EUR/USD

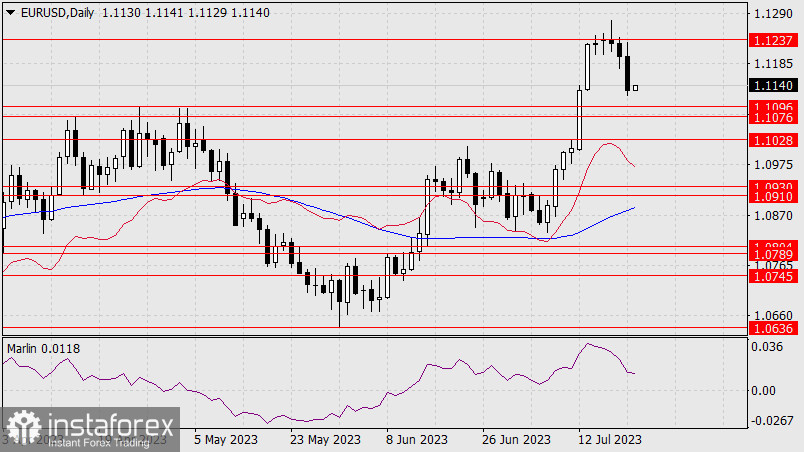

Yesterday, the euro sharply fell by more than 70 pips on high volumes. It was likely a direct selling of the euro. However, in order to confirm this, the price still needs to break through the support range at 1.1076/96. For now, we are expecting a minor correction after yesterday's sharp decline.

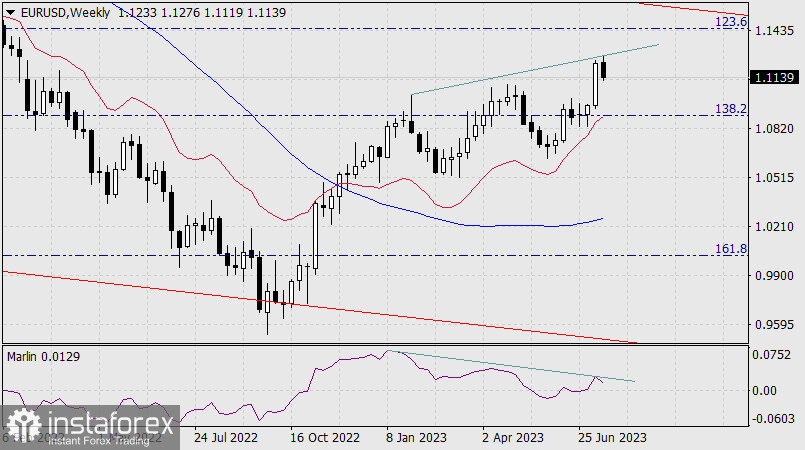

In general, a powerful reversal signal towards a medium-term decline would be a double divergence on the weekly timeframe. This is a rare phenomenon (on the weekly chart), and is often realized by the market (with one exception in the last 20 years when a double divergence turned into a triple one).

Today, there are no significant events for both the US and the EU, so the euro may take cues from the British pound. The UK will release its retail sales report for June, with a forecast of 0.2%, which should be enough for a moderate corrective growth.

On the four-hour chart, the price has settled below the MACD indicator line. The Marlin oscillator has sharply turned upwards, and a correction to 1.1175 is possible - to the low of the 19th. In this case, a break above the MACD line would be false. Next, we expect the price to fall into the target range of 1076/96.