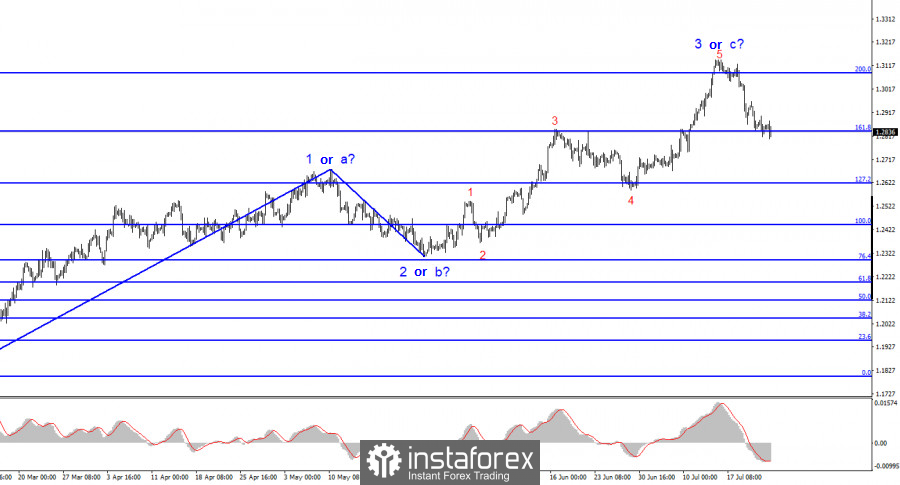

The wave analysis of the GBP/USD pair remains relatively straightforward and clear. The construction of the upward wave 3 or c has been completed, and the descending wave has begun. There are no valid reasons for the pound to continue its rise (numerous reports and events support this view). However, the wave pattern has evolved into a more complex one, with wave 3 or c taking on a more extended form than anticipated by many analysts a few weeks ago. The upward trend might adopt a five-wave pattern if the market discovers new factors to support buying.

Regarding the pound, the wave pattern now appears much simpler and clearer than that of the euro. The third wave may serve as either the concluding upward wave set or the third wave in a five-wave structure. Hence, in either case, I expect the formation of a descending wave, which has practically begun as per the schedule. Even if we observe a fourth wave within the upward wave set, it should be relatively extensive or distinctly three-wave. I do not anticipate an end to the decline in quotes in the near future, but a potential rebound upward is feasible.

British statistics are showing moderate deterioration.

On Monday, the GBP/USD exchange rate declined by only 15 basis points. Business activity indices in the United Kingdom could have been better but better than those in Germany or the European Union. This explains the comparatively smaller decrease in demand for the British pound on Monday. Business activity in the manufacturing sector fell to 45, and in the services sector to 51.5. The composite index declined to 50.7 points. Despite this, there was a decrease in all three cases rather than growth; therefore, demand for the pound was not expected to increase today. Nonetheless, we observed the first downward impulse, and the pair may now proceed to construct an upward corrective wave, which could be wave b in 4 or 2 in 1.

Regarding the pound's prospects, there is always a risk of "missing the mark." The demand for this currency consistently remains high, increasing the likelihood of a complicated upward trend. The British economy appears to fare better than the European one. However, interest rates in the UK are higher, and the pace of economic growth (GDP) is roughly similar.

Can this factor sustain demand for the pound while demand for the euro decreases? I believe it cannot. At the same time, I do not observe strong factors that could trigger a new increase in demand for European currencies. It might be better to await the results of central bank meetings this and next week and then draw new conclusions. Nevertheless, the period of growth for both the euro and the pound is ending.

General conclusions.

The wave pattern of the GBP/USD pair suggests a decline in the upcoming weeks. Following the successful breakthrough above the 1.3084 level (top to bottom), as I mentioned in my recent reviews, my readers could consider opening sales. Currently, the first target for the pair is the 1.2840 level, which has already been tested. An unsuccessful attempt to break this level now indicates the potential formation of an upward wave. However, if this attempt proves successful on Monday-Tuesday, the decline in quotes will continue as part of the first wave in a minimal three-wave structure.

The overall picture resembles the EUR/USD pair on a larger wave scale, though with some differences. The descending corrective part of the trend is complete, and the construction of a new upward wave is underway, which may already be complete or may develop into a full-fledged five-wave structure.