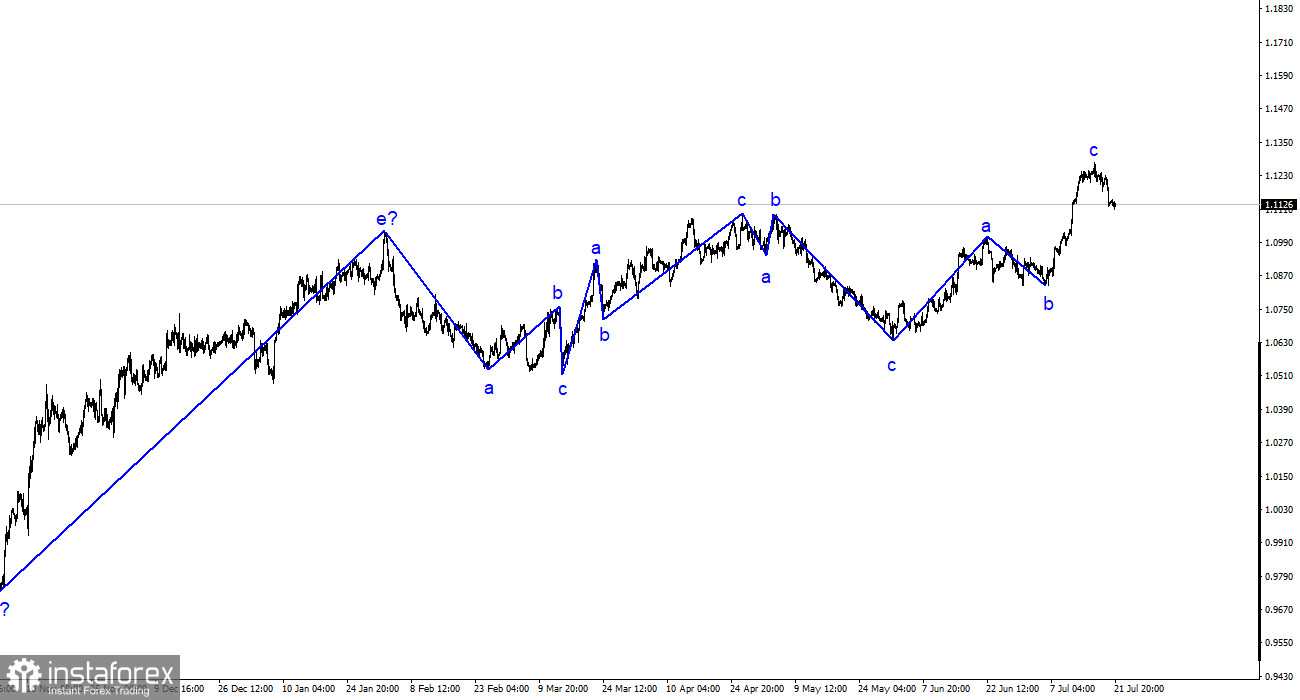

The wave analysis of the 4-hour chart for the EUR/USD pair remains clear. The upward trend, which began last year, has developed into a complex structure, with three alternating wave structures observed in the last six months. I have consistently mentioned my expectation of the pair nearing the 1.12 level, where the construction of the last upward three-wave structure began. I still hold to this view, but we must wait for the current upward trend segment to complete, which might have already happened.

