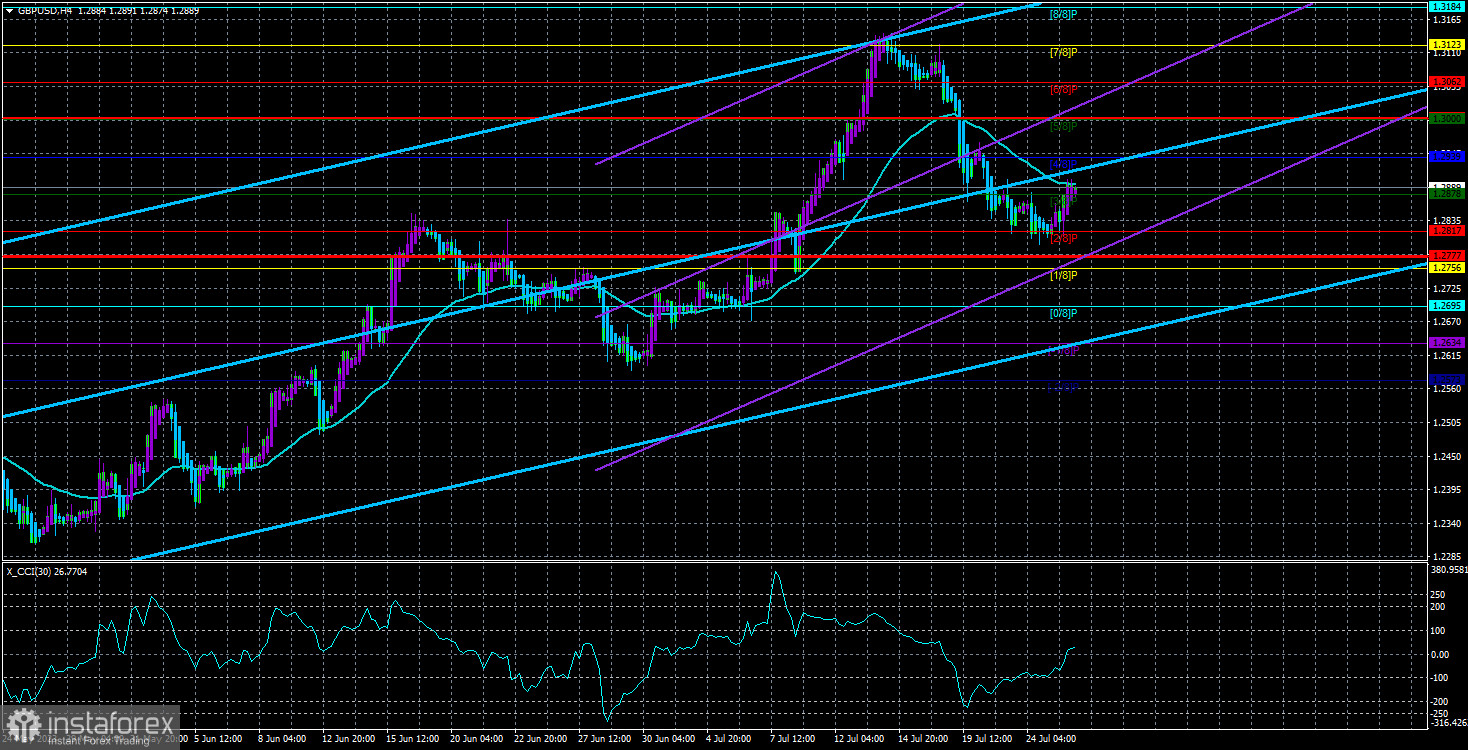

On Tuesday, the GBP/USD currency pair initiated an upward correction, as indicated by the Heiken Ashi indicator showing an ascending trend. Although the price tested the moving average line, it failed to consolidate above it, thus maintaining a short-term downward trend. Notably, the euro and the pound traded in opposite directions yesterday, suggesting various factors influencing these major currency pairs. Traders may anticipate a "soft" stance from the European Central Bank (ECB) and a more "hawkish" approach from the Bank of England (BOE), justified by the pound's stronger position. While both European currencies are in an upward trend, the pound's correction is weaker, yet it continues to strengthen overall.

Over the 24-hour timeframe, the pound did not consolidate below the critical line. Although it briefly declined below the line, it quickly rebounded and did not remain below it for even a day. The consolidation reaching only 20 points is insignificant within the daily timeframe. The pound has displayed another unclear downward retracement and is now poised to resume its upward phase. However, determining the exact basis for this growth remains challenging since the Bank of England and the Federal Reserve continue to raise interest rates, with the latter having a higher rate. Furthermore, the US economy is stronger than the UK's, and the British regulator cannot sustain indefinite tightening. Despite these factors, traders focus primarily on inflation indicators. If inflation remains high in the UK, they expect further rate hikes and, based on this factor, will continue to buy the currency.

Currently, we only have indications for selling if the price consolidates below the moving average in the 4-hour timeframe. On the other hand, if today's consolidation occurs above the moving average, all indicators will point to an upward movement. Consequently, we may observe an unwarranted rise in the British pound, which initially surged due to a decline in US inflation, then rose further due to the BOE's rate hike, and now rises without clear reasons. The inertial trend persists.

