Analysis of macroeconomic reports:

On Tuesday, July 18, there are no major macroeconomic reports scheduled in the EU and the UK. Only the US will be releasing reports on retail sales and industrial production. In fact, these are not highly significant data that would trigger a strong market reaction. If the actual and forecasted values deviate greatly, a market reaction is possible, but what kind of reaction can be expected? If the data exceeds the forecast, should we anticipate strengthening of the US currency? In recent weeks, we've seen numerous reports that had the potential to drive the dollar higher, yet they didn't have a substantial impact. On the other hand, if the data comes in weaker, the dollar is likely to decline again. However, considering the dollar's continuous depreciation even without the reports, the significance may be questionable.

Analysis of fundamental events:

Tomorrow, the speeches of FOMC members Barr and Gibson can be mentioned among the fundamental events. However, these two officials are not considered key players of the regulator, so their speeches are unlikely to attract significant attention. In recent weeks, almost all officials of the US regulator have delivered speeches, and none of them have resulted in a strong market reaction. Therefore, we shouldn't expect a major reaction tomorrow either.

General conclusion:

Tuesday lacks both fundamental and macroeconomic events. During the American session, the volatility may be higher than in the European session, as few minor events could shake the market after all. However, there are likely to be no significant movements. We should rather expect low volatility and a tight trading range.

Basic rules of a trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, then any consequent signals near this level should be ignored.

3) During a flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened from the beginning of the European session and until the middle of the American one, when all deals should be closed manually.

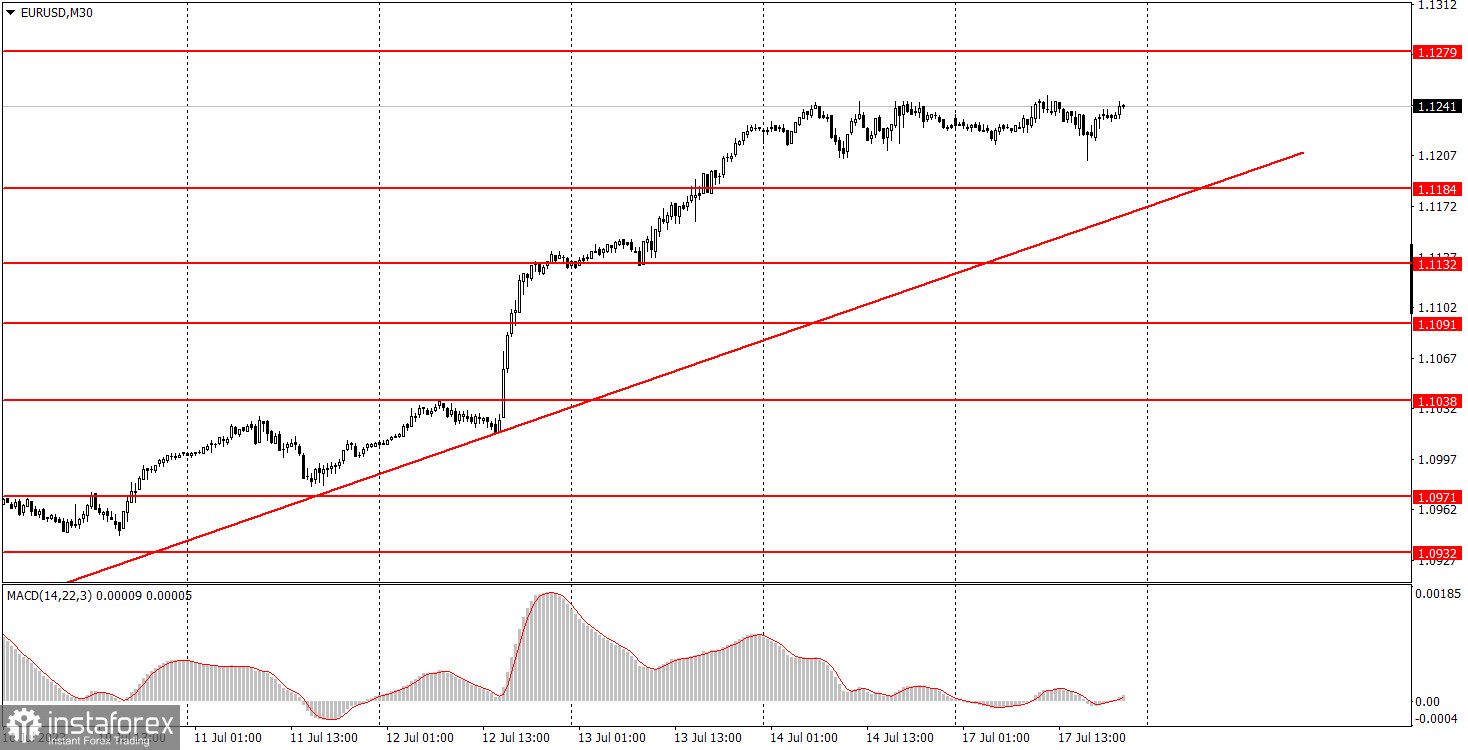

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place take profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.