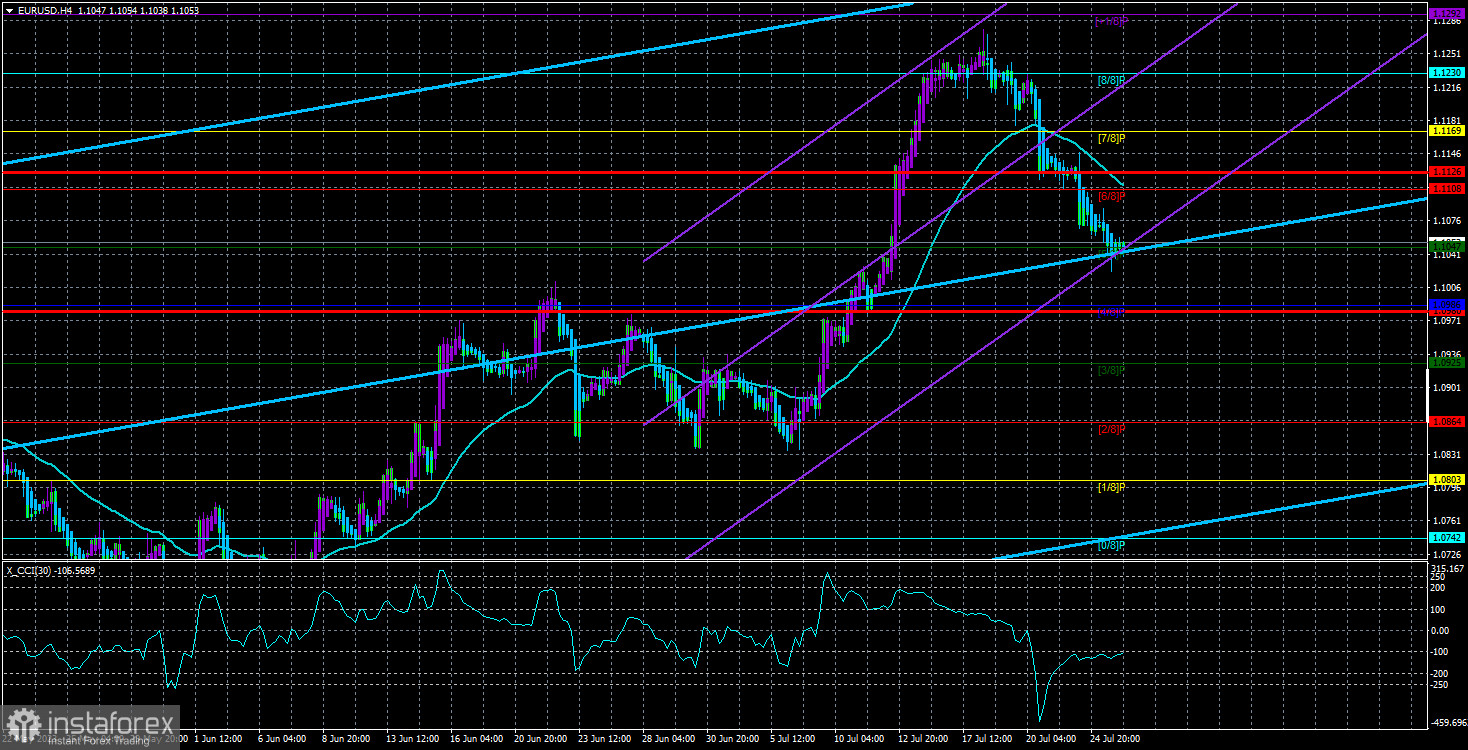

On Tuesday, the EUR/USD currency pair continued its downward trend, with the Heiken Ashi indicator showing no signs of a potential upward reversal. Consequently, traders opted to maintain short positions throughout the day. The decline in quotes could persist until the evening when the results of the Federal Reserve meeting are revealed. Traders are cautious about making hasty decisions before the outcomes of the two central bank meetings, preferring to wait patiently for the developments.

The potential outcomes of these meetings are still being determined. Jerome Powell may announce the conclusion of the current monetary tightening cycle or hint at another rate hike in the autumn or winter. Similarly, Christine Lagarde might express her readiness to continue tightening this autumn or announce a pause. Given that both central banks are near their peak key interest rates, any information shared during the meetings could cause market volatility. As a result, the current decline in the euro does not necessarily guarantee its continuation. In the 24-hour timeframe, the upward trend remains evident, suggesting that the current movement might be merely a correction.

Additionally, the CCI indicator recently entered the oversold zone, but there was no subsequent upward correction. This suggests that the correction is likely to occur sooner or later and could be substantial. The indicator may generate a second buy signal if the pair experiences a sharp fall after the Federal Reserve meeting results are released tonight. The pair has not yet firmly settled below the critical line on the daily timeframe, indicating no clear signs of an emerging downward trend except for moving below the average.

Regarding the ECB's QT program, questions arise about whether the rate's approaching peak value (in contrast to inflation) would be sufficient to bring the consumer price index back to the target level within the next two years. Some doubts about the ECB's ability to tighten its monetary policy as aggressively as the Federal Reserve or the Bank of England have been raised. The complexity arises from the ECB being the central bank for 27 countries, necessitating consideration of each country's interests. The rhetoric of the heads of these 27 central banks indicates that some advocate for further rate hikes due to their strong economies and high inflation. In contrast, others call for a pause or an end to the tightening cycle since their inflation has already significantly decreased, and further tightening is unnecessary.

