When to open long positions on EUR/USD:

When to open long positions on EUR/USD:

As the economic calendar for the United States was empty, the pair did not change markedly. However, today, the EU will unveil several crucial economic reports on PMI indices. The Manufacturing PMI Index is expected to remain below 50, showing further contraction of the sector. The Services PMI Index is likely to rise, eclipsing a prolonged fall in the manufacturing sector. Against this background, it is difficult to say what to expect from the Composite PMI Index as it is hovering near 50.

If the reports are downbeat, it will surely return pressure on the euro. It could trigger another test of 1.1109. A fall and a false breakout there will give a buy signal in anticipation of the end of a bearish correction. It may cause an upward movement to the resistance level of 1.1149, At this level, the moving averages are passing in negative territory. A breakout and a downward retest of this level will stimulate demand for the euro. It is likely to return to a high of 1.1188. A more distant target will be the 1.1226 level where I recommend locking in profits. If EUR/USD declines and bulls fail to protect 1.1109, bulls may lose the upper hand. Therefore, only a false breakdown of the support level of 1.1078 will provide a buy signal. You could buy EUR/GBP at a bounce from 1.1047, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Today, sellers have a chance of building a downward correction. However, speculators should be extremely careful when opening short positions at weekly lows. It is better to focus on the protection of the resistance level of 1.1149 formed. I would advise you to go short from this level only after a rise and a false breakout. It may create a sell signal with the prospect of a decline to the support level of 1.1109. Large buyers are likely to enter the market at this level. Yet, this level has already been tested once, bulls could retreat. In case of a breakout and consolidation below this level as well as an upward retest, there might be a sell signal. The pair is projected to fall to 1.1078. This will indicate a large correction of the euro, which may boost bullish sentiment. A more distant target will be the 1.1047 level where I recommend locking in profits. If EUR/USD rises during the European session and bears fail to defend 1.1149, which is also likely, bulls will regain control of the market. In this case, I would advise you to postpone short positions until a false breakout of the resistance level of 1.1188. You could sell EUR/USD at a bounce from 1.1226, keeping in mind a downward intraday correction of 30-35 pips.

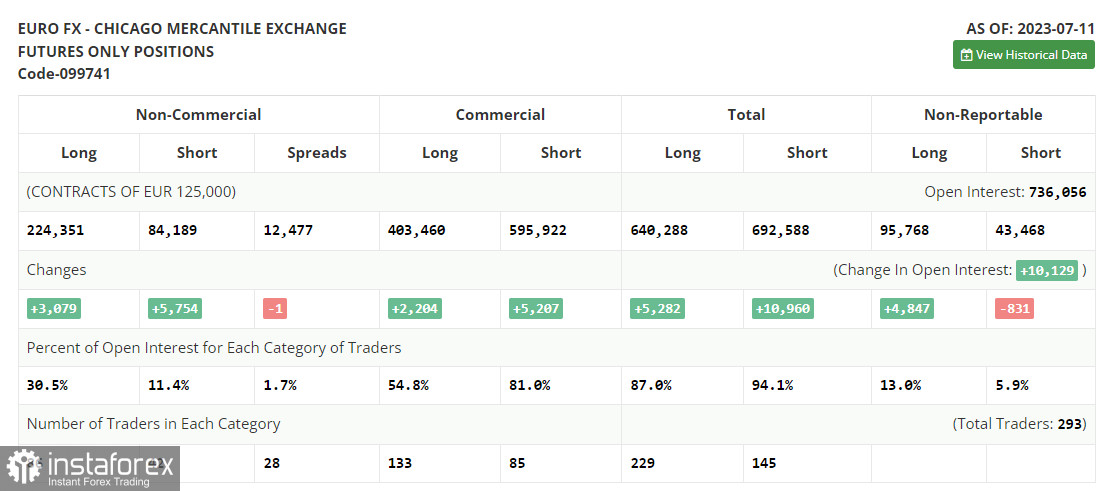

COT report

The COT report on July 11 logged an increase in both long and short positions, leaving the market balance practically unchanged in favor of euro bulls. The released inflation data from the US, indicating a sharp slowdown, especially in core prices, significantly influenced euro bulls, leading to a surge and new yearly highs below the psychological level of 1.1000, which had eluded them for almost half a year. The fact that the Fed no longer needs to raise interest rates makes the US dollar quite weak. As the market remains bullish, the optimal medium-term strategy in the current conditions is to buy the euro on declines. The COT report shows that non-commercial long positions increased by 3,079 to 223,351, while non-commercial short positions jumped by 5,754 to 84,189. The total non-commercial net position slightly decreased to 140,162 against 142,837. The weekly closing price rose to 1.1037 from 1.0953 Indicator signals:

Indicator signals:

Moving averages:

Trading is carried out below the 30-day and 50-day moving averages, which indicates a possible decrease in the pair.

Note: The author considers the period and prices of moving averages on the H1 (1-hour) chart that differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.1109 will serve as support.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.