Euro was on the verge of renewing its longest winning streak since 2004, but Klaas Knot ruined everything. According to the head of the Netherlands Bank, while a rate hike in July is necessary, there is no guarantee of its increase in September. If ECB hawks begin to doubt the peak level of borrowing costs, whether at 3.75% or 4%, it's time for EUR/USD bulls to take a break.

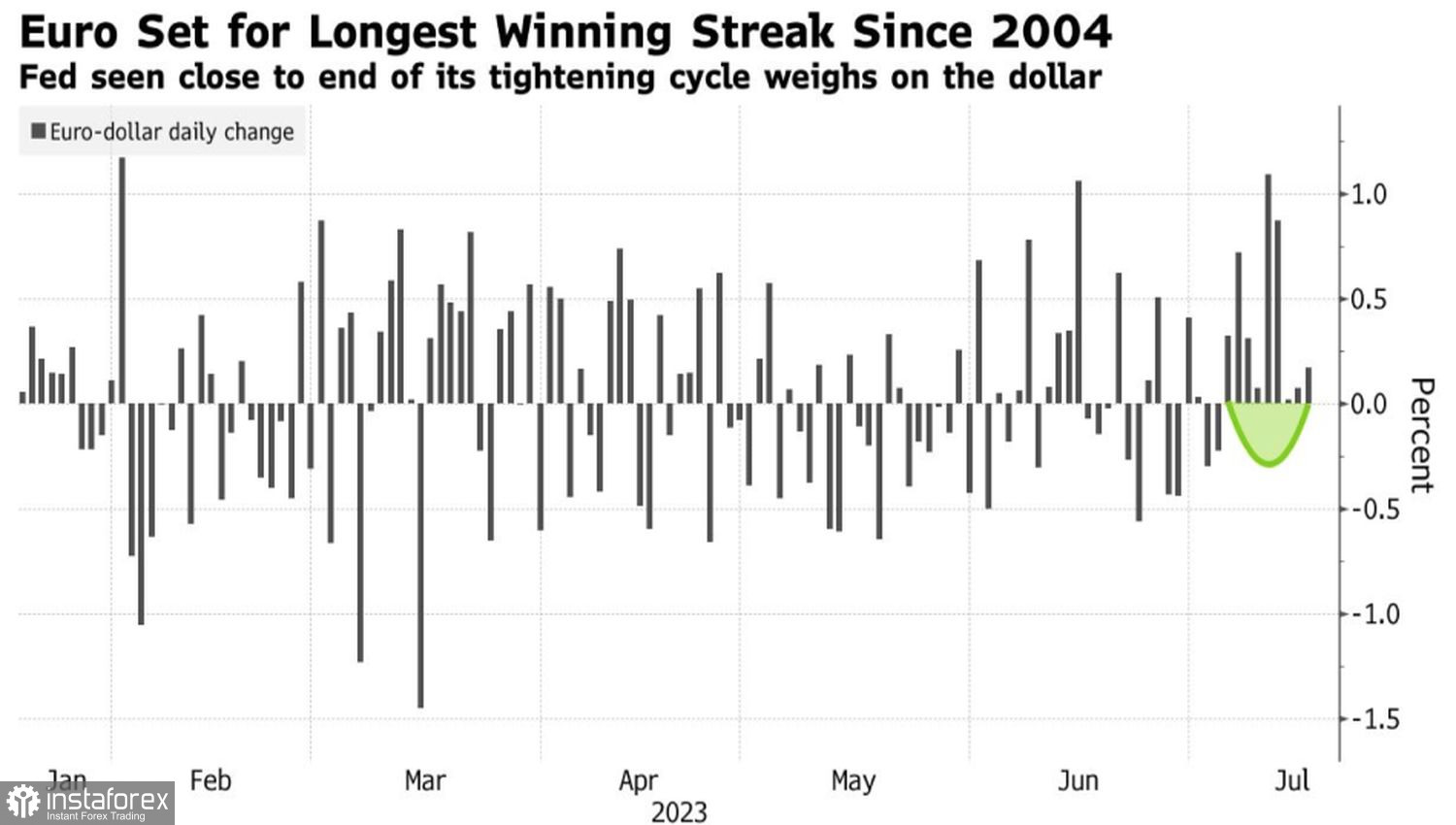

Dynamics of Euro against the U.S. Dollar

According to Banco Bilbao Vizcaya Argentaria, the upward dynamics of the main currency pair can be explained by the movement of the yield spread between 2-year U.S. and German bonds in favor of the euro, market complacency, and the evolution of stock indices. Indeed, debt market rates primarily react to central banks' monetary policies.

