The GBP/USD currency pair traded relatively calmly on Monday, but volatility was not at its lowest. Traders had access to many business activity indices from the EU, the US, and the UK. All European indices were disappointing, while the American ones left a conflicting impression. The European and British indices could not be interpreted straightforwardly (despite the market's ability to do so), so the euro and pound experienced a slight decline. However, as of today, there is no fundamental and macroeconomic background, and tomorrow evening, the Fed meeting will conclude, and its results will be announced.

The July Fed meeting is significant because the regulator may raise the rate for the last time, reaching 5.5%. This would mean a total increase of 5.25% in the past year and a half. As a reminder, the Fed rate determines the cost of borrowing or, in simpler terms, the cost of credit. What happens when the rate rises? Credit and deposit rates increase, making borrowing less attractive for companies and firms, reducing production and service provision volumes, and potentially resulting in GDP contraction, layoffs, and increased unemployment.

The American economy has managed to avoid most of these challenges. Unemployment only rose by 0.2-0.3%, and the labor market consistently displayed strong values from month to month. While the economy is slowing down, its growth rates in the first quarter of 2023 reached 2%, and in the third and fourth quarters of last year, the growth was even higher. As a result, America faces less risk of a recession than Britain or the European Union, where growth rates have been hovering around negative values for several quarters.

However, while the Fed might conclude its tightening monetary policy cycle today, the Bank of England and the ECB may raise their rates a few more times. Theoretically, this factor could support the euro and pound, which have continuously risen for the past ten months. Additionally, the Fed might start easing its monetary policy again in early 2024 to stimulate the economy, while the ECB and the Bank of England are likely to implement different measures soon. Consequently, despite the American economy's strength, the dollar prospects could be more promising.

Both currency pairs should experience significant downward corrections, but the market has shown over the past six months that it can continue buying European currencies without substantial corrections.

The British pound may maintain its upward trend.

The pair could continue its growth throughout 2023 and the following year. Despite the Fed raising the rate during the past ten months, the dollar has been on a downward trend. The market anticipated this factor in advance since last year, and when US inflation started to slow down, the market eagerly started disposing of the American currency. Logically, the market should soon start doing the same with the euro and pound, as rates in the EU and Britain will not rise indefinitely. However, at the same time, the US might begin easing its monetary policy. The question is, which of these factors will carry more weight for market participants?

