EUR/USD:

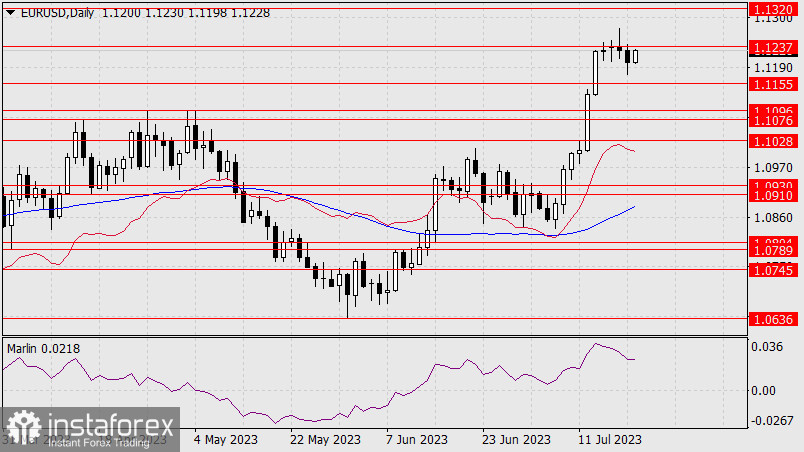

The euro quickly recovered after the drop caused by the British pound, as eurozone inflation turned out to be more stable than the UK: euro area annual inflation was 5.5 % in June 2023, down from 6.1 % in May 2023, while the core CPI was finalized at 5.5% yoy, up from May's 5.3% yoy. There was a false breakout of the signal level at 1.1205, and the price consolidated below it. The potential downtrend was hindered by the balance indicator line on the 4-hour chart. Currently, the price is consolidating below the level of 1.1237, and overcoming it will be the basis for further growth towards 1.1320.

If the price consolidates below 1.1205 again, then the price will most likely reach the support level at 1.1155. However, today, this support level will receive support from the MACD indicator line, which may eventually lead to short-term growth (1.1320).

There were no significant changes on the daily chart, the current candlestick is white, and the Marlin oscillator is slowing down its decline. Consolidation of the daily candlestick above 1.1237 will allow the price to continue rising towards 1.1320. Consolidation below 1.1155 will open the target of 1.1076/96.