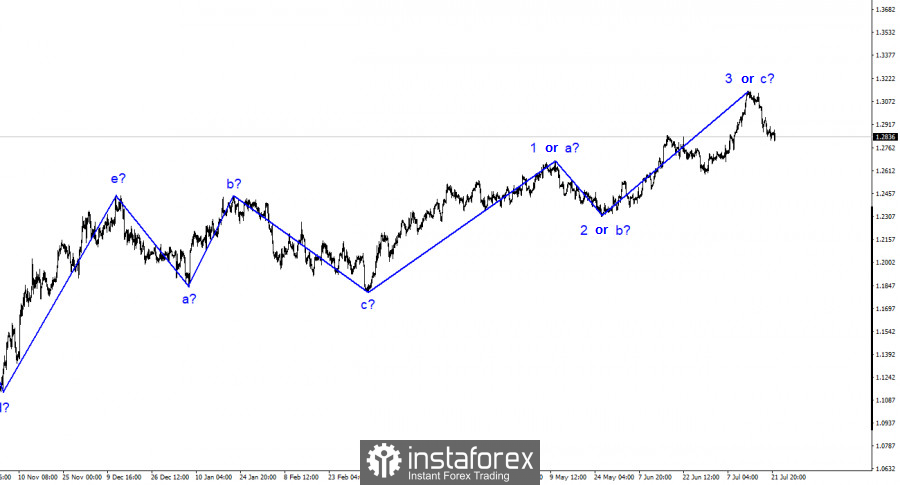

The wave analysis for GBP/USD remains relatively straightforward and understandable. Currently, the formation of the ascending wave 3 or C has been completed, and there are indications of the commencement of a descending wave. There are no strong reasons for the pound to continue rising (despite supporting reports and events). Nevertheless, the wave pattern has become more intricate. Wave 3 or C has taken on a more prolonged form than what many analysts had expected a few weeks ago. The entire ascending trend may adopt a five-wave structure if the market discovers new reasons to buy.

Concerning the pound, the current wave pattern is much more straightforward and convincing than that of the euro. The third wave may either serve as the concluding wave of the upward wave set or be the third wave in a five-wave structure. In any case, I anticipate forming a descending wave, which has already begun almost precisely as anticipated. Even if we witness a fourth wave as part of the ascending wave set, it should be extensive or distinctly three-wave. In the near future, I do not expect a complete cessation of the decline in quotes, but a rebound upward is possible.

The British statistics indicate a moderate deterioration.

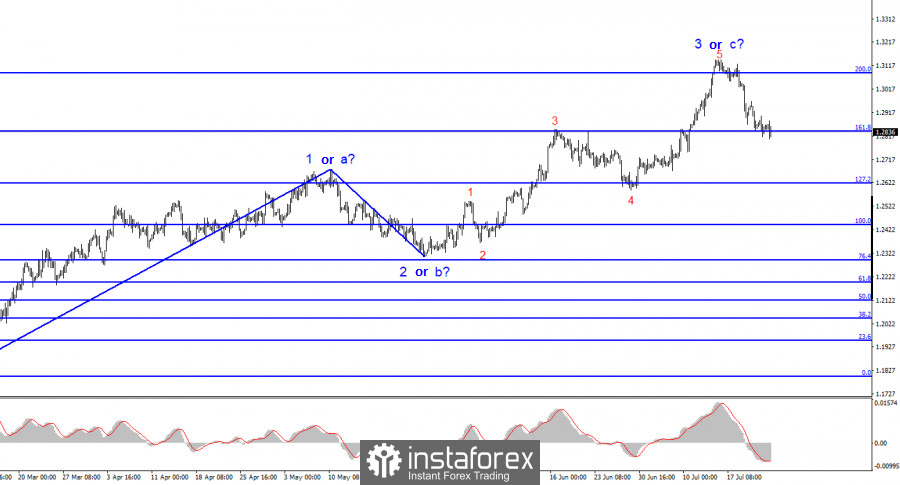

On Tuesday, the GBP/USD currency pair saw a 10-basis-point increase, finally putting an end to its decline. However, the successful attempt to breach the 161.8% Fibonacci level indirectly indicates the market's readiness to continue selling. Now is an opportune moment to construct an upward corrective wave, which, upon completion, should be followed by at least one more descending wave. Nonetheless, there is no significant news background, and the market is awaiting the FOMC meeting and Jerome Powell's speech afterward. It remains to be seen whether important statements will be made, but the market is certainly holding back until receiving an answer to a crucial question: will the regulator raise rates again after the July meeting?

Many analysts have already indirectly addressed this matter. The US economy allows for one or even two more rate increases (excluding the upcoming one). GDP growth is slowing down but remains positive. The labor market is viewed as "good" by all FOMC members, and unemployment has increased minimally. Core inflation remains relatively high and decreases slower than headline inflation. All these factors indicate that the rate should rise to 5.75% in 2023. However, it is crucial to bear in mind that any changes in monetary policy have long-term effects on the economy. Even the current rate might be sufficient to bring inflation back to the target level within a year or a year and a half. The question is whether the Fed wants to wait for this period when they can quickly raise the rate as needed. The rate will increase to 5.75% in 2023.

In summary, the wave pattern for the GBP/USD pair suggests a decline in the upcoming weeks. As the successful breakthrough of the 1.3084 level (from top to bottom) indicates, my readers could have opened sell positions, as mentioned in my recent reviews. The market successfully surpassed the 1.2840 level, implying that the pair's decline may persist. However, market sentiment could significantly shift tomorrow evening if Powell's stance is not firm enough. The current wave has declined below the peak of wave 3 in a five-wave structure, indicating the formation of a descending trend. I expect a further decline in the British pound.

On a larger wave scale, the pattern is similar to that of the euro/dollar pair, with some differences. The descending corrective trend has concluded, and the construction of a new ascending trend is ongoing, which may have already completed as a full five-wave structure.