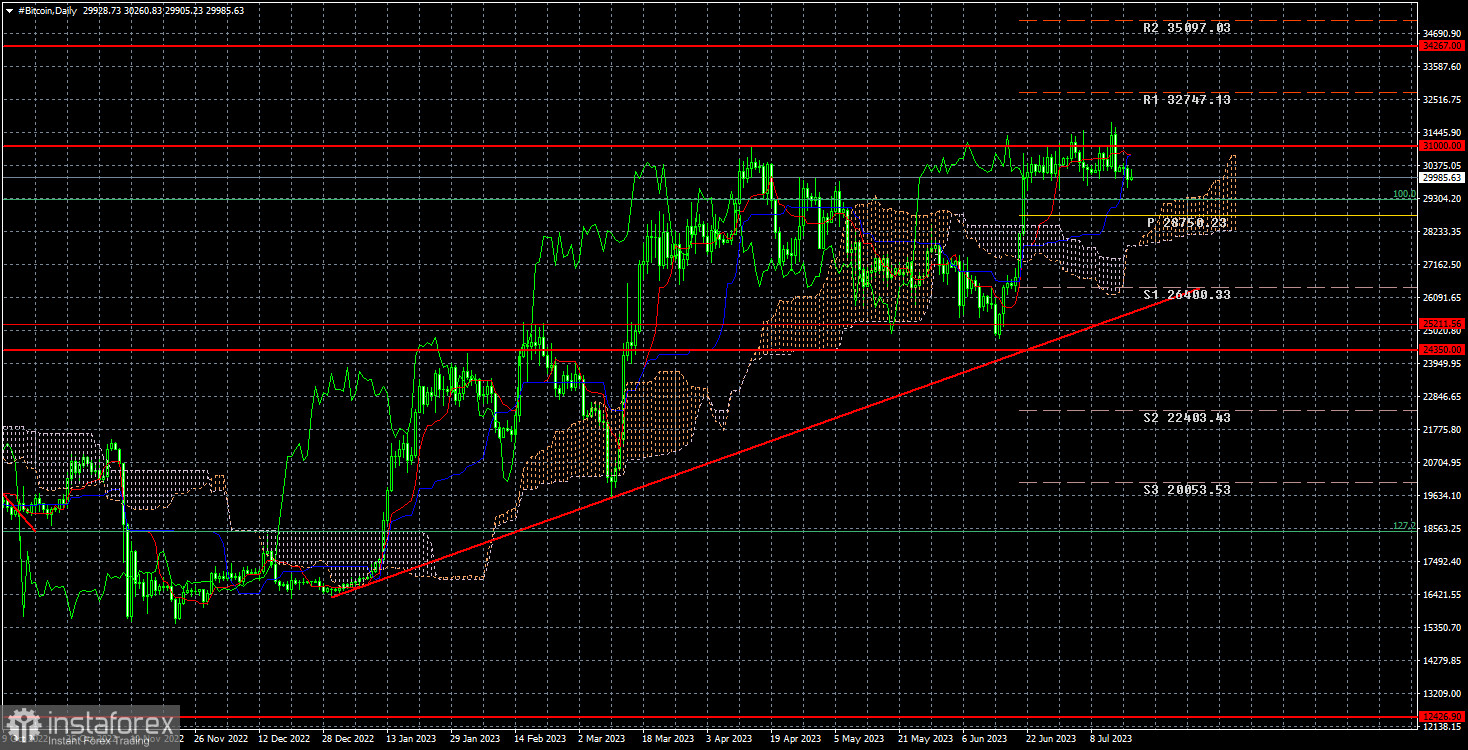

Over the past few weeks, Bitcoin has demonstrated a need for significant movements. Following a substantial increase of $6,000, the cryptocurrency has stabilized and remained just below the $31,000 level for the past 23 trading days, which acts as a strong resistance point. If this level is surpassed, Bitcoin's likelihood of further growth will significantly increase. The cryptocurrency has made several attempts to break above this level approximately five or six times. However, the number of attempts is no longer a significant factor. As of now, cryptocurrency is experiencing a period of complete stagnation.

Meanwhile, we have conducted interesting calculations that illustrate the limited long-term prospects for Bitcoin. In our previous discussion, we highlighted the necessity for Bitcoin to continually increase in price to sustain subsequent halving events until 2140. The halving occurs, on average, every four years and reduces miners' rewards by half. Consequently, for Bitcoin mining to remain profitable, the price of Bitcoin must double, on average, every four years. Basic calculations suggest that after 113 years, the price of one Bitcoin should exceed $30 billion.

However, these calculations need to account for the rising cost of electricity, which also increases over time, and the growing computational difficulty associated with mining a single block. Considering the current average global electricity cost, mining one Bitcoin costs approximately $20,000. This estimation does not encompass equipment expenses, which depreciate, malfunction, and become outdated. Miners generate a profit of around $8,000 to $9,000 per coin. However, after the next halving event scheduled for the following year, their earnings are projected to decrease from $4,000 to $5,000 per coin at the current exchange rate. Additionally, if the cost of electricity increases by just one cent, the mining cost of one Bitcoin will rise by $4,000. The conclusion is evident: mining is becoming less profitable, and sustaining it necessitates the continuous growth of Bitcoin. We need clarification about Bitcoin's capability for perpetual growth, which implies that there will come a point when mining becomes unprofitable.

Some cryptocurrency experts believe this circumstance will inevitably lead to a new surge in Bitcoin. However, we contend that this scenario only applies within the next 2-4 years.

On the 24-hour timeframe, Bitcoin recently completed a downward correction around the $25,211 level. The cryptocurrency experienced a rapid surge in value, but the downward correction may not have concluded yet. If the price reverses and declines around the $31,000 level, the decline may resume, making selling with a target around $26,000 a relevant approach. However, if the $31,000 level is surpassed, it would be reasonable to consider new purchases with a target of around $34,267. Considering the sideways channel on the 4-hour chart is essential, which currently holds greater significance.