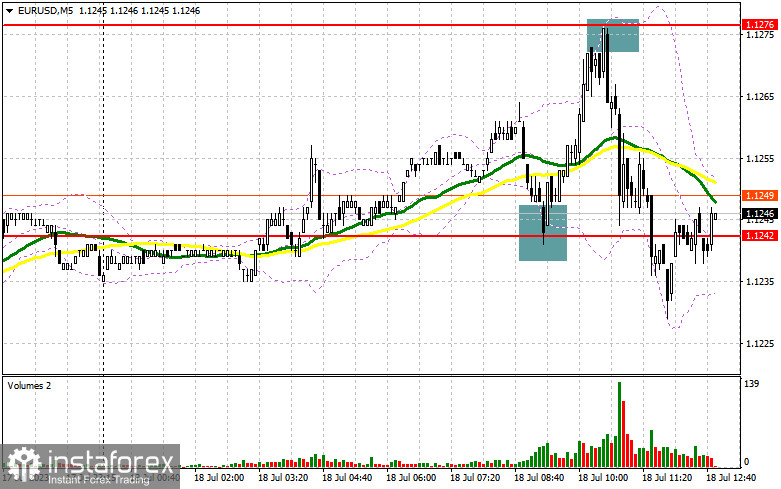

In my morning forecast, I emphasized the level of 1.1242 and recommended making entry decisions based on it. Let's examine the 5-minute chart and analyze the events. A false breakout at this level provided a buy signal, leading to an upward movement of over 30 points. However, the bears defended the level at 1.1276, triggering a sell signal and renewed pressure on the euro, causing a drop back to around 1.1240. The technical outlook has slightly changed for the second half of the day.

To initiate long positions on EUR/USD:

Considering the expected volatility during the American session following the release of US retail sales data, I have decided to remove the level of 1.1242 from trading, as it has recently seen considerable activity. Focusing on the nearest support at 1.1206 is better, which demonstrated strong performance yesterday. Strong statistics and an increase in retail sales for June will likely result in a corrective downward move for EUR/USD, weakening the euro's position. In this scenario, I will only take action around the support level of 1.1206, established based on the previous Friday's results. The defense of this level is crucial, and a false breakout similar to the one observed yesterday will serve as a buy signal, confirming the presence of major players capable of pushing the euro back toward yearly highs. In this case, the target will be the resistance at 1.1274, which remained unbroken during the first half of the day. A successful breakthrough and a subsequent test of this range from top to bottom will reinforce the demand for the euro, presenting an opportunity for a surge towards 1.1310. The ultimate target remains in the area around 1.1350, indicating the formation of a further upward trend for the euro. I will exit positions and secure profits at that point.

If EUR/USD experiences a decline and there is a lack of buyers at 1.1206 during the American session, bears might become more active in anticipating a correction. Consequently, only the formation of a false breakout around the next support level at 1.1164 will provide a buy signal for the euro. I will enter long positions from a rebound at the minimum of 1.1130, aiming for an upward correction of 30-35 points within the day.

To initiate short positions on EUR/USD:

Sellers continue to fulfill their targets and have made their presence felt around 1.1274. Defending this level will remain a top priority for the second half of the day. If US retail sales data proves weak, the euro will regain its appeal, while the dollar weakens, leading to an upward surge in the currency pair. A false breakout at 1.1274, similar to the one previously discussed, will indicate a sell signal with the target of a decline towards 1.1206, where I anticipate the presence of larger buyers. In the context of strong US data, a successful breakthrough and a subsequent reverse test of this range from bottom to top will pave the way to 1.1164. This will indicate a significant correction for the euro, reigniting buyer interest. The ultimate target will be around 1.1130, where I will close positions and secure profits.

If EUR/USD moves upward during the American session and encounters no resistance from bears at 1.1274, as this level has already been tested, there might be fewer participants in the current bullish market. In that case, I will delay initiating short positions until the next resistance level at 1.1310. Selling can be considered initially, but only after an unsuccessful breakout. I will enter short positions from a rebound at the maximum of 1.1350, aiming for a downward correction of 30-35 pips.

