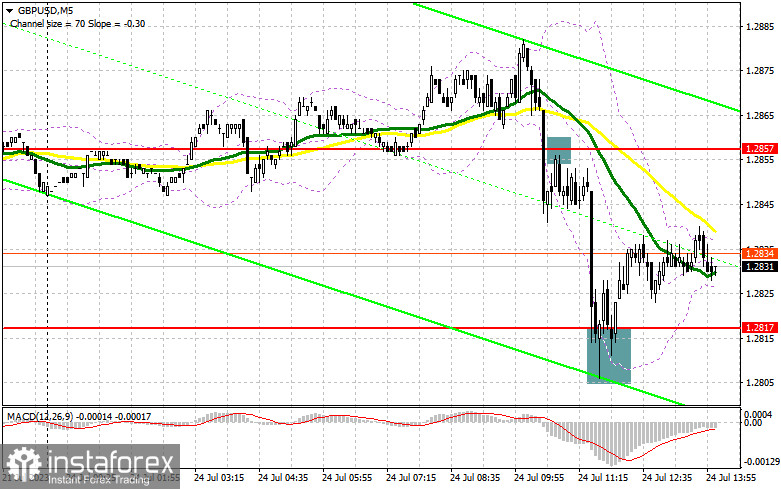

The break and subsequent test from below to above this range indicated a sell-off, which, in combination with weak PMI data, led to a decline in the pound to 1.2805. However, a false breakout at 1.2817 triggered a buying signal, resulting in a 20-point increase in GBP/USD.

For initiating long positions on GBP/USD, the following conditions should be met:

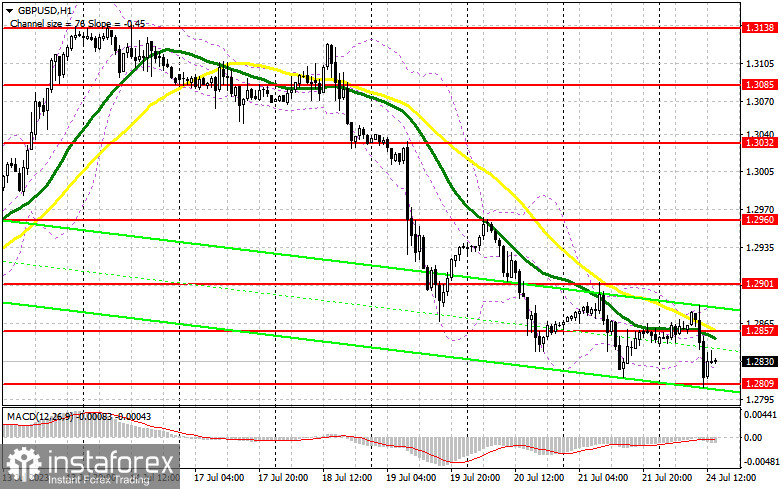

The weak activity indicators in the services sector and the composite PMI index just above the 50-point mark indicate that the Bank of England needs to be cautious with its high-interest rate policy, as an economic recession may occur in the year's second half. However, it is unlikely that we can expect such decisions from the regulator soon, making the continuation of the pound's correction highly probable. Additionally, we have similar data on the Purchasing Managers' Index for the manufacturing sector, the Services PMI, and the Composite PMI for the USA ahead, which may further weaken the pound's position.

If the pair falls after strong PMI reports for the USA and a false breakout occurs around 1.2809 - forming a new support level by the end of the trading session - I will consider opening long positions. The target in this scenario will be the new resistance at 1.2857, where the moving averages favor the bears. A break and consolidation above this range will provide an additional buying signal, with a move towards 1.2901. The ultimate target will be around 1.2960, where I will take profits. If GBP/USD declines during the American session and there are few buyers at 1.2809, which is likely, pressure on the pound will persist. In such a case, only a defense of the next area around 1.2754 and a false breakout at that level will signal to open long positions. I plan to buy GBP/USD on a rebound only from 1.2717, with a 30-35 point correction target within the day.

