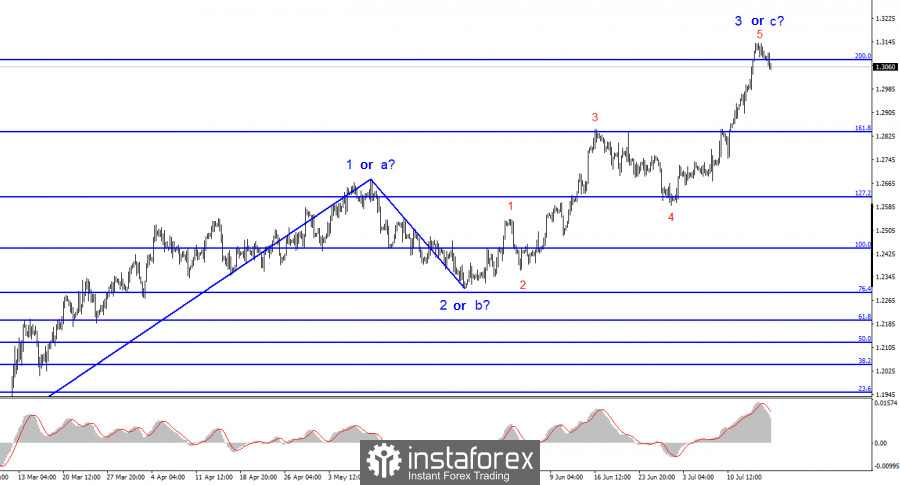

The wave analysis for GBP/USD remains relatively straightforward and understandable. There is an ongoing construction of an upward wave 3 or C, and the British pound has risen to the 31st figure. There are no valid reasons for the pound to continue its ascent (supported by various reports and events), and the presumed wave 3 or C is approaching completion. However, the wave pattern has become more complex, and wave 3 or C has taken on a more extensive form than many analysts expected. Five distinct waves are clearly visible within it, indicating that this wave may have already concluded.

Compared to the euro, the wave labeling for the pound appears simpler and clearer. The third wave could be either the final upward or third wave in a five-wave structure. In any case, I anticipate the formation of a downward wave. Although the news background could provide some insights, the market must pay more attention. The successful breach of the 1.3086 level corresponds to the 200.0% Fibonacci level, suggesting the market's readiness for slight selling pressure.

The pound surpassed expectations.

On Monday, the GBP/USD exchange rate declined by 20 basis points. If we disregard the pound's surge last week, such a movement seems predictable given the absence of news or reports from the UK and the US today, with none expected. Nevertheless, it is hard to overlook the substantial rise of the pound. We observed five upward waves. According to wave analysis principles, a descending three-wave pattern is now expected. The intensity of this pattern will indicate whether the market is capitalizing on profits from long positions or if it has started to demand the dollar. I anticipate the latter scenario, although considering the market sentiment in recent months, the overall upward trend could extend further.

The key report for the pound this week will be UK inflation. Market expectations include a decline to 8.2% y/y, but it does not anticipate a significant slowdown in core inflation. Predicting how the market will interpret this report takes a lot of work. If the market continues to demand the pound while inflation drops to 2%, citing the potential for more substantial tightening of the Bank of England's monetary policy, the pound could maintain its upward movement for another year or two. Even the Federal Reserve does not anticipate inflation returning to 2% soon; in the US, this indicator has already decreased to 3%. However, core inflation, which remains significantly higher in the US, could soon surpass the headline figure in the UK. Regardless of sounding cliche, the fate of the dollar and the pound lies in the hands of the market, which has been interpreting many reports in favor of the pound lately.

Overall, the wave pattern for the GBP/USD pair indicates the formation of an ascending wave set. However, the wave structure has already taken the form of five waves, suggesting its potential completion. Since the successful breakthrough of the level at 1.3084 (from top to bottom), we can anticipate a minor decline in the pair. Three downward waves should be constructed based on the wave pattern, leading the pair to descend to 1.2840. I advise exercising caution when considering selling.

On a larger wave scale, the pattern is similar to that of the EUR/USD pair, but some differences remain. The descending corrective segment of the trend has concluded, and a new ascending trend is underway, which may have already been completed or could assume the form of a complete five-wave pattern. The third wave could be extensive or truncated even if it becomes a three-wave pattern.