Despite the clear oversold condition of the dollar, the market remains still. As a matter of fact, we witnessed sideways trading on Monday, partly because of the empty economic calendar. And it seems that the market will continue to tread water today. Although we are seeing quite significant releases, the forecasts for these reports are mixed. While retail sales growth is expected to slow down from 1.6% to 1.1%, industrial production may accelerate from 0.2% to 0.5%. And such data relates to the United States. So, the reports will offset each other, and the market situation will remain unchanged.

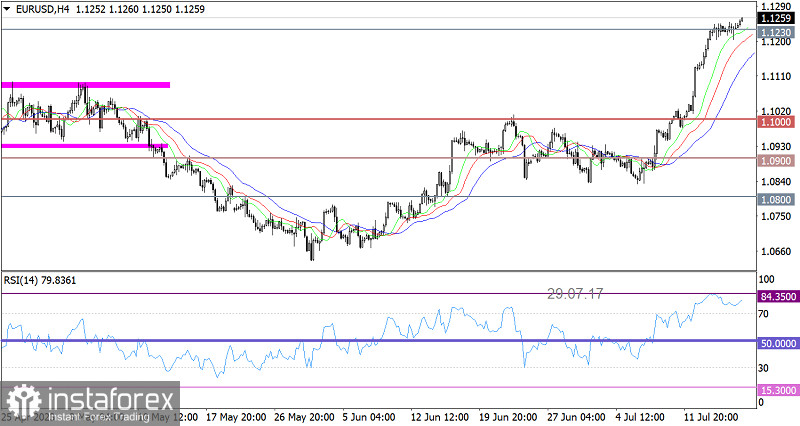

The EUR/USD exchange rate has ended the stagnant period by hitting a new local high in the medium-term trend. This increased the volume of long positions, allowing EUR/USD to show positive trades.

On the four-hour chart, the RSI is hovering above 70 and this is a strong signal of the euro's overbought conditions.

On the same time frame, the Alligator's MAs are headed upwards, which corresponds to the current upward cycle.

Outlook

Despite the technical signal of the euro's overbought conditions, the market is still fueled by the upward momentum. If the pair manages to stay above the 1.1250 level, the exchange rate may rise further, ignoring signals of longs becoming overheated.

In regards to a retracement scenario, we can see this happening if the price remains below the 1.1200 level. This could then raise the volume of short positions and potentially interrupt the uptrend.

The complex indicator analysis unveiled that in the short-term, medium-term and intraday periods, indicators are pointing to an uptrend.