Nevertheless, the ECB can freely sell off bonds from its portfolio, which has accumulated over the past few years. It's important to recall that the QE program was in effect in recent years, involving the purchase of government bonds and cash injections into the economy. The reverse QT program is active, withdrawing excess liquidity from the economy to reduce the money supply and control inflation. Given the challenges of constantly raising the key interest rate, the European regulator may resort to more active use of this tool.

According to the Financial Times, the ECB's balance sheet reduction may soon accelerate. Joachim Nagel, the President of the Deutsche Bundesbank, believes that the ECB may start more actively reducing its balance by €1.7 billion accumulated during the pandemic years. However, this opinion is from the head of the central bank of the strongest economy in the EU. While Germany can afford almost any tightening, its economy also faces challenges. In contrast, countries like Bulgaria, Greece, or perennially troubled Italy might find it more difficult to afford such measures. Nevertheless, the QT program is anticipated to be expanded, albeit only slightly. A similar program is also in effect in the United States, indicating that neither the dollar nor the euro should hold a significant advantage over the other.

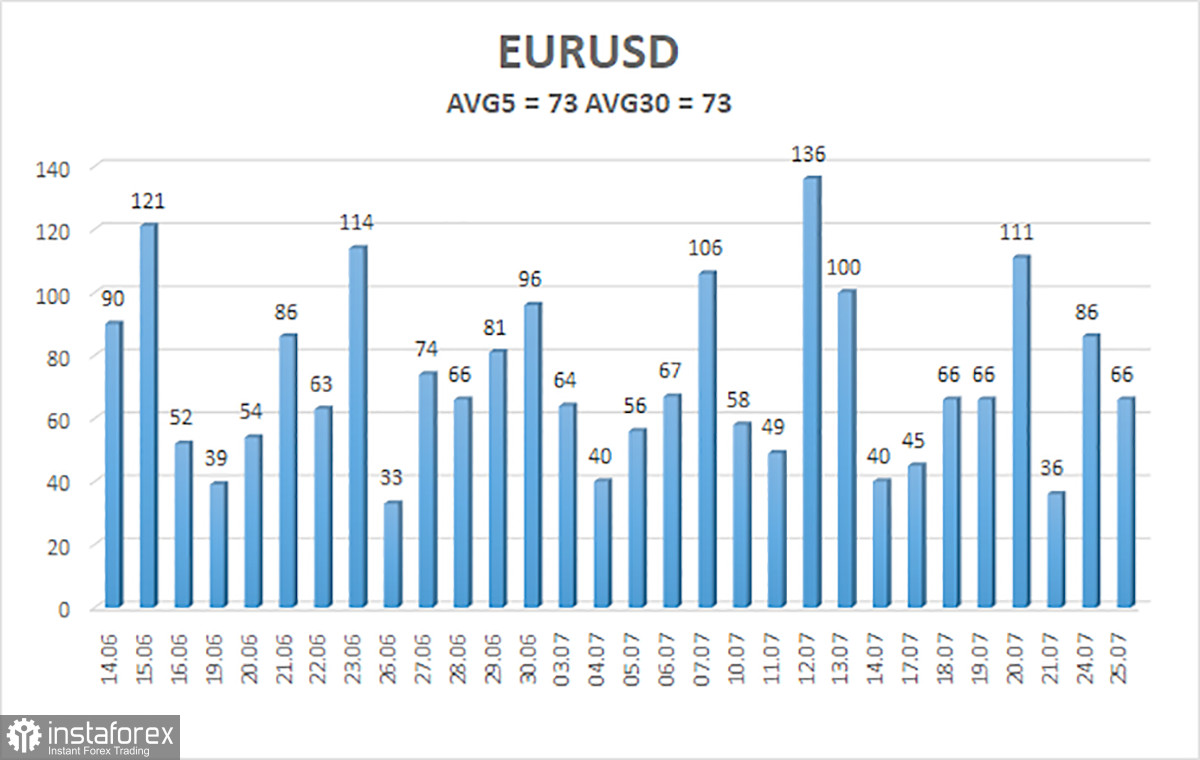

As of July 26th, the average volatility of the EUR/USD currency pair over the last five trading days is 73 points, categorized as "average." Consequently, the pair is expected to move between the levels of 1.0980 and 1.1126 on Wednesday. A reversal of the Heiken Ashi indicator upwards would suggest the start of an ascending correction.

Nearest support levels:

S1 - 1.1047

S2 - 1.0986

S3 - 1.0925

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1169

R3 - 1.1230

Trading recommendations:

The EUR/USD pair continues its downward movement; the question is how long it will last. It is advisable to maintain short positions with targets at 1.0986 and 1.0980 until the Heiken Ashi indicator reverses upwards. Long positions will become relevant only if the price consolidates above the moving average line with a target of 1.1169.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are directed in the same direction, the trend is currently strong.

Moving average line (settings 20.0, smoothed) - identifies the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move in the next 24 hours based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an upcoming trend reversal in the opposite direction.