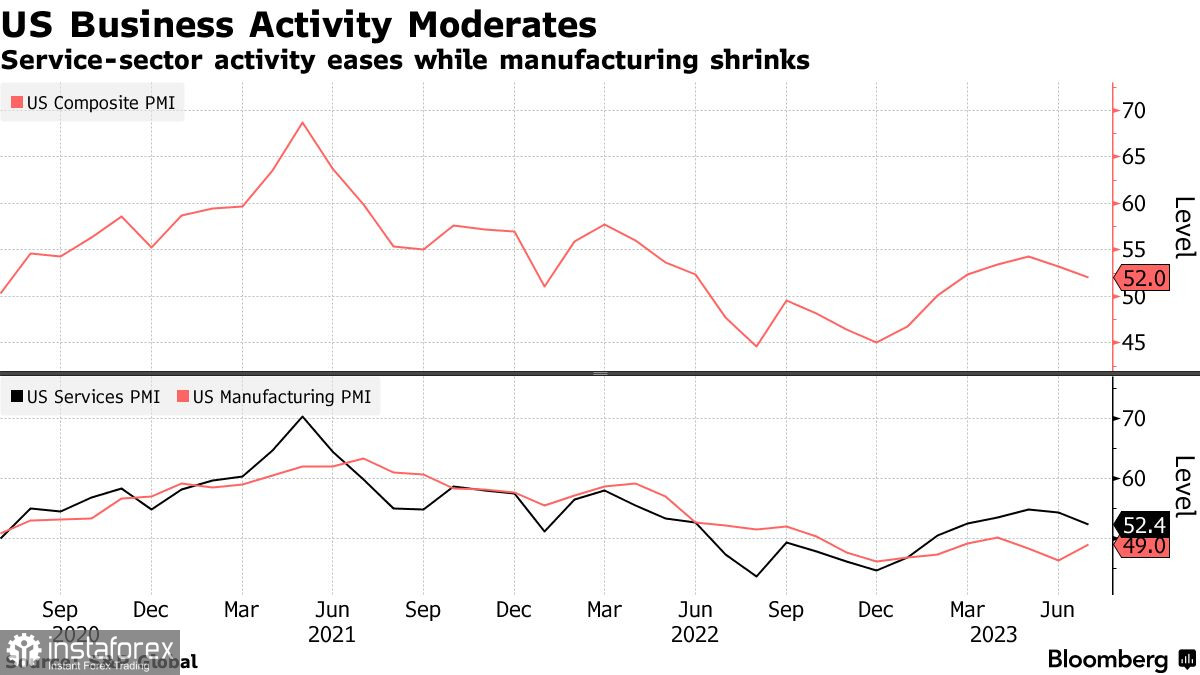

According to the report, the S&P Global Flash Purchasing Managers' Index (PMI) for the US fell by 1.2 points to 52 in July. Notably, a level above 50 indicates overall business activity growth. The future activity indicator also dropped to its lowest level this year, as suppliers' optimism decreased significantly. The manufacturing sector's business activity index rose to 49.0 points in July, still showing contraction, albeit not as severe, while the services PMI declined to 52.4 points from 54.4 compared to the previous month.

The observed situation poses several negative risks for production growth in the coming months, which, coupled with the slowdown in July, indicates concerns that the US economy might experience a significant downturn by the end of the year. One of the key and serious problems is the rigidity of price pressures. Considering the upcoming meeting of the Federal Reserve, yesterday's data might influence the committee's decisions, but I personally doubt it.

Service providers reported higher operating expenses, with wages being the main factor as companies still struggle to retain workers. The employment index in the service sector reached a six-month low.

The main negative impact on the manufacturing index was the reduction in material and finished goods inventories due to weak domestic and global demand. However, manufacturers expect a brighter future, fueled by hopes for broader hiring opportunities and reduced production costs.

Nevertheless, the situation in Europe turned out to be even gloomier, as the latest data showed a more significant contraction in the eurozone's private sector than expected. The S&P Global Flash Purchasing Managers' Index for Germany fell to its lowest level this year: the July composite index, which takes into account both sectors, dropped to 48.3 points, below the threshold of 50 points indicating growth. France fared even worse, with the index reaching a 32-month low of 46.6 points. The figures for both countries were worse than economists had predicted.

As for the EUR/USD pair, bulls need to settle above 1.1105. This is likely to pave the way to 1.1215. From there, a move to 1.1280 is possible, but without strong eurozone statistics, it might be quite challenging. If the trading instrument falls, significant action from major buyers is expected only around 1.1100. If we see weak activity there, it would be wise to wait for a retest of the low of 1.1080 or open long positions from 1.1040.

Regarding the GBP/USD pair, the pound remains balanced. To anticipate growth, control over the 1.2860 level is essential, as reclaiming this range may strengthen hopes for a recovery towards 1.2900, and then a more significant surge to 1.2960. If the pair falls, bears may try to gain control near 1.2810. If they succeed, breaking this range will deal a blow to bullish positions and push the pair to 1.2760, plummeting to 1.2710.