In this regard, the completion of the Federal Reserve's tightening cycle is a strong driver for U.S. dollar selling. However, Bank of New York Mellon believes it is already priced into the EUR/USD quotes. At the same time, it is difficult to find anything positive for the euro other than positioning adjustments. Indeed, speculative net positions appeared excessively bearish just a couple of weeks ago, and the July rally forced sellers to flee the battlefield.

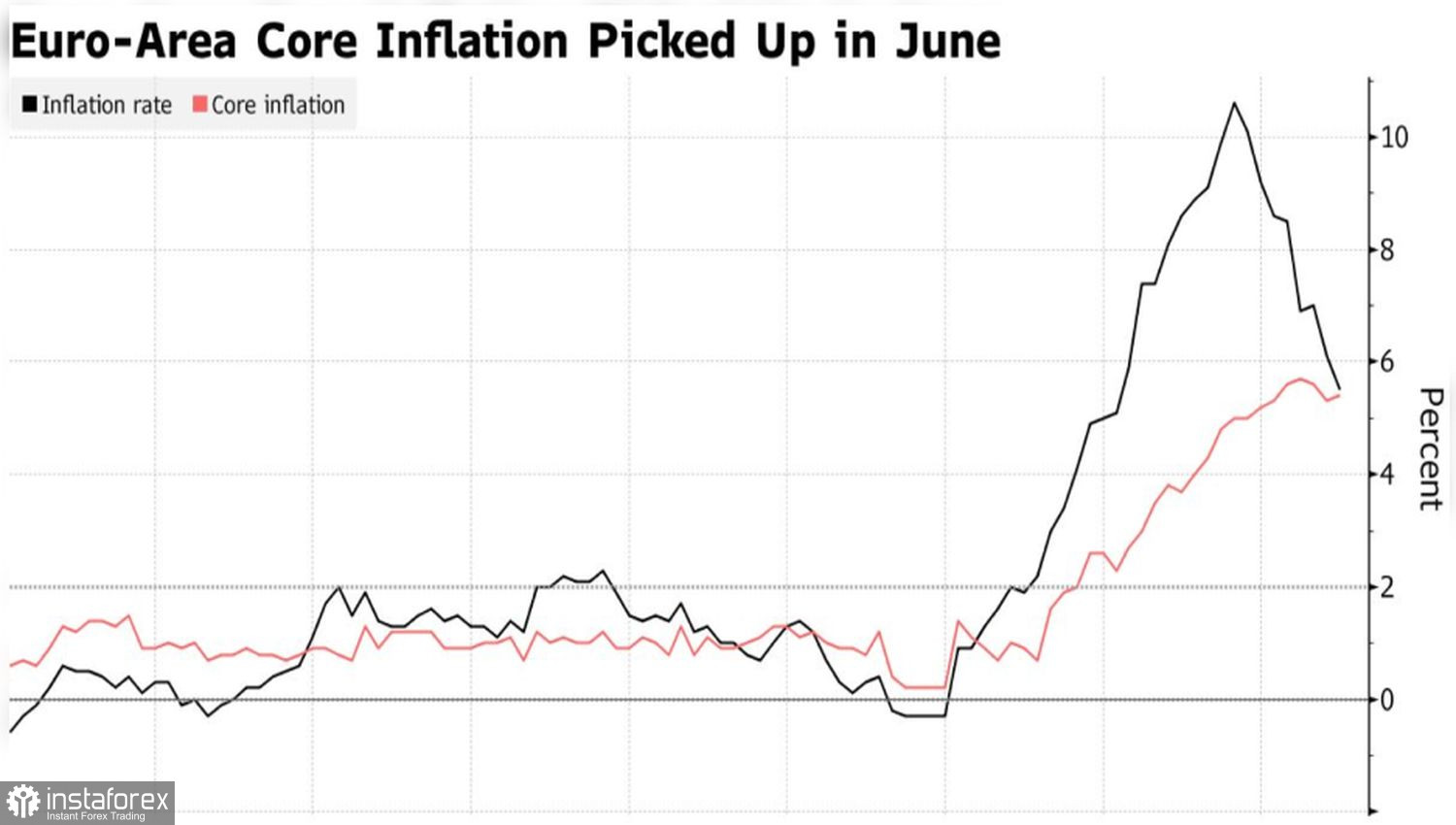

After the consensus forecast of Bloomberg experts on the deposit rate hike up to the ceiling of 4%, the market fully believed in it. However, Knot casted doubt on this coherent theory. The Dutchman noted that the ECB's further decisions would depend on the trajectory of core inflation in the eurozone. A sharp slowdown in inflation would indicate that the ECB has already done most of the work. It's time to take a break.

Eurozone Inflation Dynamics

Thus, doubts are emerging in the market about the euro's ability to continue rallying against the U.S. dollar in the near term. Especially since, in a week, we are likely to witness historical meetings of the Federal Reserve and the ECB, with rate hikes up to their peaks of 5.5% and 3.75%, respectively. In such conditions, the risks of position changes and consolidation in the main currency pair are growing.

