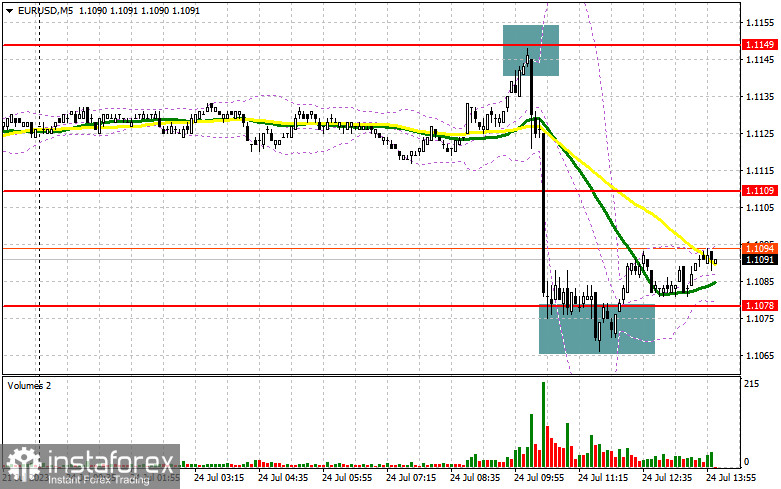

In my morning forecast, I paid attention to the level of 1.1149 and recommended making decisions on entering the market from it. Let's look at the 5-minute chart and see what happened in the European trade. Growth and a false breakout at 1.1149 after disappointing Eurozone PMIs generated a sell signal. As a result, the instrument fell by more than 50 pips. Protection of support and a false break at 1.1078 is a signal to buy with a movement of about 20 pip up. In the second half of the day, the technical picture partially changed.

What is needed to open long positions on EUR/USD

Very weak data on manufacturing activity, especially in Germany, and a decline in activity in the services sector - all this led to a sharp fall in the euro in the morning due to the risk of a recession in the eurozone economy in the second half of the year. Another rate hike by the European Central Bank will worsen the economic outlook. A similar PMI for the US manufacturing sector, the index of business activity in the services sector, and the US composite PMI will be available later today which may further weaken the position of the euro.

If the data turns out to be much better than the consensus, thus indicating the expansion in the manufacturing activity in July this year, the selling pressure on the pair will increase. In this case, I expect another downward movement to the area of the nearest support at 1.1068, formed in the first half of the day. A false breakout there will allow traders to get an excellent entry point into long positions with the target at about the resistance of 1.1109, the level slightly above which the moving averages, playing on the side of sellers, pass. A break and test from top to bottom of this range will strengthen the demand for the euro, giving a chance for a return to the high of 1.1146, from which the euro has already fallen once today.

The area of 1.1188 remains the highest target, where I will take profits. With the option of a decline in EUR/USD and no activity at 1.1068 in the afternoon, things for the buyers will go from bad to worse. Therefore, only a false breakdown in the area of the next support at 1.1015 will give a signal to buy the euro. I will open long positions immediately on a dip from the low of 1.0981, bearing in mind an upward correction of 30-35 pips intraday.

What is needed to open short positions on EUR/USD

The sellers retain all chances for a further downward correction, especially after the morning PMIs. Only similar weak figures for the American economy can create problems for the bears. For this reason, it is best for the bears to focus on protecting the resistance at 1.1109, where movement can take place after the release of the macroeconomic data in the US. I prefer to act from this level only after growth and a false breakout, which will give a sell signal, suggesting EUR/USD's drop to a new support of 1.1068. I expect larger buyers to appear there, but I won't bet strongly on this level, since it has already been worked out once today. In case of a breakout and consolidation below this area, as well as a reverse test from the bottom up, you can get a sell signal with a downward target at 1.1015. This will indicate a fairly large correction of the euro, which can revive the appetite of the buyers. The lowest target will be the area of 1.0981, where I will take profits. If EUR/USD moves up during the American session and there are no bears at 1.1109, which also cannot be ruled out, the bulls will regain control of the market. With such market development, I will postpone short positions until the next resistance at 1.1146. You can also sell there, but only after an unsuccessful consolidation. I will open short positions immediately on a bounce from the high of 1.1188 with the aim of a downward correction of 30-35 pips.

