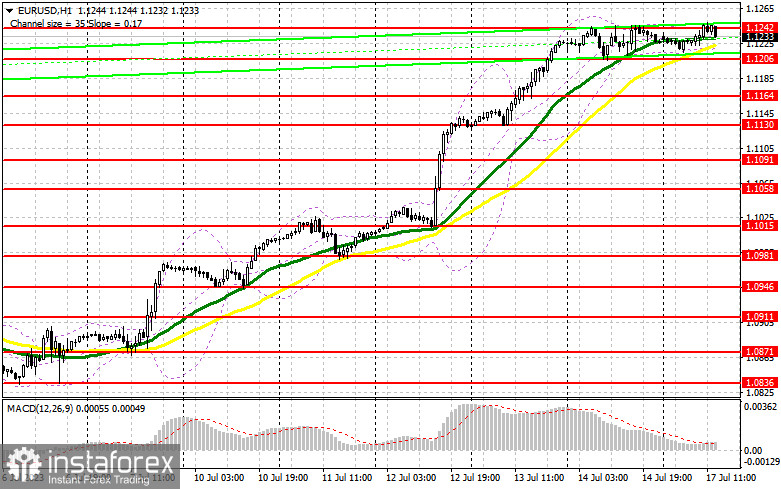

In my morning forecast, I drew attention to the level of 1.1242 and recommended making entry decisions based on it. Let's look at the 5-minute chart and analyze what happened there. A false breakout at this level gave a sell signal, resulting in a downward movement of only 10 points. However, the fact that bears have successfully defended the yearly highs for the second trading day in a row speaks for itself. The technical picture remains unchanged for the second half of the day.

To open long positions on EUR/USD, the following is required:

Only the Empire Manufacturing Index will be released during the American session, which is unlikely to significantly impact the pair's direction. Therefore, bears will have a chance to establish a downward correction. Considering the current highs, I prefer to act only near the support level of 1.1206, which was formed based on last Friday's data. Defending this level is crucial, and a false breakout there will give a buy signal, confirming the presence of major players in the market capable of pushing the euro to new yearly highs at the beginning of the week. In that case, the target will be the resistance at 1.1242. A breakthrough and test of this range from top to bottom will strengthen demand for the euro, providing an opportunity to move towards 1.1276. The ultimate target remains around 1.1310, indicating further upward trend formation for the euro. I will take profits there.

Suppose EUR/USD experiences a decline during the American session, and buyers are lacking at 1.1206, which coincides with moving averages favoring the bulls. In that case, bears might become more proactive in pursuing a correction. Hence, a valid buy signal for the euro will only emerge with a false breakout around the subsequent support level at 1.1164. I intend to initiate long positions upon a rebound from the minimum of 1.1130, aiming for an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, the following is required:

Sellers are persistently fulfilling their objectives, and unless the US data disappoints, a more substantial correction in the pair can be anticipated. Safeguarding the immediate resistance level at 1.1242, which has undergone multiple tests and a false breakout, will signal to sell EUR/USD, indicating a potential decline toward the support level at 1.1206. I anticipate the presence of larger buyers at that level. Consolidation below this range and a reverse test from bottom to top against strong US statistics will be a direct path to 1.1164. This would indicate a substantial correction for the euro, which could reignite buyer appetite. The ultimate target will be around 1.1130, where I will take profits.

In the event of an upward movement in EUR/USD during the American session and the absence of bears at 1.1242 in the second half of the day, which is quite possible in the current bullish market, the euro will continue to rise. In that case, I will postpone short positions until the next resistance at 1.1276. It can also be sold, but only after a failed breakout. I will open short positions immediately on a rebound from the maximum of 1.1310, targeting a downward correction of 30-35 pips.

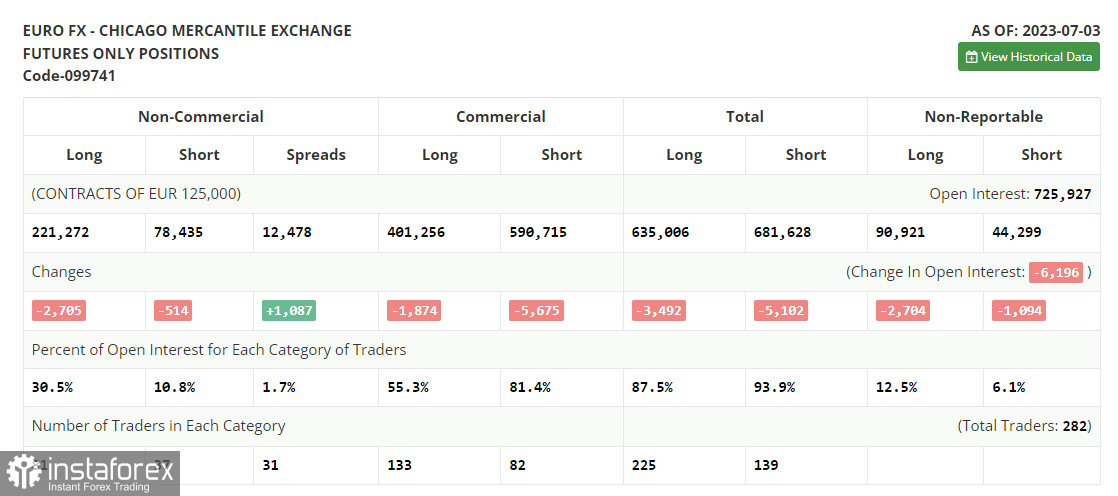

In the Commitment of Traders (COT) report for July 3rd, there was a reduction in both long and short positions, leaving the market balance virtually unchanged. The released US labor market data indicate the first signs of cooling, which favors risk asset buyers who anticipate further aggressive monetary policies by their central banks. However, this cannot be said about the Federal Reserve. Many believe that the expected rate hikes by the Fed are already factored into the quotes, and any data indicating a decrease in price pressure could lead to a larger sell-off of the dollar. Buying the euro on declines remains the optimal medium-term strategy under current conditions. According to the COT report, non-commercial long positions decreased by 2,705 to 221,272, while non-commercial short positions fell by 514 to 78,435. The overall non-commercial net position slightly decreased to 142,837 from 145,028. The weekly closing price fell to 1.0953 from 1.1006.

Indicator signals:

Moving Averages

Trading occurs around the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart, which differs from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In the case of an upward movement, the upper boundary of the indicator around 1.1242 will act as resistance.

Description of Indicators:

• Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence - measures the convergence or divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The overall non-commercial net position differs from non-commercial traders' short and long positions.