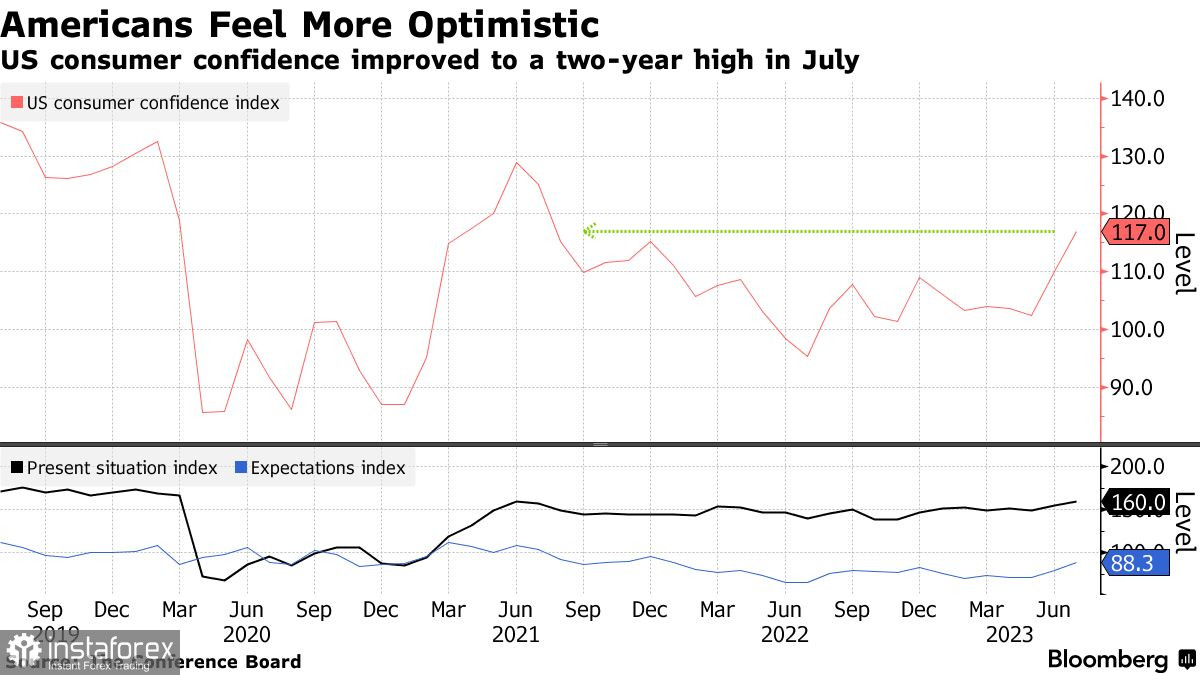

Both the current conditions index and the six-month consumer expectations index reached their highest levels in a long time, indicating optimism among Americans. The slowdown in overall price pressure in the country also contributed to a drop in the expected inflation indicator.

Consumer confidence rose across all income groups, whether earning less than $50,000 or over $100,000. Recent economic data has once again bolstered hopes that the US can avoid a recession, with the labor market remaining a key driving force. Wages are now keeping up with inflation, allowing many households to increase spending.

The report also revealed that the proportion of consumers considering a recession "likely" or "very likely" increased slightly. Nevertheless, recession expectations remained below their recent peak, suggesting reduced concerns compared to the beginning of the year. Many consumers reported sufficient job opportunities in July, resulting in a decline in respondents experiencing difficulties in finding employment, reaching a historically low level.

Regarding big-ticket purchase plans, some respondents expressed intentions to buy cars and houses, while a smaller portion planned to acquire major appliances like refrigerators and washing machines.

These data underscore the remarkable resilience of the US economy during a period of high-interest rates, enabling the Fed to mitigate inflationary pressures with minimal disruption to the economy and labor market.

Notably, there is a high likelihood that the Open Market Committee will approve the 11th interest rate hike during its July meeting. Many investors hope this will be the final move in the tightening cycle that started in March 2022, aiming to combat the highest inflation in decades.

As for the EUR/USD pair, bulls need to climb above 1.1060 and consolidate above this level to regain control of the market. This would pave the way to 1.1105, and further progress to 1.1145 might be possible, but it could be challenging without significant eurozone statistics. If the trading instrument falls, serious actions from major buyers are anticipated around 1.1025. In their absence, waiting for a drop to 1.0980 or opening long positions from 1.0940 could be beneficial.

Regarding the GBP/USD pair, the British pound remains balanced. A bullish scenario requires control above 1.2905, strengthening hopes for recovery to 1.2960 and 1.3030. Bears may attempt to take control at 1.2850, and breaking below this range could drag the pair to 1.2800 and 1.2760.