What could support the dollar this evening?

Unfortunately, the US currency still lacks strong factors to stimulate market demand, leading to overselling. Despite not being so weak as to continuously decline for the past ten months, the market appears to disregard this fact. Therefore, the dollar requires exceptionally compelling reasons to increase market demand.

This evening, the Federal Reserve will raise interest rates by another 0.25%, which might lead to a renewed depreciation of the US currency due to this undoubtedly "hawkish" decision. Given the recent strengthening of the dollar over the past week and a half, this development is logical, suggesting that the market may have already factored in this rate hike. Consequently, there is a high probability of a new devaluation phase for the US currency. This likelihood is further enhanced as the market believes the Federal Reserve will conclude its monetary tightening cycle after the recent inflation report indicated a slowdown to 3%. The dollar may continue to rise if Jerome Powell permits another rate hike later this year. However, even this factor may not prevent a further long-term decline since the market still perceives no compelling reasons for further purchases of the US currency.

As a result, today's Federal Reserve meeting will not significantly alter the balance of power between the dollar and the pound. The Bank of England's meeting will be more crucial in this context. With its interest rate already at 5%, the market rightly anticipates hints about a pause in the tightening cycle. If Andrew Bailey suggests an imminent pause next week, market participants may begin taking profits on long positions and not rely on further pound growth.

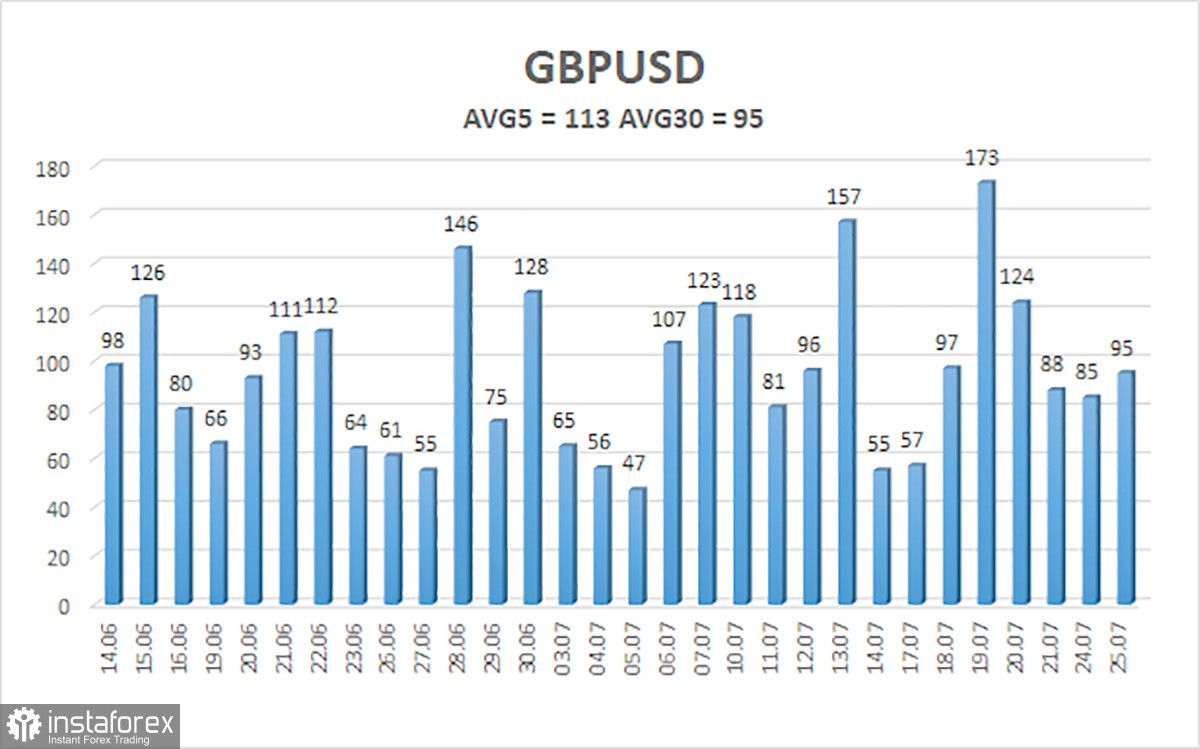

The average volatility of the GBP/USD pair over the last five trading days is 113 points, categorized as "high" for this currency pair. Therefore, on Wednesday, July 26th, we expect movements within the range bounded by the levels of 1.2777 and 1.3003. A reversal of the Heiken Ashi indicator back downwards will signal a potential resumption of the downward movement.

Nearest support levels:

S1 - 1.2878

S2 - 1.2817

S3 - 1.2756

Nearest resistance levels:

R1 - 1.2939

R2 - 1.3000

R3 - 1.3062

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair remains below the moving average. Short positions with targets at 1.2817 and 1.2777 are relevant and should be opened in case of a price rebound from the moving average line. Long positions can be considered if the price consolidates above the moving average, with targets at 1.2939 and 1.3000.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels are directed in the same direction, it indicates a strong trend.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - probable price channel where the pair is expected to move within the next day, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or the oversold area (below -250) indicates an approaching trend reversal in the opposite direction.