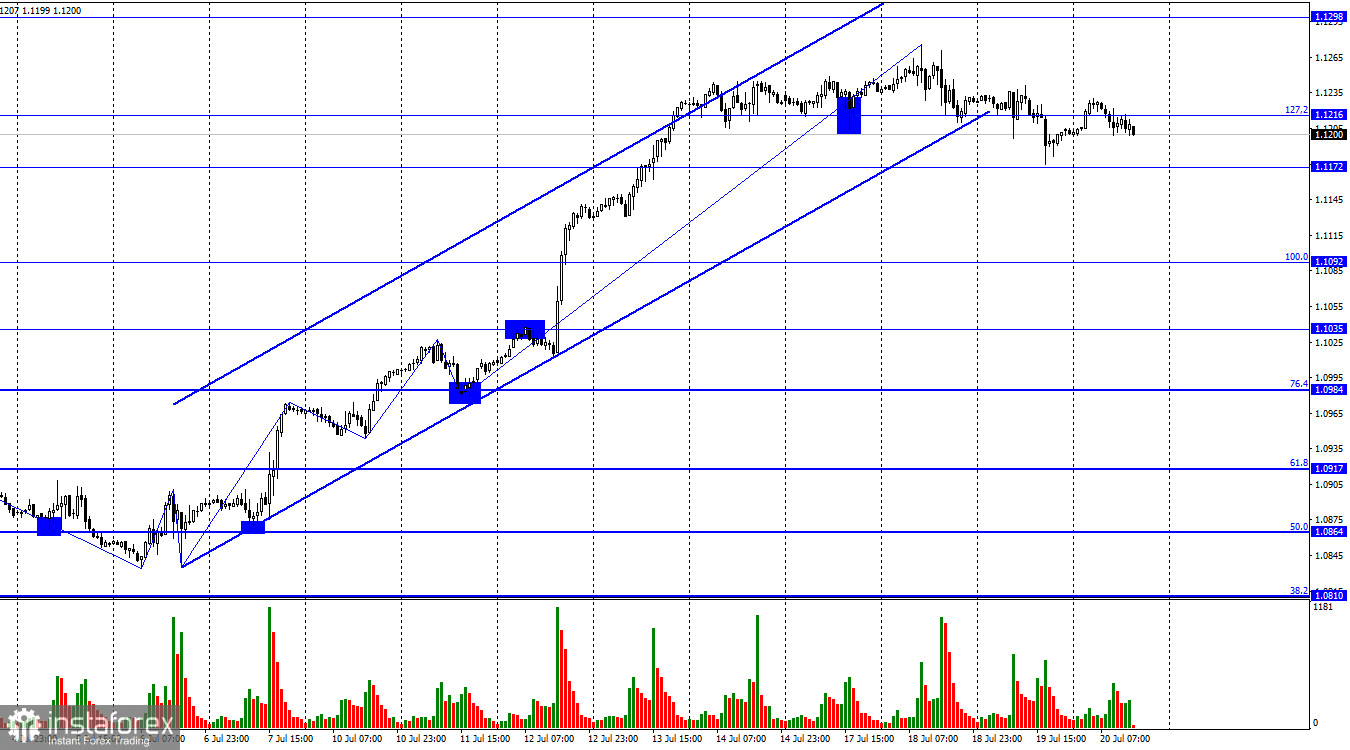

On Wednesday, the EUR/USD pair experienced a minor decline to 1.1172, but the drop was quite weak, similar to the overall trader activity in recent days. Today, the pair briefly returned to 1.1216, but it is falling again towards the same level of 1.1172. The pair's consolidation below the ascending trend corridor suggests the possibility of further decline, but it is evident that this downward movement is feeble.

The waves still need to provide new information. After reaching the peak of the upward wave on Tuesday, the pair is gradually declining. However, the downward wave has not yet been completed, and there are no signs of the end of the "bullish" trend. To reiterate, we need to witness either a breakout below the low of the last descending wave or a failure to surpass the peak of the last ascending wave. We have yet to witness a complete descending wave, but neither of these conditions has been met.

The information background for Thursday is expected to be quite weak, similar to Wednesday. US reports on building permits (worse than forecasts) and housing starts (worse than forecasts) were released. This led to a slight dollar strengthening during the day, but the rise was so insignificant that it didn't allow any concrete conclusions. Today's situation is even more unfavorable. The report on initial and continuing jobless claims, which carries a similar status as yesterday's reports, will be released. Given that traders showed little interest in trading the pair on Monday, Tuesday, and Wednesday, it is unlikely that their enthusiasm will arise today.

