c structure, and afterwards we can expect the pair to fall into this area. Buying is quite risky. The euro takes any opportunity to rise, but the news background for the dollar is not as weak as it may seem.

The wave pattern of the GBP/USD pair suggests the formation of an upward set of waves. However, the wave structure has already taken on a five-wave appearance, which means it may be completed. If the attempt to break the level of 1.3084 (from top to bottom) proves unsuccessful, the instrument may continue to rise with targets located around 1.3478 (261.8% Fibonacci extension). A successful breakthrough attempt will initiate a more expected and logical process of building a descending Wave 4 or a new downward segment of the trend with initial targets around the 1.2840 level.