Analysis and Bitcoin trading tips

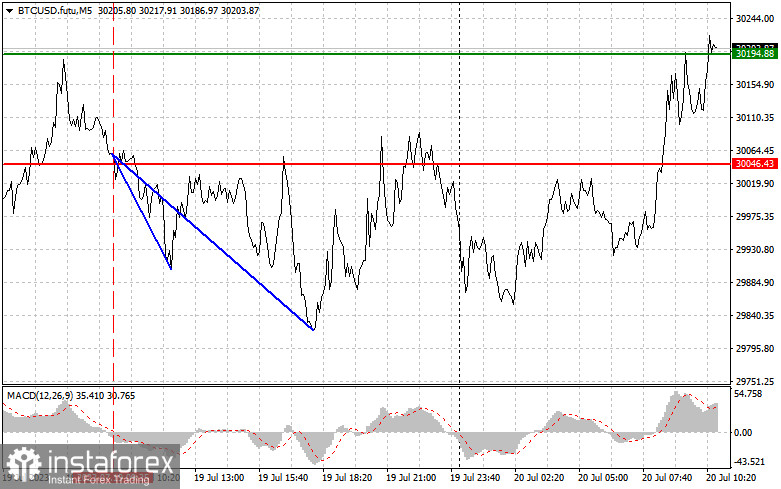

Bitcoin tested $30,046 in the first half of the day, which coincided with the MACD being in a selling area. It confirmed the correct market entry point for the developing short-term bearish trend. Consequently, Bitcoin declined to $29,900 and ended the move there.

One notable report that came out yesterday showed that 29% of Bitcoin's total circulating volume ($235 billion) has been inactive for 5 years. Experts believe that most of these coins are probably lost forever. Meanwhile, US presidential candidate Robert F. Kennedy Jr. announced that he wants to issue Treasury securities backed by BTC. Initially, about 1% of issued T-bills will be backed by BTC, which is a rather unorthodox idea for politicians of this level.

The fact that Bitcoin bears can't overcome the lower border of the sideways channel indicates the presence of major bullish traders there. Yesterday, active buying continued around $29,700, which means that Bitcoin has a good enough opportunity to grow within the sideways channel, in which it has been for a long period of time. Today, I will make trading decisions based on the realization of scenarios number 1.

Buy signal

Scenario 1: You can go long on Bitcoin today once it reaches the entry point at 30,259 (the green line on the chart), targeting 30,564 (the thicker green line on the chart). Once the asset reaches the area of 30,564, you should close the long position and open a short position. Bitcoin is expected to increase while trading is carried out above the lower boundary of the sideways channel. Caution! Make sure the MACD indicator is above zero before going long on Bitcoin.

Scenario 2: long positions on Bitcoin can also be opened if the cryptocurrency tests 30,092 two times in a row while the MACD indicator is in the oversold area. This will limit the trading instrument's downward potential and lead to an upward reversal in the market. In such a scenario, Bitcoin might reach 30,259 and 30,564.

Sell signal

Scenario 1: short positions on Bitcoin can be opened after BTC hits 30,092 (the red line on the chart), which would lead to a rapid decline. The level of 29,793 will be a key target level for bearish traders, where you should close your position and open a long position immediately, expecting BTC to reverse upwards. The pressure on Bitcoin will persist if BTC breaks below the lower boundary of the wide sideways channel. Caution! Make sure the MACD indicator is below zero before going long on Bitcoin.

Scenario 2: you can also go short on BTC once Bitcoin tests 30,259 two times in a row while the MACD indicator is in the overbought area. This will limit the trading instrument's upside potential and lead to a downward reversal in the market. In such a scenario, Bitcoin might decline to 30,092 and 29,793.

Indicators on charts:

A thin green line indicates a buy entry point.

A thick green line indicates a point where you can set a Take Profit order or lock in profits manually because the price will unlikely go above this level.

A thin red line indicates a sell entry point.

A thick red line is the estimated price level where you should place a Take Profit order or close positions manually because the quote is unlikely to fall below this mark.

MACD. When entering the market, it is important to pay attention to the indicator's overbought and oversold zones.

Important! Novice crypto traders should be very careful when deciding to enter the market. Before the release of important fundamental data, you should stay out of the market in order to avoid sharp price fluctuations. If you decide to trade during news releases, make sure to always place a stop order to minimize losses. Without the order, you may quickly lose your entire deposit, especially if you do use money management but trade large volumes.

Remember that in order to succeed in the market, you should have a clear trading plan, like the one I presented above. Spontaneous decisions based on the current state of the market are a losing strategy for an intraday trader.