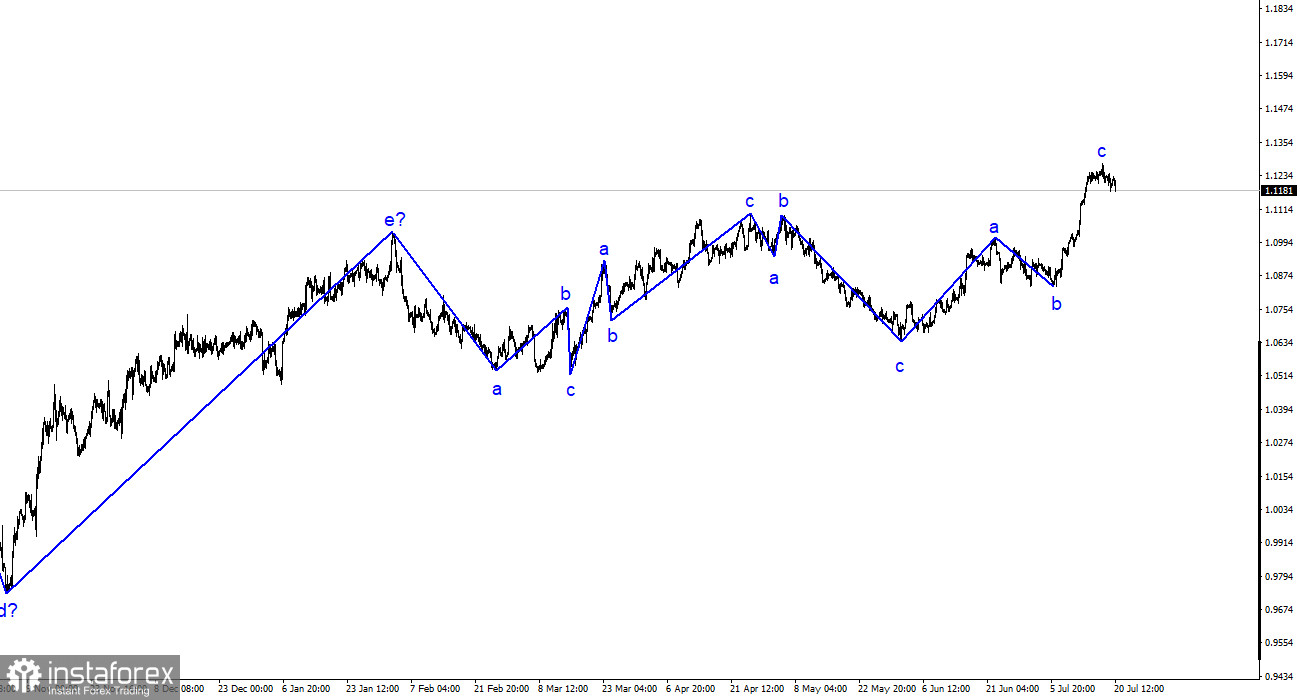

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. The ascending trend formed last year has become complex, with only three wave structures alternating in the last six months. I have consistently mentioned my expectation for the pair to reach around the 5th figure, where the ascending three-wave pattern began. I still hold on to this view, but we must wait for the current three-wave pattern to complete, which might already be true.

