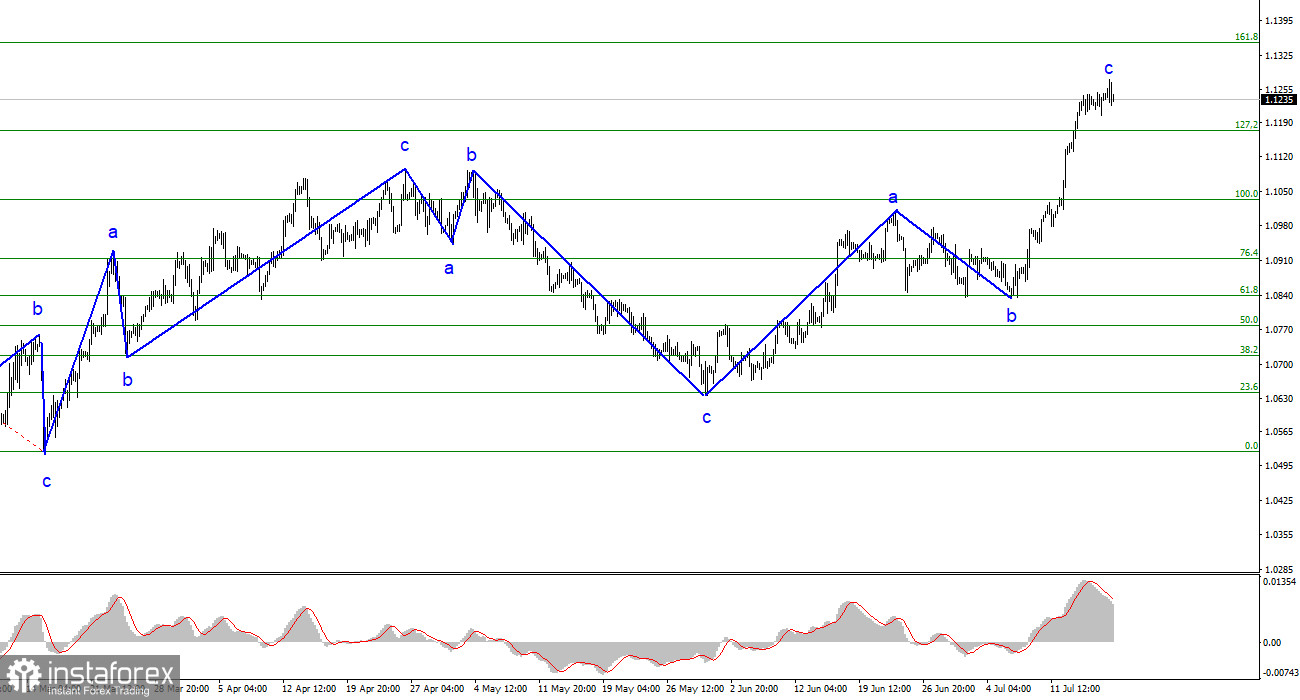

The wave analysis on the 4-hour chart for the euro/dollar pair has again transformed, but it remains relatively understandable. The ascending trend segment began forming last year and has taken on a complex structure, with three wave structures alternating over the past six months. Recently, I have consistently mentioned my expectation for the instrument to approach the 1.5 level, where the upward three-wave formation originated. While I still hold to my word, we now need to wait for the completion of the current three-wave structure.

Theoretically, the trend segment that started on May 31 could exhibit an impulsive five-wave pattern, but asserting this is challenging. The news background is not strong enough for the euro currency to appreciate by 300 basis points in a week. A successful break above the 1.1172 level, corresponding to the 127.2% Fibonacci, indicates the market's readiness to continue buying with targets around the calculated level of 1.1349, equivalent to the 161.8% Fibonacci. However, Wave C appears to have already been completed.

The sideways movement persists

The exchange rate of the euro/dollar pair remained unchanged on Tuesday, with a daily price range of 25 basis points. In other words, there were no significant market movements on Friday, Monday, and Tuesday. While the market acted in line with the news background on Friday and Monday (with no news available), economic reports were released today, which, as we can see, did not impact market sentiment.

