There was no correction, even though some time has passed since the release of the US inflation data, and the market should have calmed down by now. Moreover, the economic calendar was empty on Friday, which should have been enough for a local rebound. However, the dollar has also stopped losing ground. So the market was simply treading water. Nevertheless, the dollar remains oversold, so the market still needs some form of correction, even if it's minor. Today, the economic calendar is still empty. Therefore, there is still a probability of a slight pullback, unless we receive unexpected news capable of influencing the market.

The GBP/USD pair was trading near 1.3150 when the volume of long positions fell. As a result, the pair became stagnant and pulled back.

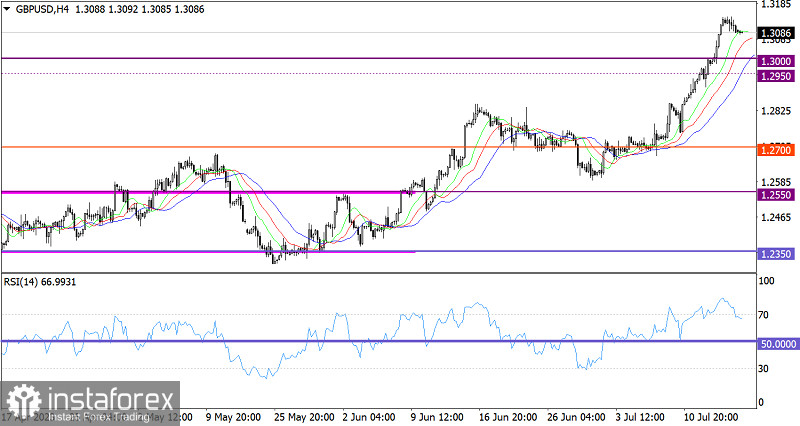

On the four-hour chart, the RSI has left overbought territory, but long positions on the pound are still overheated.

On the same chart, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

Due to the fact that the pound remains excessively overbought, we can assume the pullback phase will become more active. In this case, GBP may fall towards the 1.3000 level.

However, speculators may ignore any technical signals, and in this case, keeping the price above the 1.3150 level could fuel the current momentum.

In terms of the complex indicator analysis, we see that in the short-term period, technical indicators are pointing to a pullback. Meanwhile, in the intraday and mid-term periods, the indicators are reflecting an upward cycle.