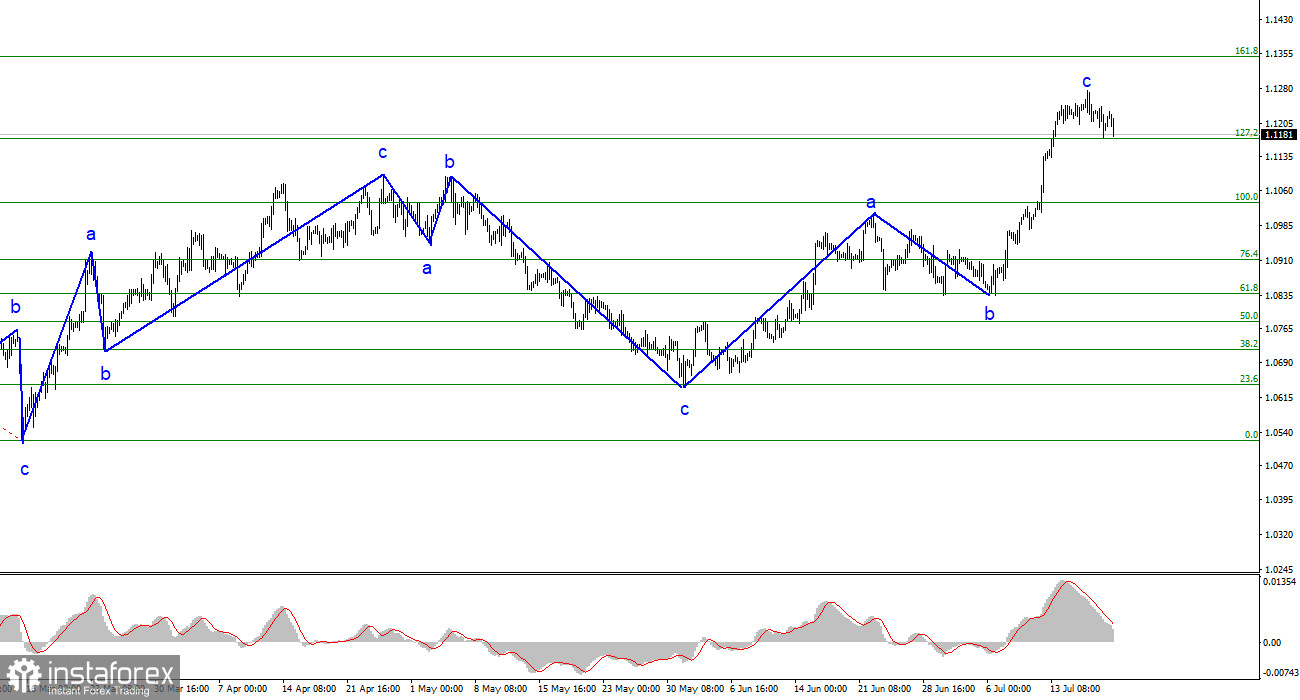

The part of the trend that began on May 31st could take the form of an impulsive five-wave pattern, but it isn't easy to assert this confidently. The news background needs to be stronger for the euro currency to grow by 300 basis points weekly. A successful attempt to break the level of 1.1172, corresponding to 127.2% on Fibonacci, indicates the market's readiness to continue buying with targets around the calculated level of 1.1349, equivalent to 161.8% on Fibonacci. Despite the apparent completion of wave c, the market needs more desire to increase demand for the US currency.

Unemployment in the USA continues to please the market. On Thursday, the rate of the euro/dollar pair decreased by 20-30 basis points. The demand for the euro currency continues to decrease very slowly, raising doubts about the completion of the ascending trend. However, market movements can vary, and slow and weak movements are also part of it. Hence, we should avoid overreacting and hasty conclusions. An unsuccessful attempt to break the 127.2% Fibonacci level may complicate the ascending wave c, leading to a potential further rise in the euro currency.

Today, the US dollar received slight market support after the release of the report on initial jobless claims. The number of claims for the past week was 228,000, 10-15 thousand lower than market expectations. Consequently, an increase in demand for the dollar was expected. However, the news background this week is relatively weak. The market believes it is better to focus on next week, when the ECB and the Fed will hold their meetings, rather than rushing events this week.

This does not apply to the British pound, as it experienced a stir of emotions this week due to the inflation report it received. While there is a high probability of further decrease in the instrument, it is currently near the 1.1172 level, which should be considered when making decisions.

In conclusion, based on the conducted analysis, constructing an ascending set of waves is ongoing, but it could be completed at any moment. I still consider the targets around 1.0500-1.0600 quite realistic, and I recommend selling the instrument with these targets. The a-b-c structure is presumably complete, but signals confirming this are needed. However, cautious sales are possible at the moment. Buying at this time is considered quite risky, but above the 1.1172 level, such positions become more attractive.

On the larger wave scale, the wave marking of the ascending trend has taken an extended form, but it is likely to be completed. We have observed five upward waves, likely the structure of a-b-c-d-e. Subsequently, the pair formed three three-wave structures: two downward and one upward. Currently, it is in the process of building another ascending three-wave structure.