The rise in gold at the beginning of last week to a two-month high triggered strong bullish sentiments. Nevertheless, analysts warn investors about the upcoming Federal Reserve meeting, where a decision on the interest rate that affects the U.S. dollar will be made.

The latest weekly gold survey shows that retail investors anticipate a price around $2,000 per ounce, even though the Federal Reserve plans to raise interest rates by another 25 basis points. Market analysts, on the other hand, remain more cautious, although they are generally optimistic.

Sean Lusk, co-director of commercial hedging at Walsh Trading, said he maintains an optimistic outlook on gold since the Federal Reserve cannot fully control inflation pressures, and there are supply problems in the broader commodity markets. He explained that under a hawkish Federal Reserve stance after the rate hike, gold prices might temporarily drop by $50. However, due to existing inflation and supply issues, he believes gold is still a good investment.

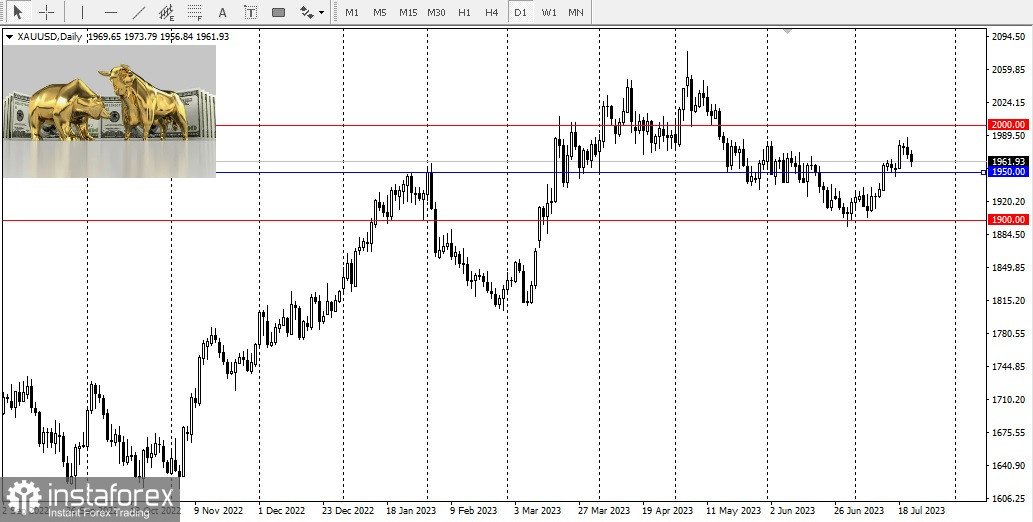

According to James Stanley, market strategist from StoneX, ahead of news about the interest rate, gold prices will continue to rise, possibly testing $2,000 and staying above $1,950.

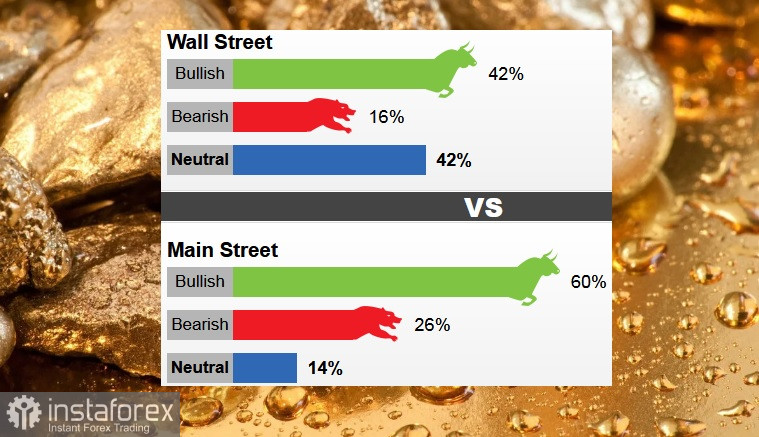

Last week, 19 analysts from Wall Street participated in the gold survey. In a tie vote, 42% or eight votes each were bullish and neutral, while three analysts, constituting 16%, had bearish views.

Last week, 19 analysts from Wall Street participated in the gold survey. In a tie vote, 42% or eight votes each were bullish and neutral, while three analysts, constituting 16%, had bearish views.

In online polls, 369 votes were cast. Among them, 60% (221 votes) were in favor of price growth, 26% (95 votes) believed the price would drop, and 14% (53 votes) remained neutral.

According to the latest survey, retail investors expect gold to retest the resistance at $1,980 per ounce by the end of the week and conclude the current week at $1,965.80.

The monetary policy meeting scheduled for Wednesday represents the most significant event risk of the current week, as the markets are almost fully pricing in an interest rate increase. There is a high likelihood that the rate hike and a hawkish tone will support the U.S. dollar, consequently putting pressure on gold.