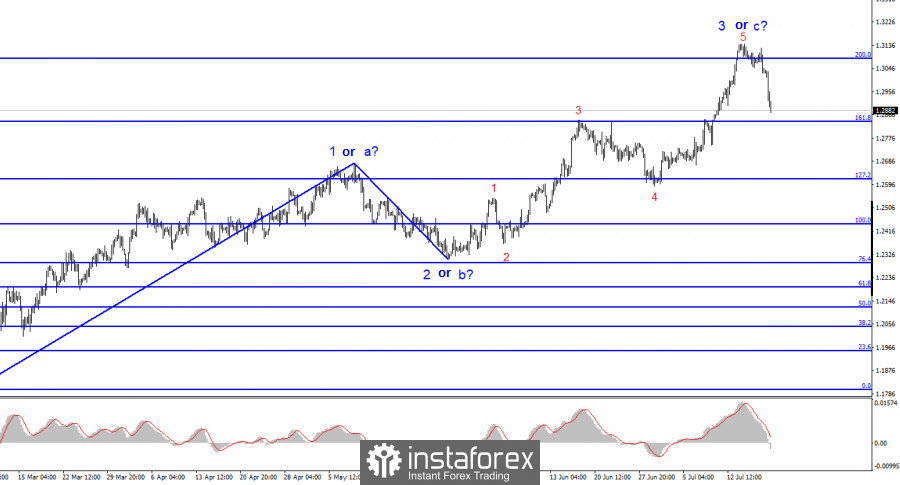

The wave analysis of the GBP/USD pair remains relatively straightforward and understandable. There is an ongoing construction of an ascending wave 3 or C, with the pound reaching the 31 level. There are insufficient reasons for the pound to continue its upward movement (supported by various reports and events), and the presumed wave 3 or C has already been completed. However, the wave analysis has become more complex, with wave 3 or C taking on a more extensive form than anticipated by many analysts a few weeks ago. The entire ascending trend segment may adopt a five-wave pattern.

Comparatively, the wave analysis for the pound appears simpler and more understandable than that for the euro. The third wave could either conclude the upward wave set or be the third wave within a five-wave structure. Therefore, in either case, I expect the formation of a downward wave, which began almost exactly as scheduled. Even if we witness a fourth wave within the upward wave set, it should be sufficiently prolonged or manifest as a three-wave structure. In the near future, I do not anticipate the decline in quotes reaching its end.

Sellers have received the necessary signal

On Wednesday, the GBP/USD exchange rate dropped by 150 basis points, and such a significant decline in the pound is entirely justified. Over the past two weeks, I have repeatedly drawn attention to the fact that the news background does not align with the performance of the GBP/USD pair. The pound has been rising too rapidly and forcefully, even on days when there was no positive news to support it. Now, the time for a correction has arrived. The market is capitalizing on profits from unfavorable long positions while the pair is only beginning its descent, which may be substantial. Based on the current wave analysis, the pound could drop to 26 in the coming days.

What about inflation? Today's inflation report could have been more surprising. Inflation decreased slightly more than expected, affecting both the headline and core indicators. Consequently, the Bank of England may relax its stance. The report will not directly impact upcoming interest rate decisions and meetings, but it has raised the possibility of concluding the tightening of monetary policy in the UK. It is worth recalling that the interest rate was increased by 50 basis points in June, but it is likely that the Consumer Price Index has yet to account for this tightening fully. Hence, a further slowdown is expected, potentially occurring at a significant pace considering the substantial and swift rate increase. The pound's decline has been delayed by a few weeks, but it is better late than never.

General conclusions.

The wave pattern of the GBP/USD pair suggests the construction of an ascending wave set. It is crucial to understand the current situation: is the fourth wave forming within the upward wave set, or is it the first wave of a new downward pattern? The direction will become clearer as the pound progresses. Since the successful breakthrough above the 1.3084 level (top-down), readers could consider initiating selling positions, as I mentioned in my recent reviews. Currently, the initial target for the pair is the 1.2840 level, which is likely to be reached. The downward wave should have at least three waves, indicating that the decline will not conclude today or tomorrow.

The pattern resembles the EUR/USD pair on a larger wave scale, although there are some differences. The downward corrective phase of the trend has been completed, and the construction of a new upward wave set is underway, which may already be complete or take the form of a complete five-wave pattern.