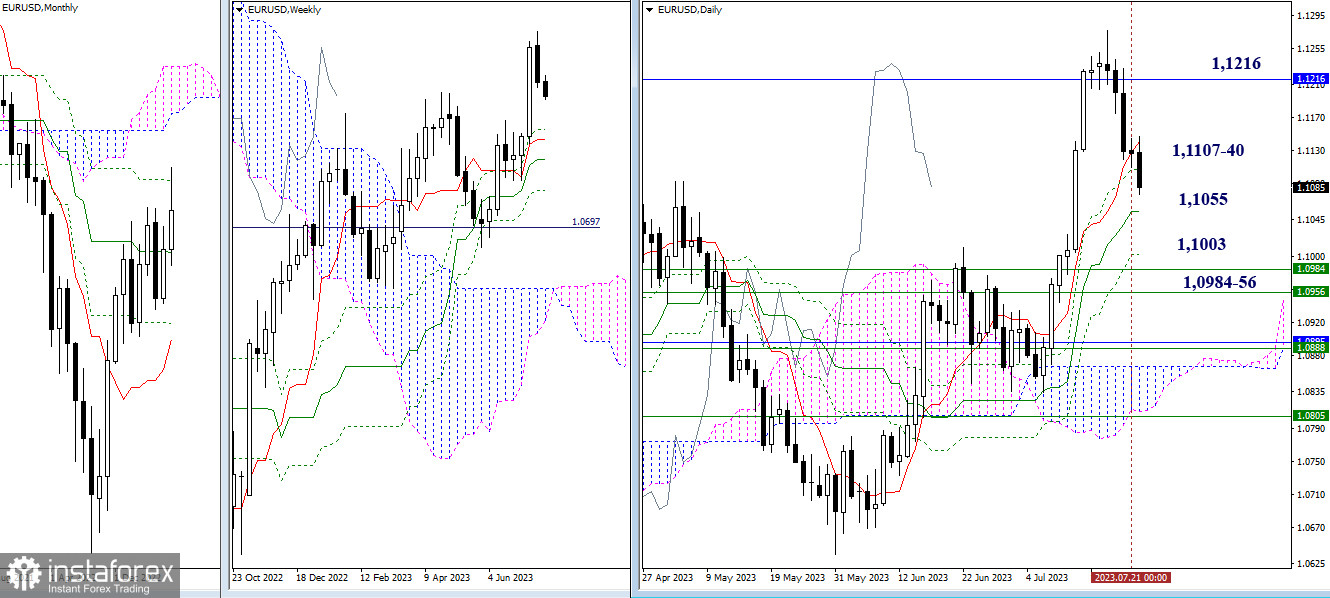

EUR/USD

Higher timeframes

Bearish players concluded the previous week within the range of daily levels (1.1107 - 1.1140). In the event of a further downward correction, attention will be focused on breaking through the daily Ichimoku cloud (1.1055 - 1.1003) and testing weekly support levels (1.0984 - 1.0956). The target for upward movement for the current week remains the final level of the monthly Ichimoku cross (1.1216). Breaking through the resistance and reaching a new high of the current correction (1.1276) will open up opportunities for considering new prospects.