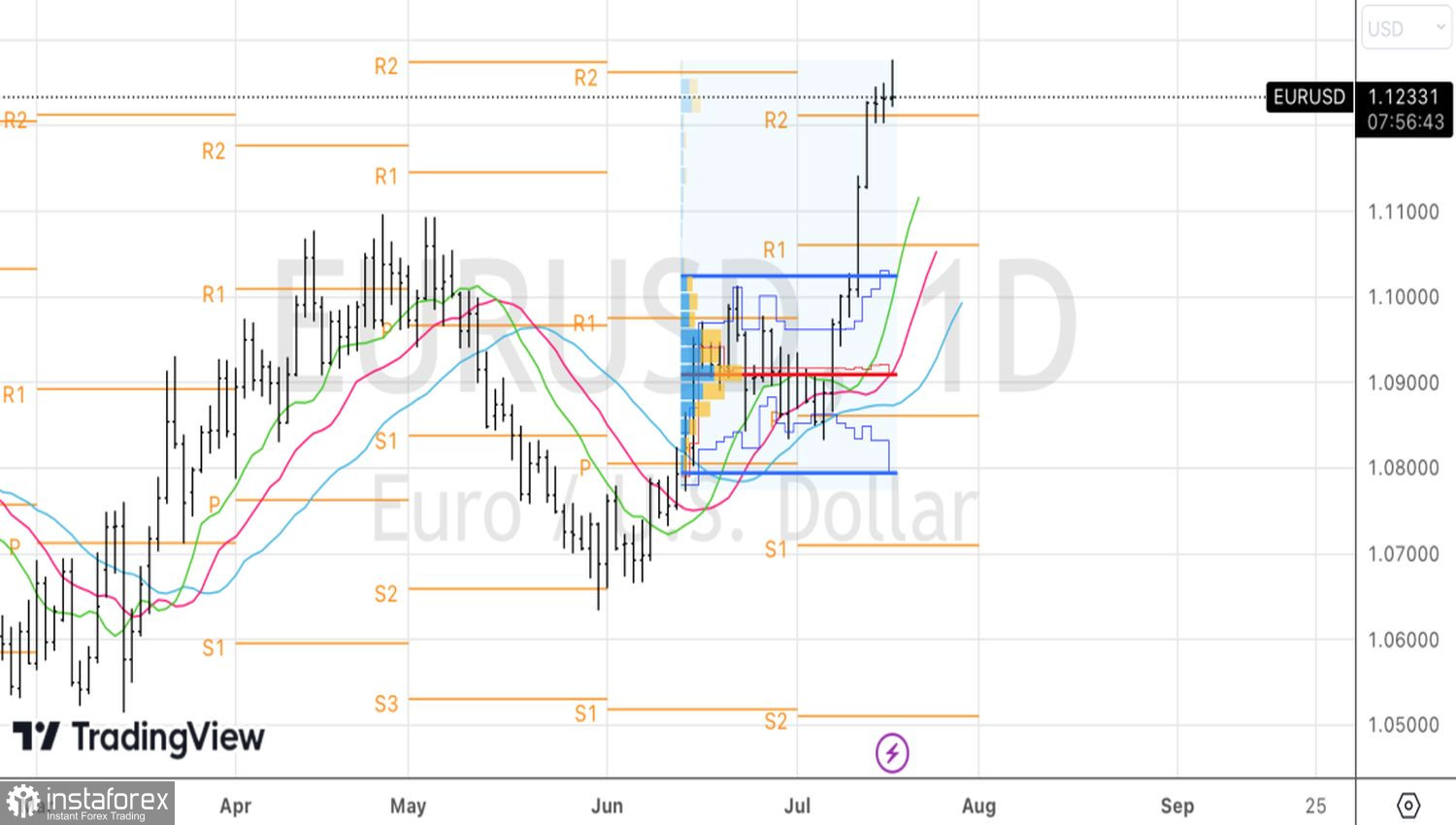

As for its medium- and long-term prospects, they look bullish. And it's not so much about the end of the Federal Reserve's tightening cycle. It's about the prevailing optimism in the market. For a long time, investors were afraid that inflation would anchor at elevated levels and the U.S. economy would plunge into a recession.

In July, the risks of such scenarios significantly diminished. The return of inflation to the target and a soft landing are what the markets are concerned about. In such an environment, EUR/USD has good chances to continue its rally. After shedding the ballast—getting rid of buyers who don't believe in it.

Technically, the formation of a pin bar with a long upper shadow indicates a shift in initiative to the "bears." Moreover, a break of the pivot level at 1.1215, followed by an update of the local bottom of the accumulation at 1.12, could serve as grounds for short-term selling of EUR/USD.