For initiating short positions on GBP/USD, the following conditions should be met:

Sellers have performed well and are focused on breaking through the next weekly lows. In the event of weak PMI indices and a surge in GBP/USD in the second half of the day, I will postpone selling until there is a test of the new resistance at 1.2857, where the moving averages favor the bulls. A false breakout at this level will be an ideal signal to enter the market and continue the bearish trend, which is about to turn into a new trend, leading to 1.2754. A break and subsequent test from below to above this range will deal another serious blow to buyers' positions, pushing GBP/USD towards 1.2717. The ultimate target remains at a minimum of 1.2675, where I will take profits.

If GBP/USD rises and there is little activity at 1.2857 in the second half of the day, buyers will try to stabilize the situation and keep the pair within a sideways channel at the beginning of the week. In this case, I will postpone selling until a resistance test at 1.2901 exists. A false breakout at that level will provide an entry point for short positions. If there is no downward movement and testing at that level, I will sell the pound on a rebound immediately from 1.2960, but only with the expectation of a 30-35 point correction within the day.

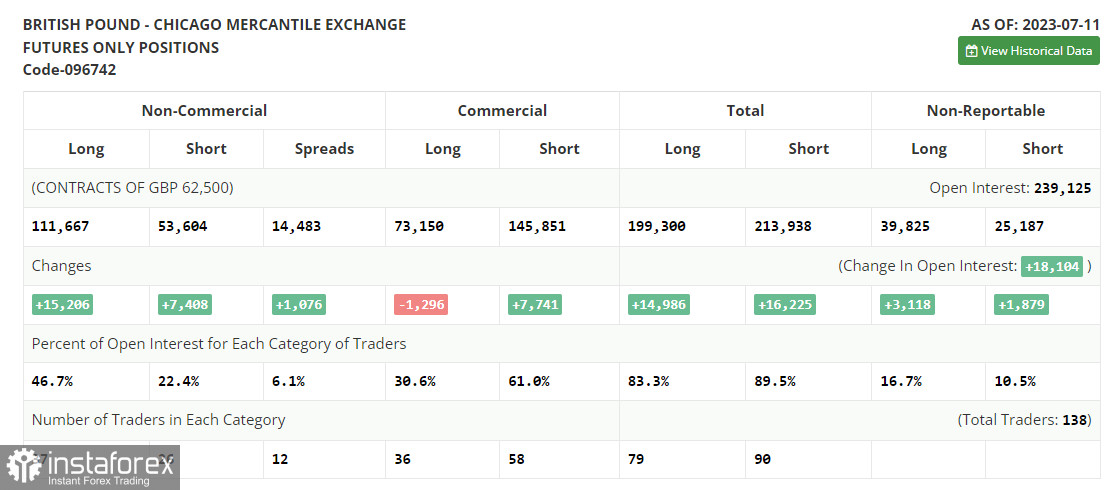

In the COT report (Commitment of Traders) for July 11, both long and short positions increased. However, the number of buyers was twice as high, confirming the bullish market we have observed this month. Pound buyers have a good chance to act more aggressively. On the one hand, the Federal Reserve is content with the rapid decline in inflation, reducing the likelihood of further rate hikes. On the other hand, the Bank of England, despite all the economic problems, will continue to pursue a policy of high-interest rates due to serious inflation issues affecting household living standards. The policy difference will lead to a stronger pound and a weaker US dollar. The optimal strategy remains to buy the pound on declines. The latest COT report shows that non-commercial long positions have increased by 15,206, reaching 111,667, compared to 96,461, while non-commercial short positions have only increased by 7,408, reaching 53,604, compared to 46,196. This has led to another surge in the non-commercial net position to 58,063, compared to 50,265 the previous week. The weekly price has risen and reached 1.2932, compared to 1.2698.

Indicator signals:

Moving Averages

Trading is taking place below the 30 and 50-day moving averages, indicating further decline in the pair.

Note: The author considers the period and prices of moving averages on the hourly chart (H1), and they differ from the general definition of classic daily moving averages on the daily chart (D1).

Bollinger Bands

In the event of a decline, the lower boundary of the indicator, around 1.2830, will act as support.

Description of Indicators:

• Moving Average (determines the current trend by smoothing volatility and noise). Period - 50. Marked in yellow on the chart.

• Moving Average (determines the current trend by smoothing volatility and noise). Period - 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). Fast EMA - period 12. Slow EMA - period 26. SMA - period 9.

• Bollinger Bands (Bollinger Bands). Period - 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.