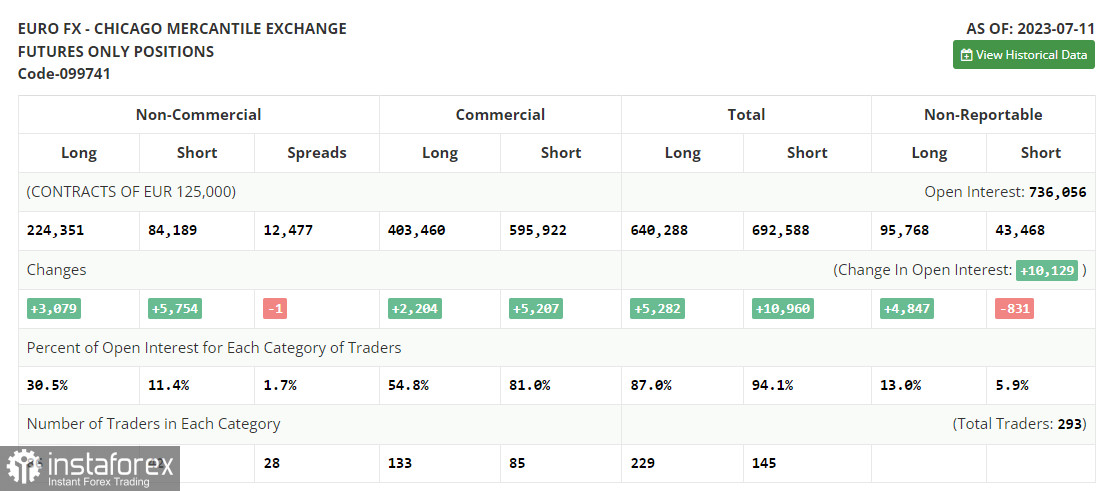

In the Commitment of Traders (COT) report for July 11, both long and short positions increased, resulting in the market balance remaining nearly unchanged in favor of euro buyers. The released US inflation data, indicating a significant slowdown, particularly in core prices, had a considerable impact on euro buyers, leading to a surge and a new yearly high beyond the psychological level of 1.1000, which had remained elusive for almost six months. The fact that the Federal Reserve no longer needs to raise interest rates has weakened the US dollar. Under current conditions, buying the euro on dips remains the optimal medium-term strategy for the bullish market. According to the COT report, non-commercial long positions increased by 3,079 to 223,351, while non-commercial short positions rose by 5,754 to 84,189. The overall non-commercial net position slightly decreased to 140,162 from 142,837. The weekly closing price rose to 1.1037 from 1.0953.

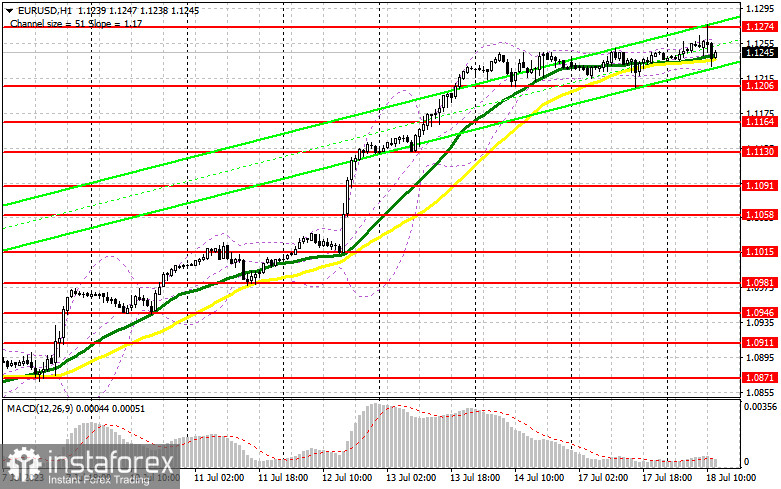

Indicator Signals:

Moving Averages

Trading occurs near the 30-day and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of the moving averages considered by the author are on the H1 hourly chart and differ from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of an uptrend, the upper boundary of the indicator around 1.1265 will act as resistance.

Description of Indicators:

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence) - Fast EMA period 12, Slow EMA period 26, SMA period 9.

• Bollinger Bands - Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.