During yesterday's speech, Ignazio Visco, a member of the European Central Bank's Governing Council, stated that inflation could decrease more rapidly than the institution had forecasted last month, as the decline in energy prices continued to impact a broader range of prices. The politician added that while core inflation, which excludes volatile items, remained persistent, the drop in commodity prices, including natural gas, was expected to have an increasing influence on this indicator. "As we also observe a significant decline in energy prices, we should expect it to affect underlying inflation in the coming months. This will be particularly noticeable by the end of the year," Visco added in Gandhinagar.

Currently, the ECB predicts that inflation will eventually return to its target value of 2% by the end of 2025, but many European policymakers believe it could happen sooner. If that is the case, there will be fewer reasons to maintain an aggressive policy stance from the European Central Bank, which directly indicates weakness in the European currency, currently outperforming the US dollar due to expectations of significant divergence in central bank policies.

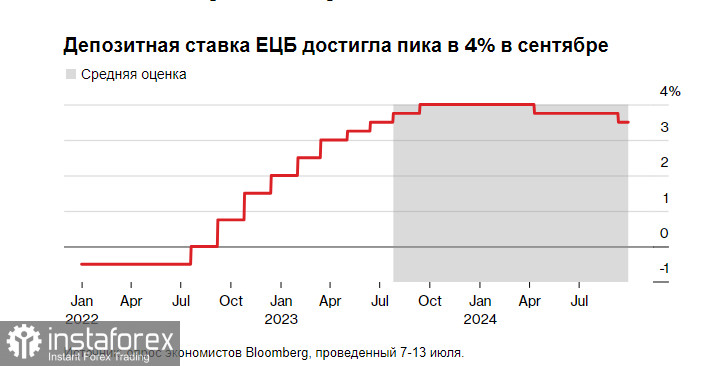

EU officials plan to raise interest rates by another 25 basis points at the meeting next week. It is unclear whether this will mark the end of their path or if the most severe tightening campaign in the central bank's history will continue at the next session in September. More hawkish officials propose extending the hike until autumn, while others fear the damage to economic growth after the technical recession that began in the eurozone during the winter.

"There is a risk of doing too much and I think that we have to be careful about that," Visco said. "There is also a risk that we may do too little, so we have to be balanced and we have to decide on the basis of the incoming information."

Yesterday, Bundesbank President Joachim Nagel also spoke, stating that he expects another hike this month and that any move in September will depend on the data.

Policymakers are very concerned about core inflation, which has proven to be stronger than anticipated. Last month, the core index rose to 5.4%, although the ECB predicts it may slow down to 2.2% in the fourth quarter of 2025.

As for the EUR/USD pair, bulls need to climb above 1.1250 to maintain control over the market, pushing the price to 1.1275 and 1.1310. From that level, they may drag the pair to 1.1350. However, it will be quite challenging without strong Eurozone statistics. In the case of a decline in the trading instrument, large buyers are expected to act near 1.1210. If there is no significant activity there, it would be better to wait for the pair to reach a new low near 1.1170 or 1.1130.

As for the GBP/USD pair, demand for the pound remains strong despite a slight downward correction. A rally in the pair can be expected once control is established above 1.3110, as a breakthrough of this range would foster hopes of further recovery towards 1.3165, after which a sharper upward surge towards 1.3200 may occur. In the event of a decline in the pair, bears may attempt to gain control below 1.3050. If they succeed, breaking this range will strike a blow to bullish positions, pushing the pound/dollar pair toward the low of 1.3000, pushing the price lower to 1.2950.