Market balance returned, as indicated by the slight weakening in dollar and consolidation of Treasury yields, as well as the attempts of stock markets to resume a rally following the release of data indicating a sharp decrease in consumer inflation in the US.

It seems that investors realized that the Fed could just be using verbal interventions, and that further rate hikes may not happen anymore since inflation continues to decline. Accordingly, expectations that the US economy will plunge into a deep recession dropped noticeably, while the economy's current precarious balance shows real possibilities for recovery.

The release of important economic data today, namely the data on retail sales and their volumes in the US, could serve as an additional positive signal for the markets. Forecasts say the core index will sharply rise from the May value of 0.1% to 0.3% in June, while the volume of retail sales will increase 0.5% m/m, from 0.3% a month before.

In addition to these data, the volume of industrial production in the US will also attract attention. In monthly terms, the indicator may demonstrate zero dynamics, in contrast to the 0.2% decrease in May. However, in annual terms, a sharp increase to 1.10% may be seen, from 0.25% in the previous period.

If these important indicators do not disappoint, they may stimulate a new wave of demand for risk assets, accompanied by a weakening of dollar and increase in commodity assets. After all, positive news from the US indicates the gradual recovery of the local economy and move away from the edge of recession.

In such a situation, major players will start to respond unequivocally by purchasing previously undervalued assets in anticipation of their prospective growth.

Forecasts for today:

XAU/USD

Gold rose in price as dollar demand weakened amid decline in expectations for further interest rate hikes in the US. Continued positive market sentiment may provoke a breakdown of 1963.20, which will lead to a rise towards 1981.20.

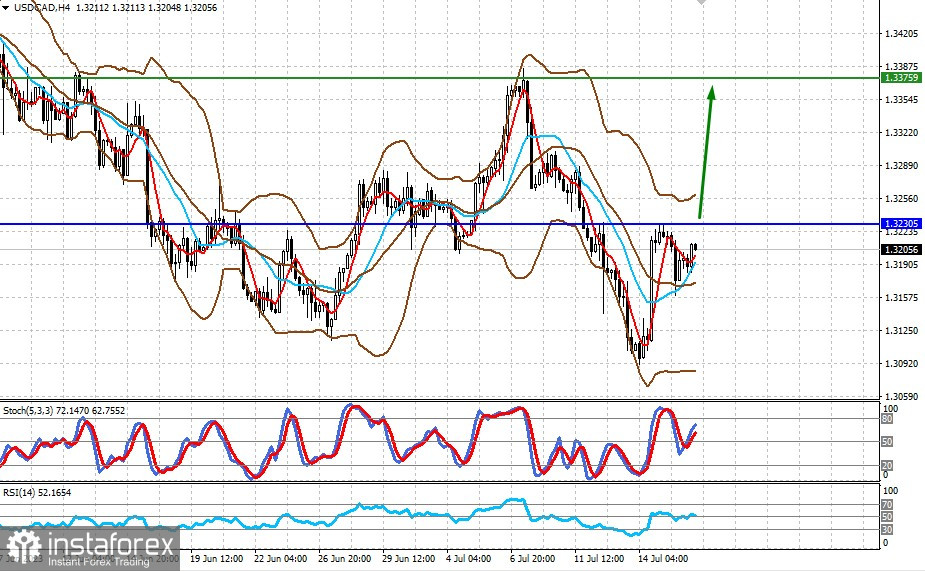

USD/CAD

Further growth may occur if inflation data in Canada shows a decrease, since such a situation may mean that the Bank of Canada will pause its interest rate hikes at the next meeting. If that happens, the pair will rise above 1.3230 and head towards 1.3375.