Stock rally continued, thanks to the overall positive market sentiment caused by the growing hopes of investors that the US economy will not fall into recession and that the Fed will halt the rate hike cycle amid decreasing inflation.

Macroeconomic reports released yesterday also supported such an idea, as both the year-on-year and month-on-month data on industrial production and retail sales fell below expectations. This highlights the stabilizing situation of the US economy, which may further improve in the near future.

As for today, attention should be paid to the report on consumer inflation in the eurozone, since forecasts say it will decrease from 6.1% to 5.5% y/y, but increase from zero to 0.3% m/m. Euro will likely decline amid this news, following the movements of pound, which fell due to a noticeable decrease, from 8.7% to 7.9%, in a similar indicator from the UK.

The slowing inflation in both the UK and the eurozone may convince the Bank of England and the ECB to pause the increase in rates, and then end it completely when inflation hits the target levels.

Forecasts for today:

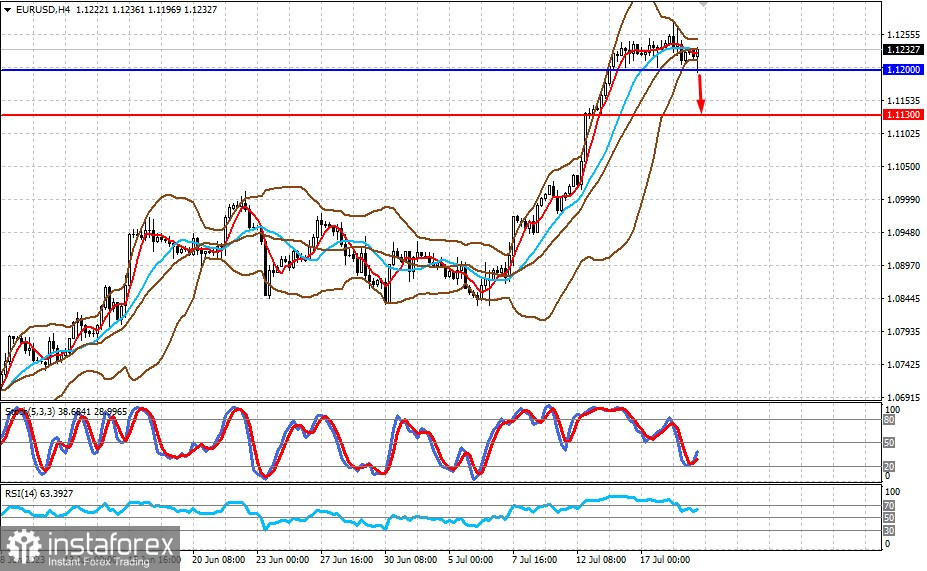

EUR/USD

The pair consolidated above 1.1200 ahead of fresh inflation data in the eurozone. A noticeable decrease in the indicator will likely result in a local price drop towards 1.1130.

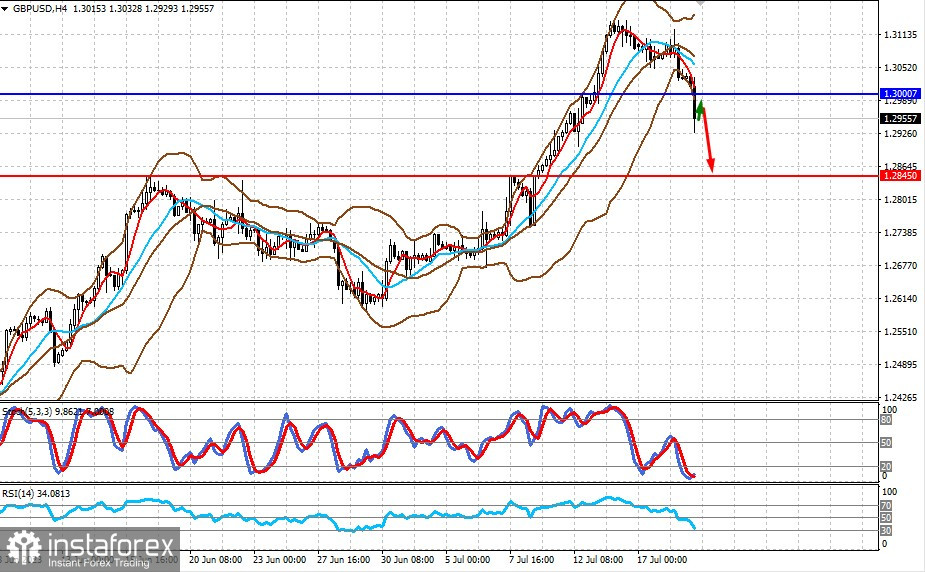

GBP/USD

The pair corrected below 1.3000, following the release of inflation data in the UK. There may be a slight upward movement before the pair continues to decline towards 1.2845.