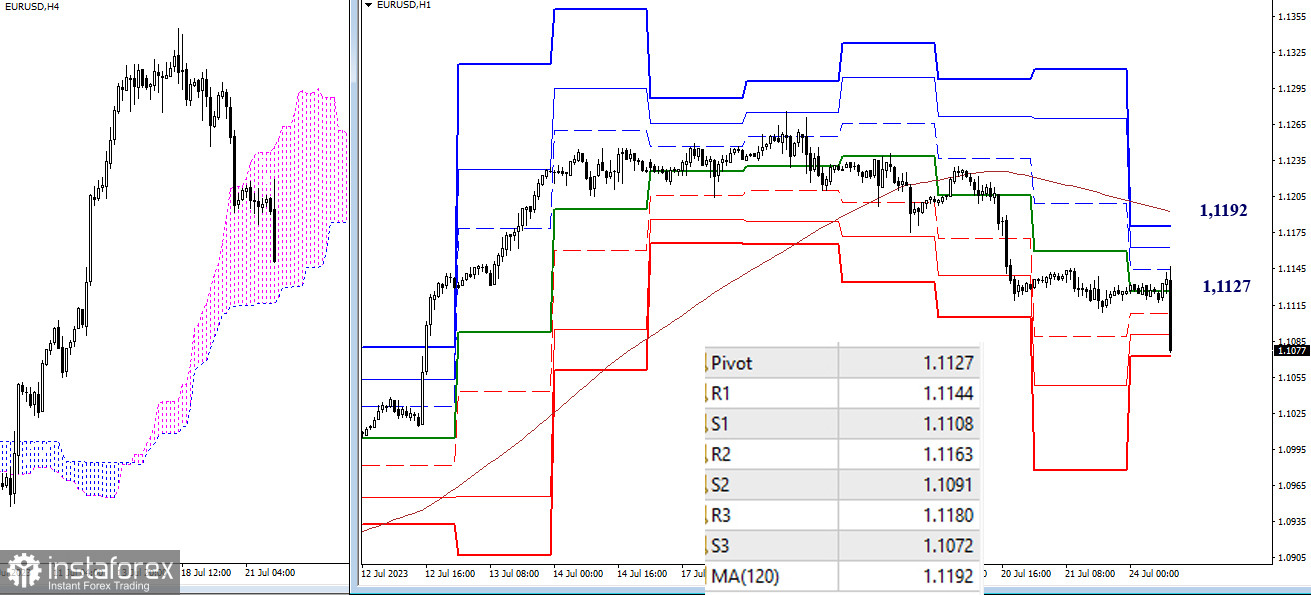

H4 - H1

The decline has already brought the pair to the last support level of the classic pivot points (1.1072). Next, the focus may be on the lower boundary of the H4 cloud (1.1055), and after breaking through it, attention will shift to higher timeframe levels. Key levels on lower timeframes today act as resistance, ranging from 1.1127 (central pivot point of the day) to 1.1191 (weekly long-term trend), and intermediate resistances on this path may be at 1.1144 - 1.1163 - 1.1180 (resistance levels of classic pivot points).