Hence, my expectation for the pair is a weak decline characterized by a measured pace and frequent upward corrections.

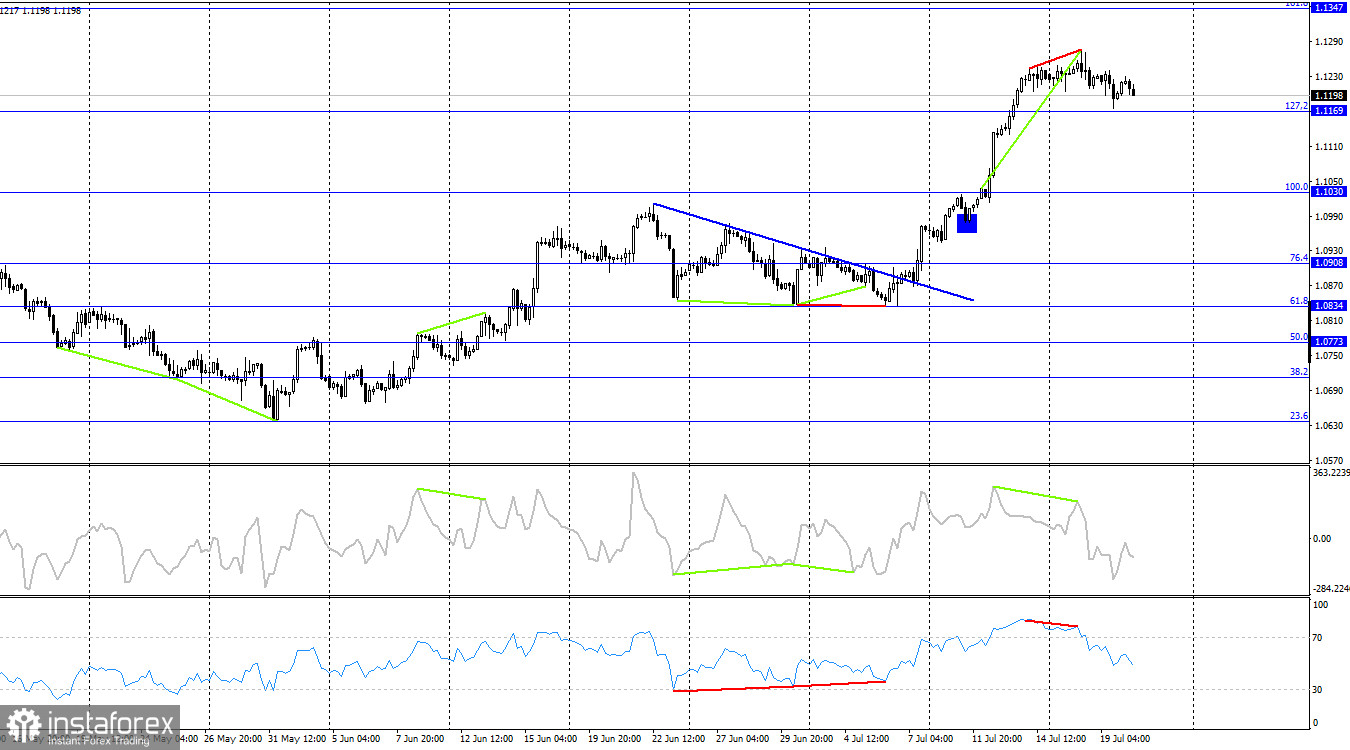

On the 4-hour chart, the pair has solidified its position above the Fibonacci level of 127.2% (1.1169), enabling it to continue upward toward the next corrective level of 161.8% (1.1347). As I mentioned earlier, traders ignored various reports and factors last week, but the euro currency is still rising, and there are no graphical signals indicating a reversal yet. However, two "bearish" divergences have formed on the RSI and CCI indicators, suggesting the potential for a decline. Nevertheless, the pair has not closed below the level of 1.1169.

