Analysis of macro reports:

On Monday, no macroeconomic reports are scheduled in the US, the EU, and the UK. So, traders will have nothing to react to during the day. However, the euro and the pound are growing rapidly without macro data. Any strong report or event that drives the dollar leads to an increase of 20-30 pips. The rest of the time, the euro and the pound continue rising regardless of news and data. A correction is impending and can begin at any moment, not necessarily tomorrow.

Analysis of fundamental events:

There will be no noteworthy fundamentals tomorrow either. Last week, several officials from the Federal Reserve System and the European Central Bank delivered speeches that had no impact on prices. Even Andrew Bailey spoke, mentioning high wage growth rates. It is unlikely that the market simultaneously began buying out the euro and pound based on expectations that the ECB and the Bank of England will be raising rates for a long time. We see unexplained movements in terms of fundamental and macroeconomic analysis.

Conclusion:

On Monday, there will be neither reports nor fundamental events. We may assume that a correction will begin tomorrow, but considering the strength of the current movement in both pairs, it is not excluded that the dollar will continue its decline. For intraday trading, the direction of the trend does not matter; the main thing is to avoid a flat market. Therefore, at the first signs of sideways movement, it is wiser to exit the market. From this point of view, there is a higher probability of an intraday trend during the American trading session.

Basic principles of the trading system:

1) The strength of a signal depends on the time period during which the signal is formed (a rebound or a breakout). The shorter this period, the stronger the signal.

2) If two or more trades are opened at some level following false signals, i.e. those signals that do not lead the price to the Take Profit level or the nearest target level, any consequent signals near such a level should be ignored.

3) During a flat market, any currency pair may generate a lot of false signals or no signals at all. In any case, a flat market is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and the middle of the American session when all positions should be closed manually.

5) We pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend, confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), they make a support or resistance area.

How to interpret charts:

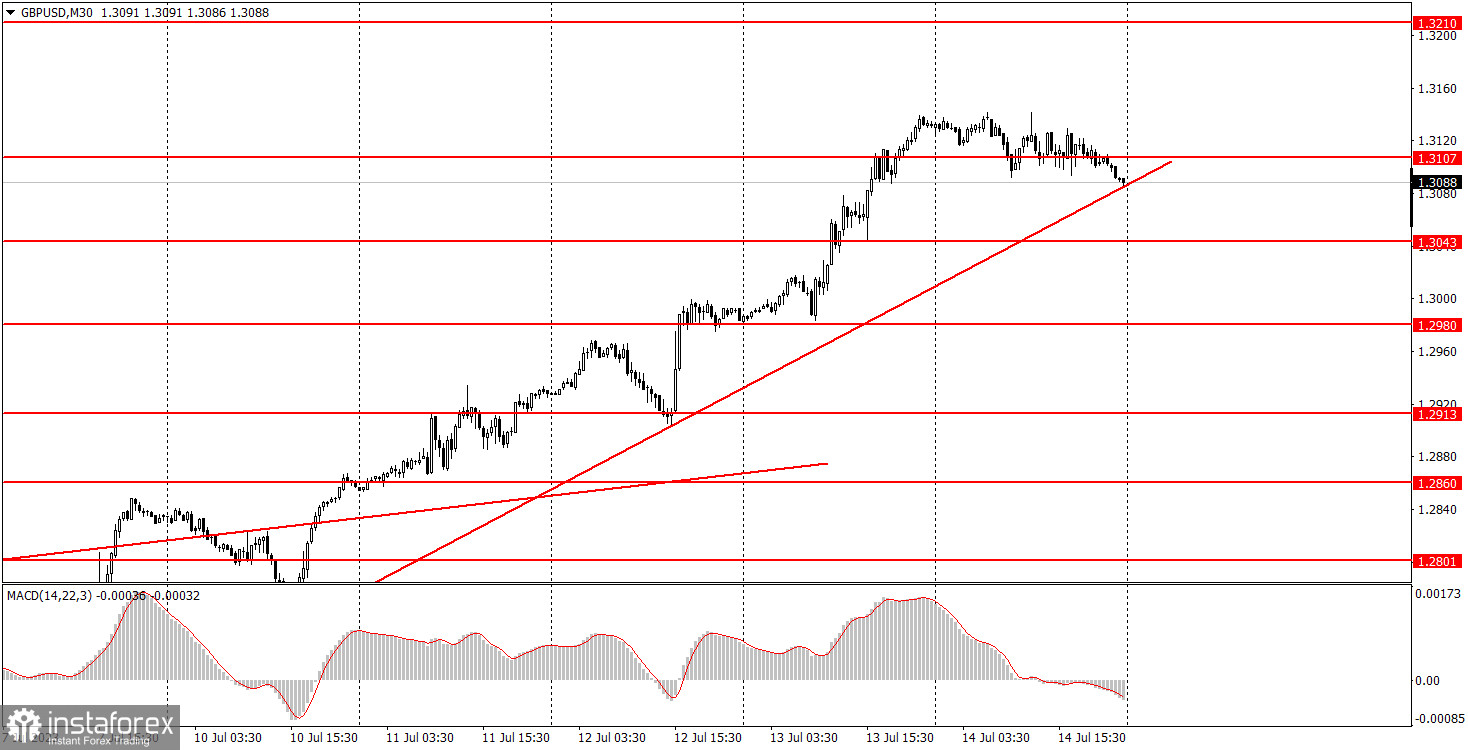

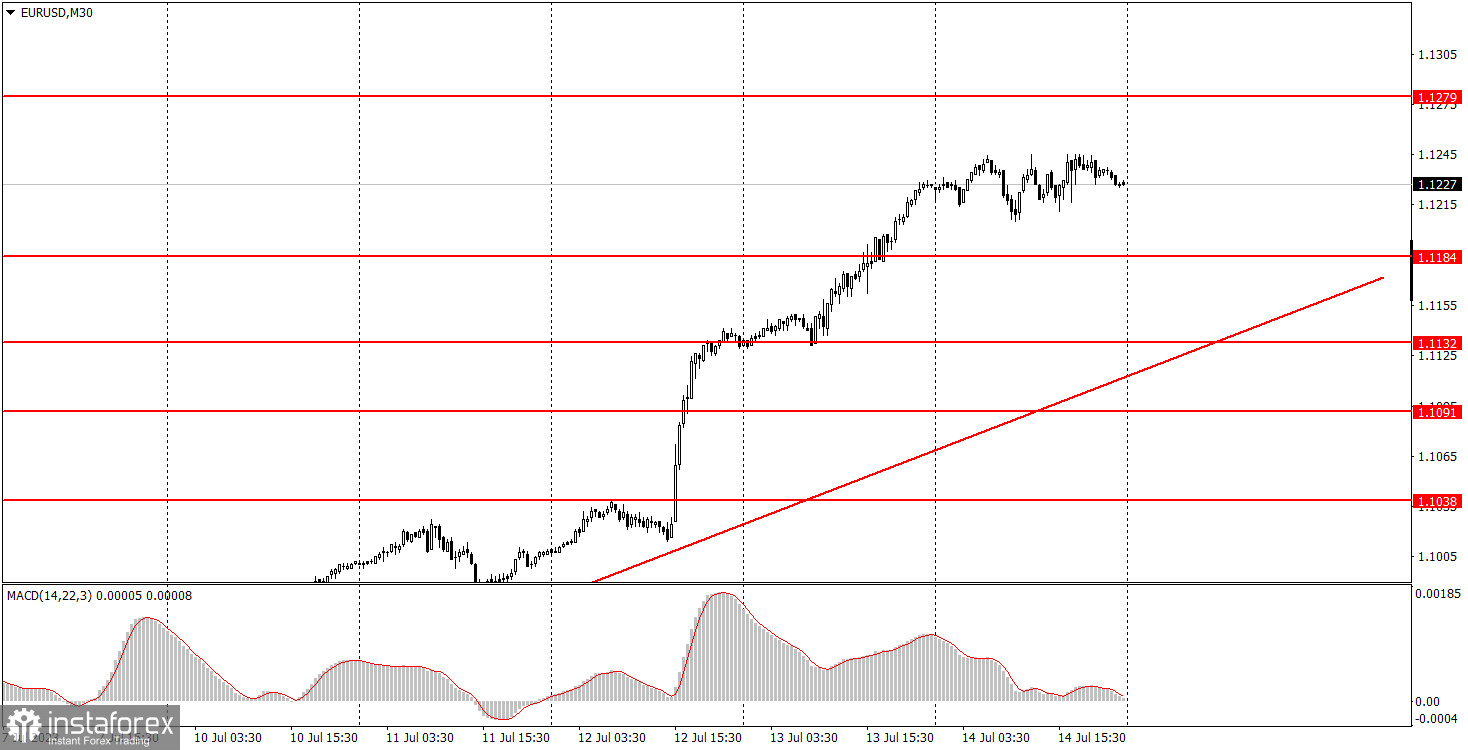

Support and resistance can serve as targets when buying or selling. You can place a Take Profit near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market.

Important speeches and reports in the economic calendar can greatly influence a currency pair. Therefore, during such events, it is recommended to trade as cautiously as possible or exit the market to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that some trades can be unprofitable. Having a reliable trading strategy and a money management approach is the key to success in long-term trading.