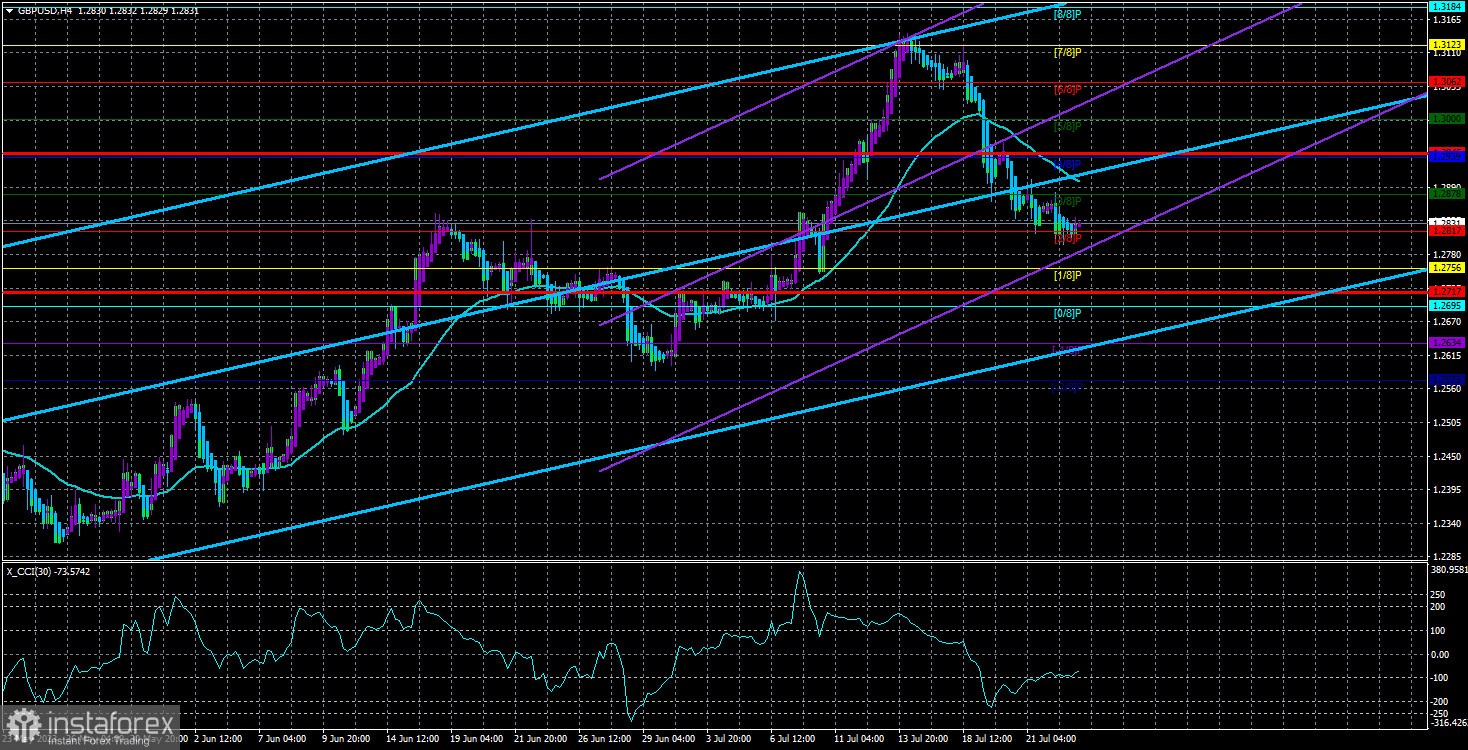

The pound should have already started declining, but on the 24-hour TF, there are no signs of a trend reversal yet. On the 4-hour TF, the pair has been trading below the moving average for several days, but this does not necessarily mean the decline will continue for a few more weeks or months. In general, as before, the euro and pound are overbought, but the market might again favor them due to fundamental background shifts and continue buying. Even now, the price has dropped below the critical line on the 24-hour TF, but how much? By 20 points?

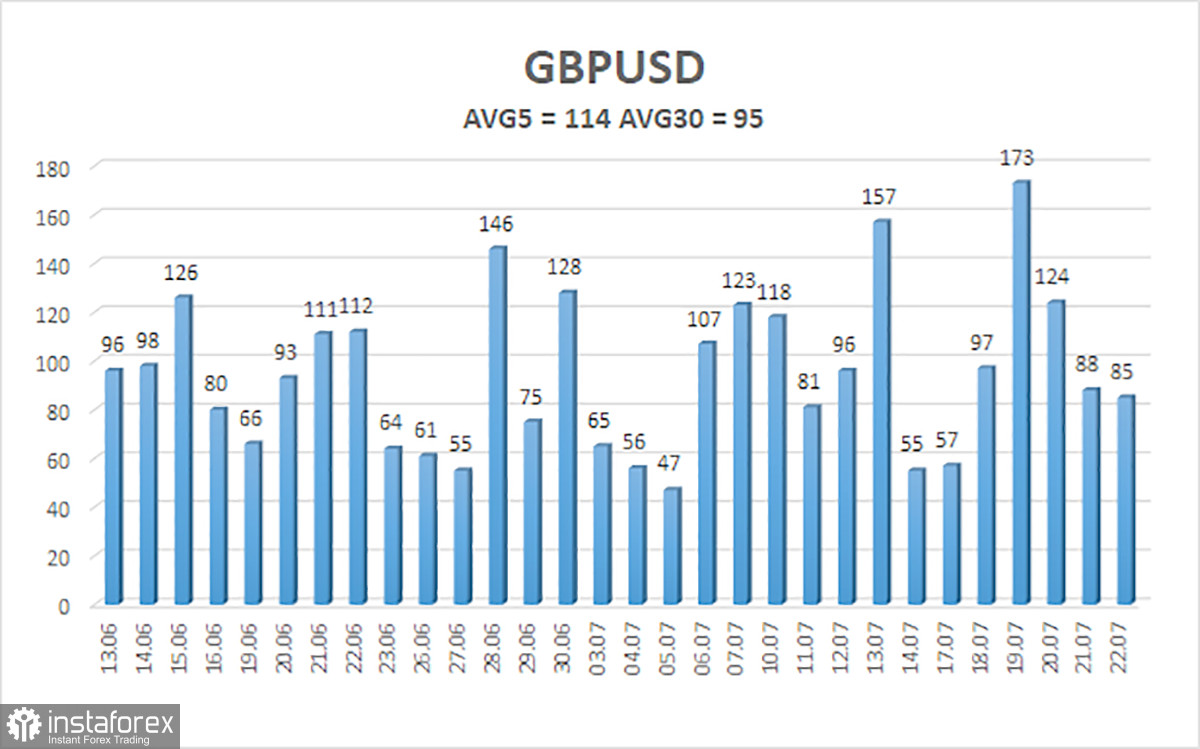

The average volatility of the GBP/USD pair for the last five trading days, as of July 25, is 114 points, which is classified as "high." Therefore, on Tuesday, July 25, we anticipate movement between 1.2717 and 1.2945. A reversal of the Heiken Ashi indicator upwards will signal a potential upward correction.

Nearest support levels:

S1 - 1.2817

S2 - 1.2756

S3 - 1.2695

Nearest resistance levels:

R1 - 1.2878

R2 - 1.2939

R3 - 1.3000

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair remains below the moving average. Short positions with targets at 1.2756 and 1.2717 are currently relevant, and these positions should be closed in case the Heiken Ashi indicator reverses upwards. Considering long positions will be possible if the price establishes above the moving average with targets of 1.2939 and 1.3000.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it indicates a strong trend at present.

Moving average line (settings 20.0, smoothed) - identifies the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel within which the pair is expected to trade over the next day, based on current volatility indicators.

CCI Indicator - its entry into the overbought zone (above +250) or the oversold zone (below -250) indicates an approaching trend reversal in the opposite direction.