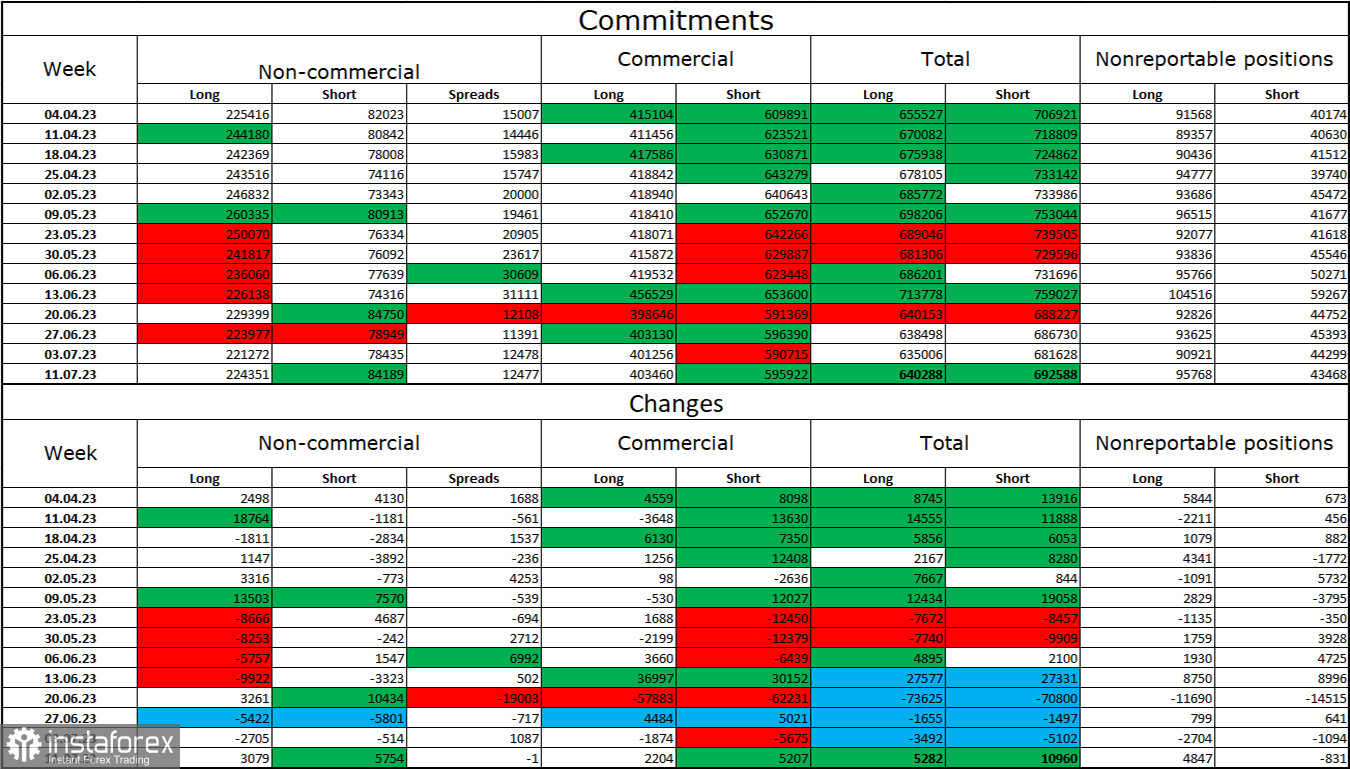

Commitments of Traders (COT) Report:

During the last reporting week, speculators initiated 3,079 long contracts and 5,754 short contracts. While major traders remain "bullish," their sentiment is gradually weakening. The total number of long contracts speculators hold now is 224,000, whereas short contracts are only 84,000. The bullish sentiment persists, but the situation will gradually shift in the opposite direction. The significant number of open long contracts indicates that buyers might start closing their positions soon (or have already begun), revealing a notable bias towards the bulls. The current data suggest a potential decline in the euro currency in the coming weeks, particularly considering its strong rise last week. Nevertheless, there are currently no graphical signals indicating a selling opportunity.

News Calendar for the USA and the Eurozone:

USA - Initial Jobless Claims (12:30 UTC).

USA - Philadelphia Fed Manufacturing Index (12:30 UTC).

On July 20th, the economic events calendar features two entries of relatively low significance. The impact of the information background on traders' sentiment during the remaining part of the day may be weak.

Forecast for EUR/USD and advice to traders:

Selling was viable when the pair consolidated below the level of 1.1216 on the hourly chart, with targets at 1.1172 and 1.1092. As the trend remains bullish, I do not recommend expecting a significant decline in the pair. Positions can be held open. I suggest buying the pair with a target of 1.1298 on a rebound from the level of 1.1169 on the 4-hour chart.