PMIs were just released for the European Union, the United Kingdom, and separately for Germany. All indices fell more than expected, as a result, the demand for the euro and pound both declined. However, in the long term, these indicators could have an even stronger destructive effect on currencies that have been performing exceptionally well in the past year. Some analysts have started to question whether the euro and pound are overpriced given the current news background.

I'll remind you that the Federal Reserve is closest to its peak interest rate. The July meeting may be the last time the interest rate is raised, bringing it to 5.5%. Certainly, we may see two more rate hikes this year, but no one is expecting further tightening beyond that. The latest US inflation report clearly indicates that the target level is already close, so the Fed may conclude its tightening cycle. The only thing in favor of two rate hikes is that the US GDP and labor market are still in good shape, despite the rate hikes in the last year and a half. Under both scenarios, the FOMC is unlikely to change its rate plans.

The business activity indices are more significant for the European Central Bank and the Bank of England. The BoE, struggling with the highest inflation in nearly 40 years, continues to raise interest rates, but business activity clearly indicates that the economy may slow down at a higher pace than in the last few quarters. The British central bank needs to balance between two fires: high inflation and the beginning of a recession. If the rate continues to rise until the end of 2023 (as required by the current inflation level), the last two quarters of the year will be negative. Is the BoE prepared for this?

The ECB has it worse. Its inflation also remains high, while the interest rate is the lowest among the three "major" banks. However, business activity in the European Union is declining more sharply than in the US or the UK. Last week, Eurostat reported a correction of the GDP value for the first quarter, which is now 0%. But in the second, third, and fourth quarters, the slowdown could be even stronger. If the rate hikes are stopped this autumn, inflation will return to 2% very slowly over the next 2-3 years. The euro's position looks the least attractive at the moment.

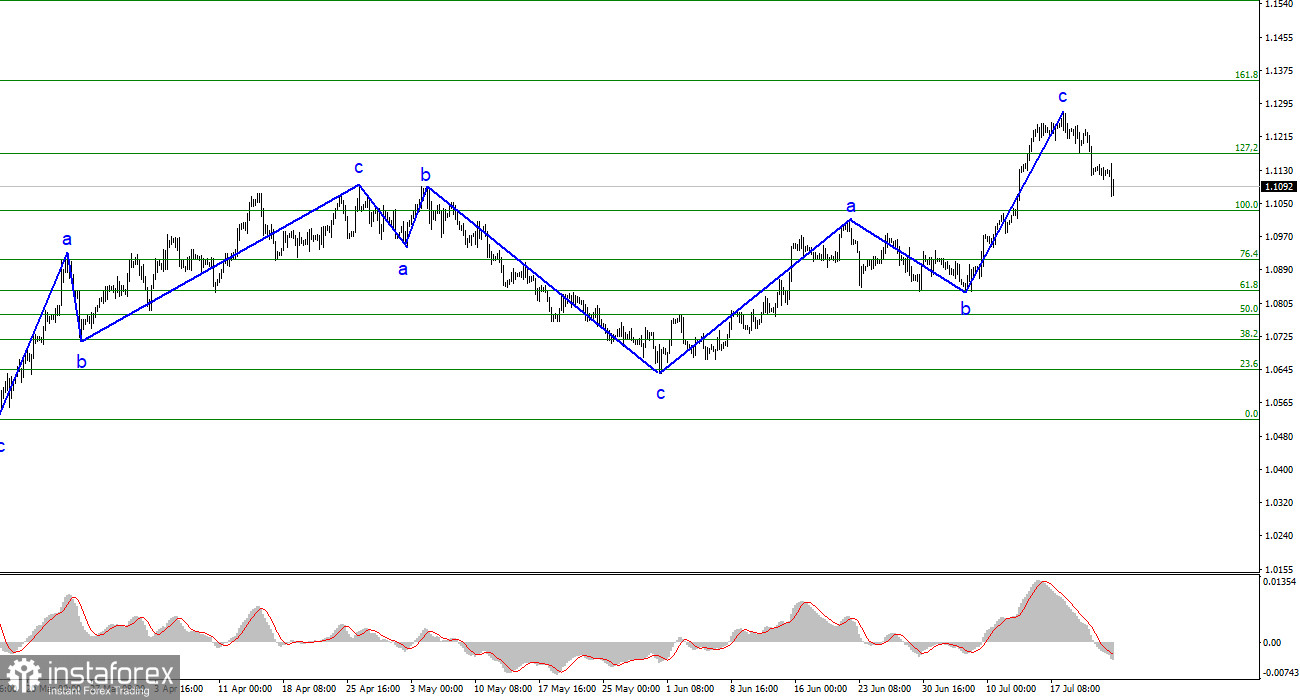

Based on the analysis, I conclude that the upward set of waves have been built. I believe that targets around 1.0500-1.0600 are quite realistic, and I advise selling the instrument with these targets. We presume that the a-b-c structure looks complete and appears convincing, and closing below the 1.1172 mark indirectly confirms the formation of a downtrend. Therefore, I recommend selling the instrument with targets located around the 1.1034 mark, but in reality, the decline should be much stronger if all three waves are formed.

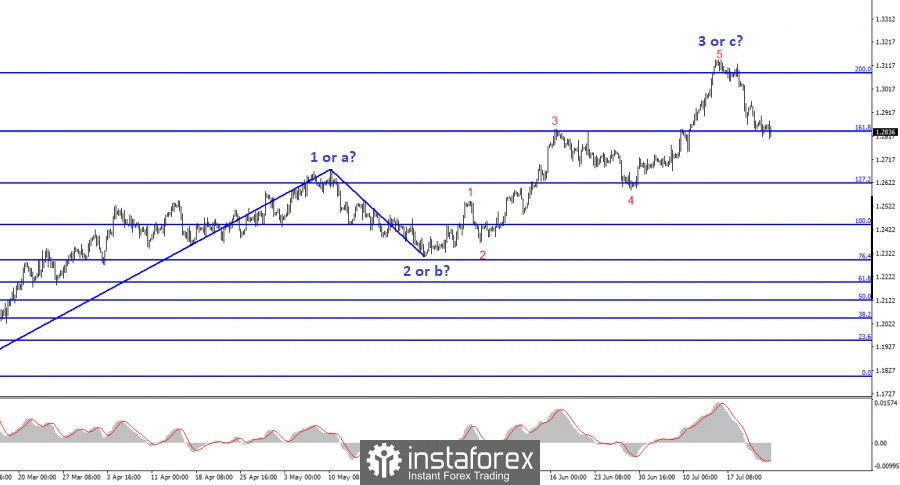

The wave pattern of the GBP/USD pair suggests a decline in the coming weeks. As the attempt to break through the 1.3084 mark (from top to bottom) was successful, you could open short positions, as I mentioned in my recent reviews. Currently, the first target will be the 1.2840 mark, which the pair has already reached. An unsuccessful attempt to break this mark indicates a possible formation of an upward wave. However, if it succeeds on Monday or Tuesday, quotes will continue to fall as part of the first wave within the minimum required three-wave structure.