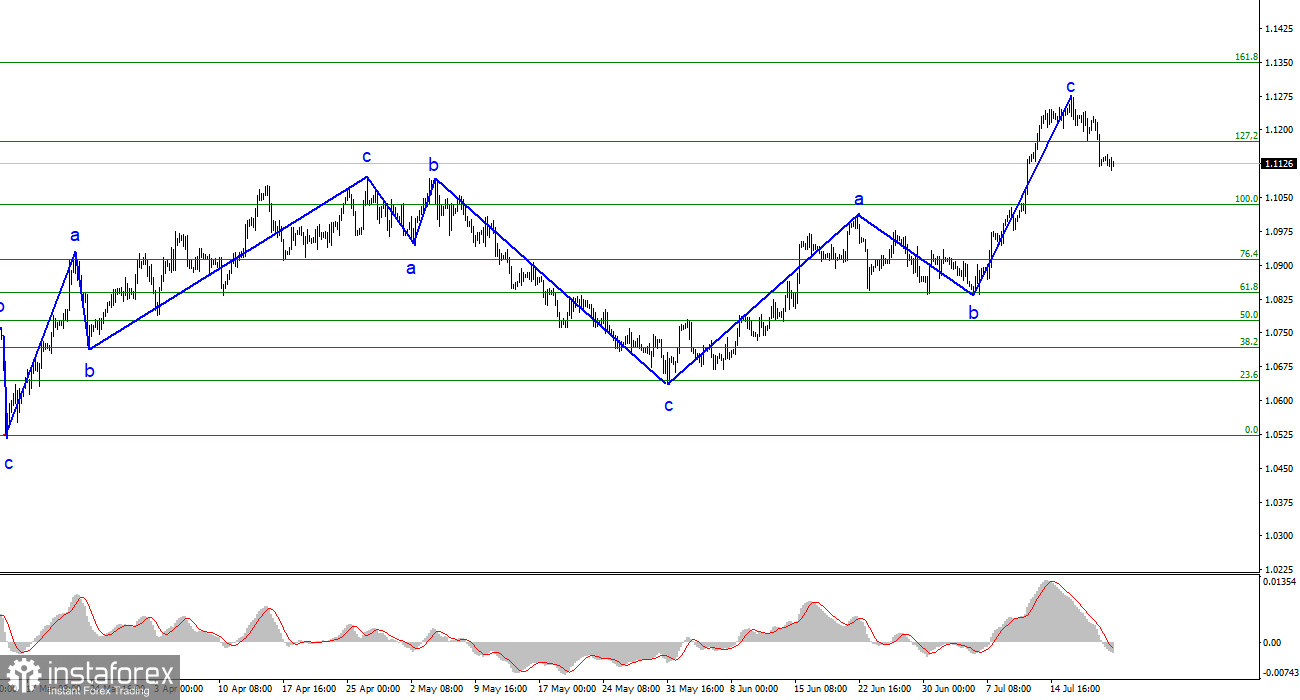

The trend segment that started on May 31 could be an impulse five-wave structure, but speaking confidently about it now is quite challenging. The news background must be stronger to sustain consistently high demand for the euro. A successful attempt to break the level of 1.1172, which corresponds to 127.2% Fibonacci, indicates the market's readiness to sell with targets near the calculated level of 1.1034, equivalent to 100.0% Fibonacci. Although the wave structure seems complete, the market is not rushing to sell.

Friday was quiet, and the euro's prospects are uncertain.

The EUR/USD pair remained unchanged on Friday, and the low amplitude of movements can be attributed to this factor. The market may have already shifted into a waiting mode for the upcoming ECB and Federal Reserve meetings next week. However, speculating on the statements of Christine Lagarde and Jerome Powell after the meetings is challenging, as is predicting the pair's movements for the following Wednesday and Thursday.

The market is confident that the FOMC rate will increase by 25 basis points, as will the ECB rate. This creates a certain parity for the next week. However, the wave analysis indicates the completion of the upward three-wave structure, suggesting that the demand for the euro should continue to increase. Achieving this goal will depend on whether Jerome Powell hints at another rate hike after the July meeting or if Christine Lagarde hints at the soon completion of the monetary policy tightening program. Otherwise, the entire three-wave structure may revert to a five-wave structure, either impulsive or corrective.

The pair has the potential to decline by another 100 points, but monitoring the market's actions will be essential to understand if it leans towards building a bearish wave set or a fifth wave as part of the current upward trend segment. The first scenario is more likely.

In conclusion, based on the conducted analysis, the construction of the upward wave set is complete. I still consider the targets in the range of 1.0500-1.0600 realistic, and I recommend selling the pair with these targets. The a-b-c structure appears complete and convincing, with the close below the level of 1.1172, indirectly confirming this view. Therefore, I recommend cautious selling of the pair with targets near the level of 1.1034. Buying at the moment is considered risky, but it may become more attractive above the level of 1.1172.

On a larger wave scale, the wave analysis of the ascending trend segment has taken an extensive form, but it is likely nearing completion. We have observed five upward waves, most likely forming a structure of a-b-c-d-e. Subsequently, the pair constructed three three-wave structures: two downward and one upward. It is likely in the stage of building yet another ascending three-wave structure.