***

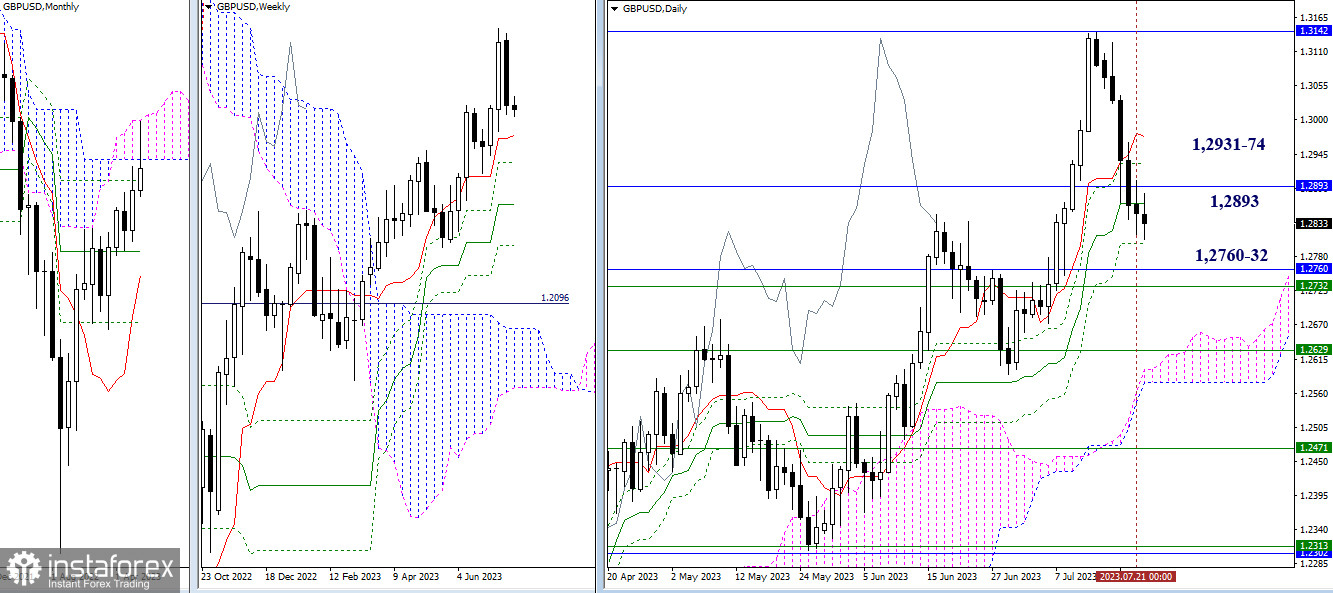

GBP/USD

Higher timeframes

Bearish sentiments of the previous week neutralized all previous achievements of the bulls. The pound reached the final level of the daily Ichimoku cloud (1.2800). The liquidation of this level and testing the next supports around 1.2760 - 1.2732 (weekly short-term trend + monthly Fibo Kijun) are the tasks for bearish players now. Previously passed levels currently act as resistances, which, if the market direction changes, will meet the market at 1.2893 (lower boundary of the monthly cloud) and 1.2931 - 1.2974 (daily Ichimoku cross levels).

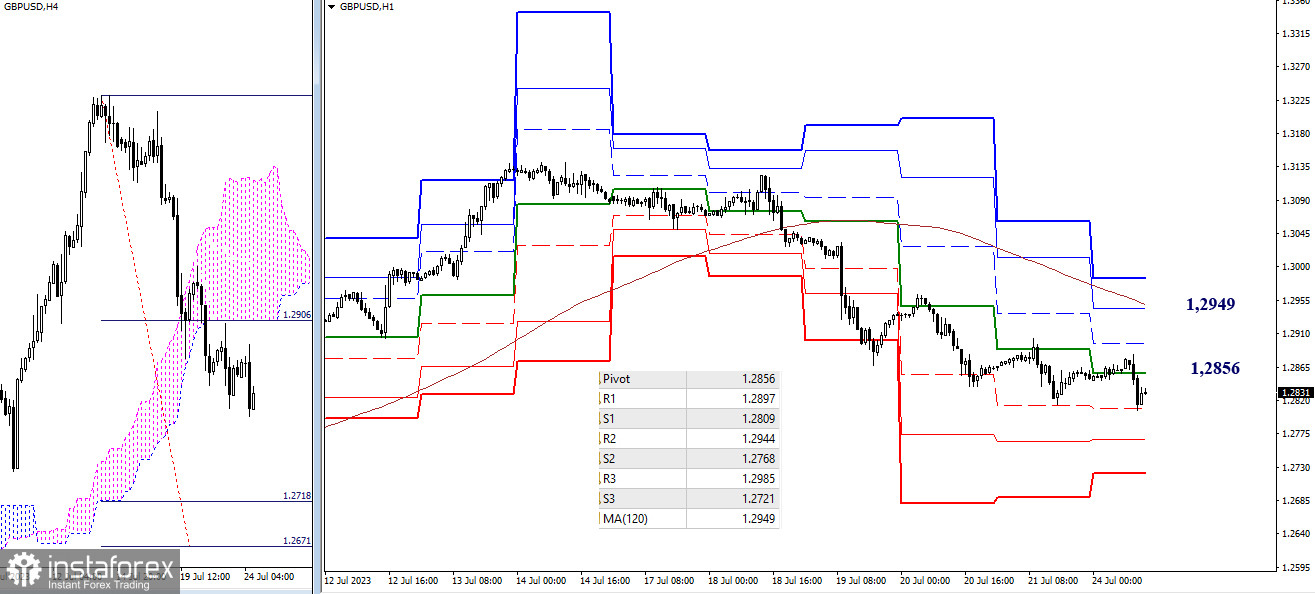

H4 - H1

On lower timeframes, the main advantage currently belongs to the bears. They tested the first support of classic pivot points (1.2809), and further downward movement awaits the pair at 1.2768 (S2) - 1.2721 (S3). The next bearish target will be aiming for breaking through the H4 cloud (1.2718 - 1.2671). In case the market initiative shifts to the bulls' side, and the pair consolidates above the central pivot point (1.2856), it will head towards the key level of 1.2949 (weekly long-term trend). This level represents the current balance of power.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)