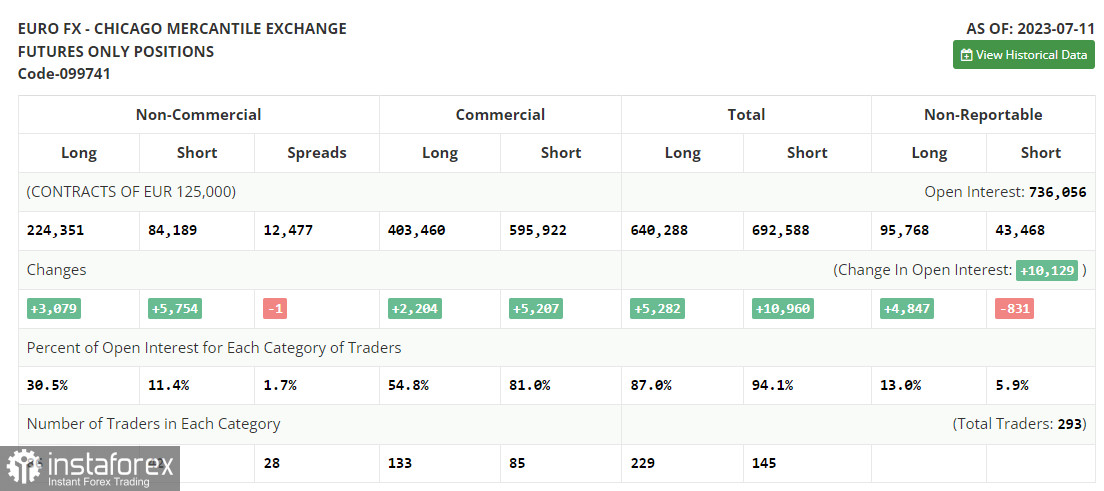

In the July 11 COT (Commitment of Traders) report, there was an increase in both long and short positions, which left the balance of trading forces practically unchanged in favor of the euro buyers. The data on US inflation, indicating its sharp slowdown, especially in core prices, had a very strong impact on the euro buyers, which led to a breakout, updating annual highs, and going beyond the psychological level of 1.1000, which could not be hit for almost half a year. The fact that the Fed no longer needs to raise interest rates makes the US dollar rather soft. While the market is bullish, the best medium-term strategy in the current environment is buying the euro on the decline. The COT report shows that long non-commercial positions rose by 3,079 to 223,351, while short non-commercial positions jumped by 5,754 to 84,189. At the end of the week, the total non-commercial net position slightly decreased and amounted to 140,162 from 142,837. EUR/USD closed last week higher at 1.1037 versus 1.0953 a week ago.

Indicators' signals

Moving Averages

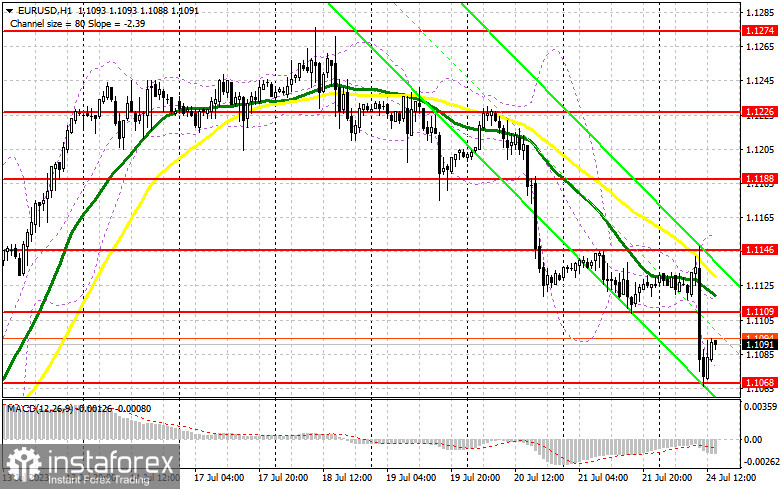

The instrument is trading below the 30 and 50-day moving averages. It indicates further weakness in the euro.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD extends its growth, the indicator's upper border around 1.1146 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.