Long positions on EUR/USD:

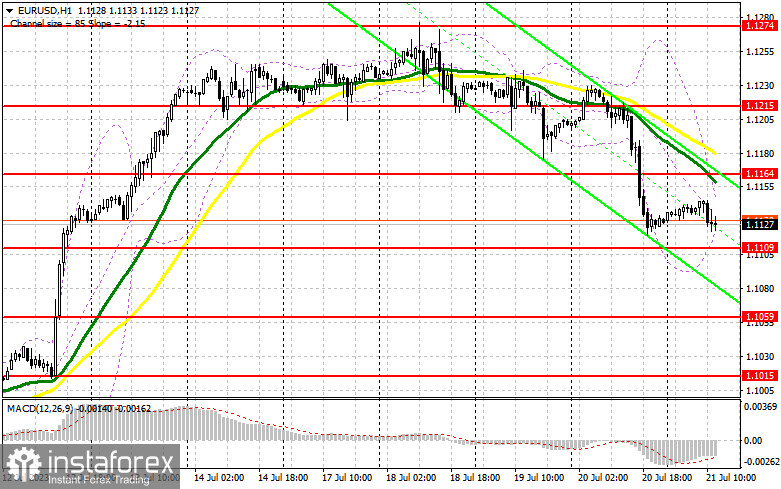

Considering the lack of important fundamental data from the Eurozone affecting market volume and the possibility of volatility, the second half of the day may unfold similarly. With no scheduled reports from the US, expecting a one-sided movement is unlikely. The pair may continue its downward movement towards the support at 1.1109, where a false breakout combined with MACD indicator divergence could provide an excellent entry point for long positions. The target for such a movement would be the resistance at 1.1164, where moving averages support bears. A breakthrough and a top-down test of this level would strengthen the demand for the euro, potentially leading to a return to the high at 1.1215. The next target remains in the area near 1.1274, where one may take profits. However, if the euro/dollar pair declines and we see no activity near 1.1109 in the second half of the day, things will not look good for bulls. Therefore, only a false breakout near the next support at 1.1059 would give a buy signal. You may open long positions from a low of 1.1015, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Bears still have a chance to further establish a downward correction, but be extremely cautious when selling near weekly lows. It is better to focus on defending the resistance at 1.1164, which was formed as a result of yesterday's trading session. It would be better to act after an upward movement and a false breakout, indicating a sell signal with the prospect of the pair's decline to the new support at 1.1109, where more bulls may come into play. If a breakthrough and consolidation below this range, along with a reverse test from the bottom-up, occurs, it could signal a sell opportunity, leading directly to 1.1059. This would indicate a substantial euro correction, potentially reigniting buyers' interest. The next target would be near 1.1015, where traders may take profits. If the pair moves up during the US session and there are no bears at 1.1164, which is also possible, bulls are likely to regain control of the market. In that scenario, it would be better to postpone short positions until the pair reaches the next resistance at 1.1215. You may consider selling the euro at this level, but only after an unsuccessful consolidation. Short positions can also be opened from a high of 1.1274, allowing a downward correction of 30-35 pips.

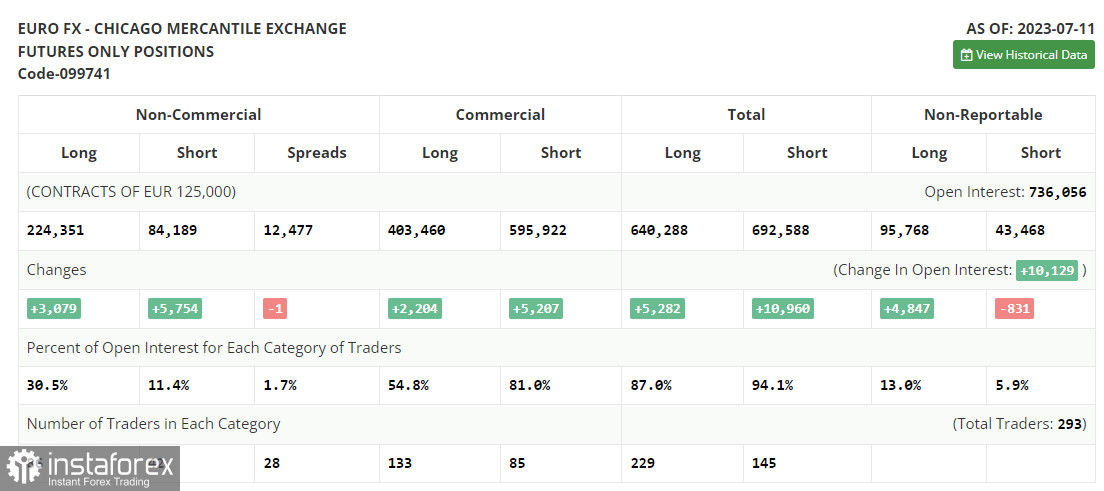

The COT report on July 11 logged an increase in both long and short positions, leaving the market balance practically unchanged in favor of euro bulls. The released inflation data from the US, indicating a sharp slowdown, especially in core prices, significantly influenced euro bulls, leading to a surge and new yearly highs below the psychological level of 1.1000, which had eluded them for almost half a year. The fact that the Fed no longer needs to raise interest rates makes the US dollar quite weak. As the market remains bullish, the optimal medium-term strategy in the current conditions is to buy the euro on declines. The COT report shows that non-commercial long positions increased by 3,079 to 223,351, while non-commercial short positions jumped by 5,754 to 84,189. The total non-commercial net position slightly decreased to 140,162 against 142,837. The weekly closing price rose to 1.1037 from 1.0953.

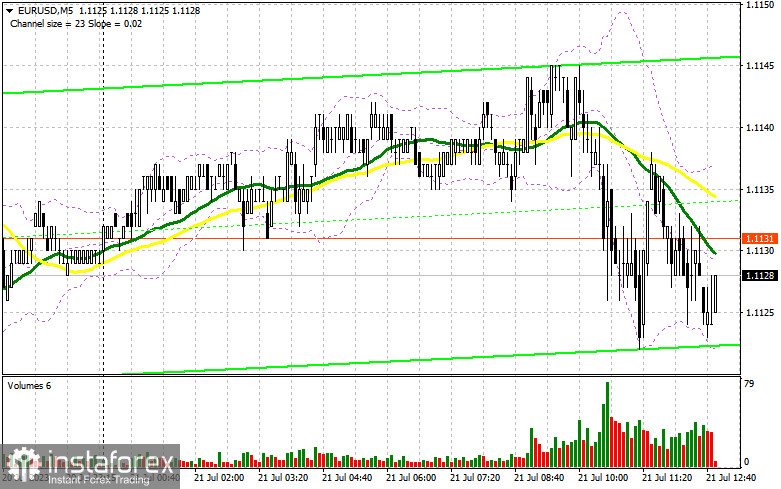

Signals of indicators:

Moving Averages:

The pair is trading below the 30- and 50-day moving averages suggesting further euro decline.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), which differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands:

In case of an upward movement, the upper Bollinger Band near 1.1140 will offer resistance.

Descriptions of indicators:

- Moving Average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands (indicates volatility and possible overbought/oversold conditions). Period 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between non-commercial short and long positions.