Two noteworthy reports from the United States were released today. Retail sales volumes grew by 0.2% month-on-month in June, falling short of the market's expectation of +0.5%. Industrial production volumes decreased by 0.5% month-on-month in June, while the market anticipated no change. Neither report provided a slight boost to the dollar against the euro currency. More significant support could have come from the fact that the pair has significantly appreciated recently and is due for a corrective wave. However, at present, there is no support benefiting the U.S. currency. Each negative report from America further weakens the dollar.

Wave analysis currently holds the utmost importance. Regardless of how much the euro currency rises, the market will eventually start closing long positions. There have yet to be any signs of the wave structure's completion. While the MACD indicator gives a "down" signal, the pair has not started declining. Therefore, the upward movement still needs to be completed. This week's news background may not be the strongest, but the market does not require strong support, particularly when it favors the euro.

General conclusions.

Based on the conducted analysis, constructing an upward wave set is ongoing but could reach completion at any moment. I still consider targets around 1.0500-1.0600 realistic and recommend selling the pair with these targets. However, we now need to wait to complete the a-b-c structure before expecting a decline to the indicated area. Buying at the moment carries significant risk. The euro currency capitalizes on any opportunity for upward movement, but closing below the 1.1172 level would indicate a possible start of a downward wave.

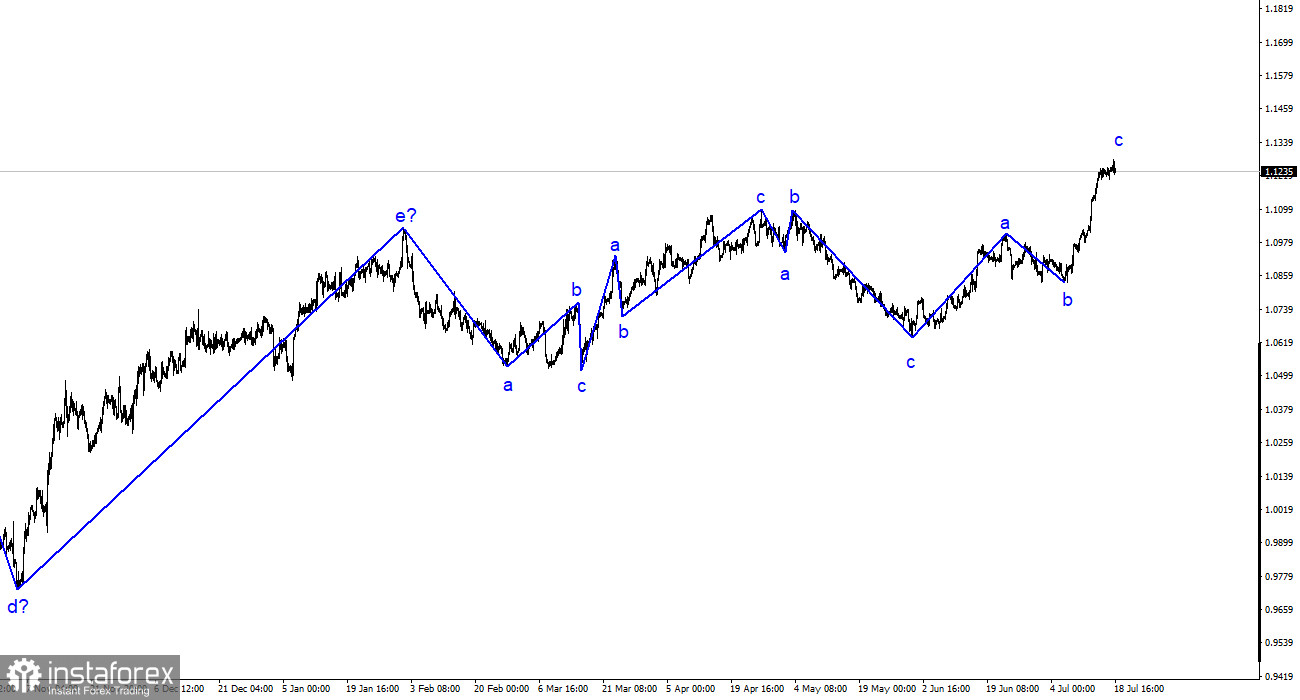

On a larger wave scale, the wave analysis of the ascending trend segment has taken on an extended form but is likely completed. We have observed five upward waves, most likely forming the a-b-c-d-e structure. The pair subsequently formed three three-wave formations: downward and upward. It is likely in the process of constructing another upward three-wave structure.