EUR/USD

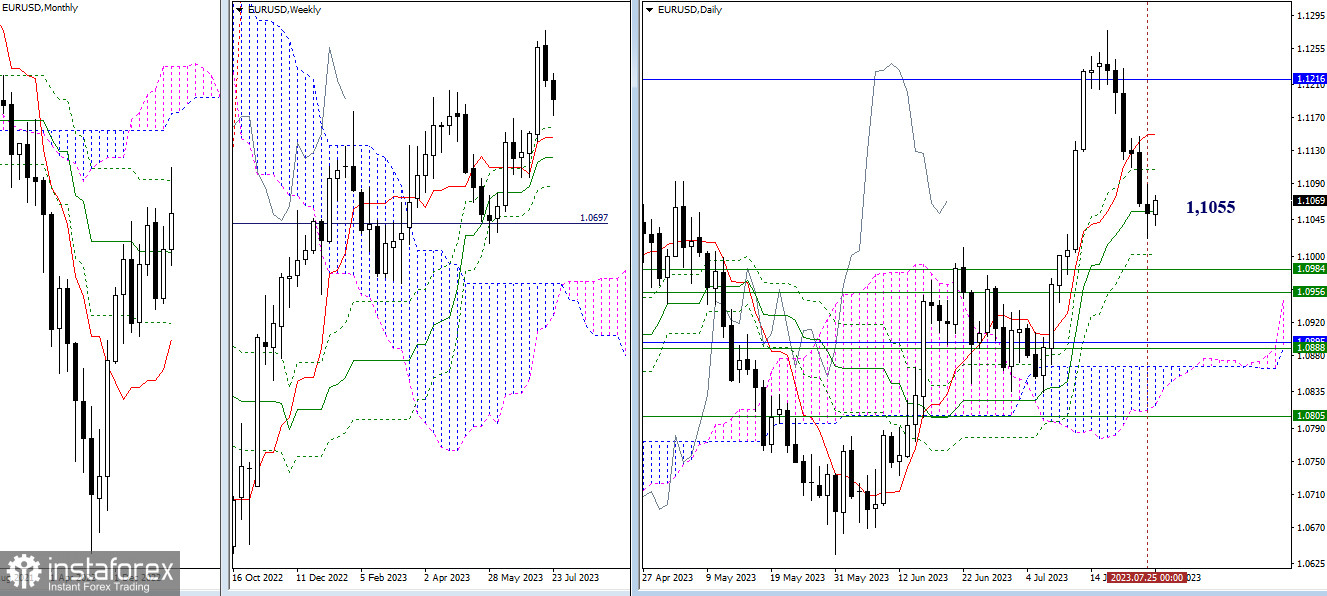

Higher timeframes

The development of the current decline was halted by the support of the daily medium-term trend (1.1055). The nearest bearish targets remain relevant today, still situated around 1.1003 – 1.0984 – 1.0956. If a rebound occurs and the bullish activity resumes, the pair will be directed towards testing the daily resistances at 1.1107 – 1.1149.

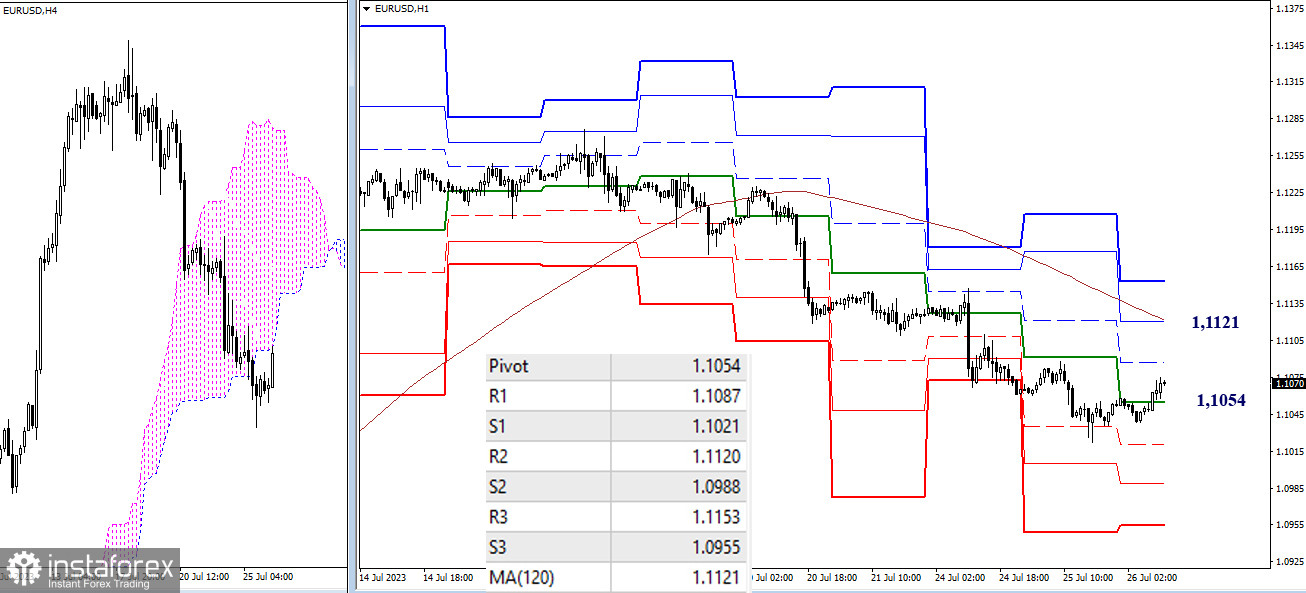

H4 – H1

As of writing, the main advantage belongs to bearish players. Nevertheless, the pair is currently within an upward correction zone. The bulls seek to establish themselves above the central pivot point (1.1054), and their attention then shifts to the key level responsible for the current balance of power—the weekly long-term trend (1.1121). The interim resistance on this path could be encountered at R1 (1.1087). If the correction exhausts itself, the pair will return to the decline, where it will find support from the classic pivot points within the day (1.1021 – 1.0988 – 1.0955).

***

GBP/USD

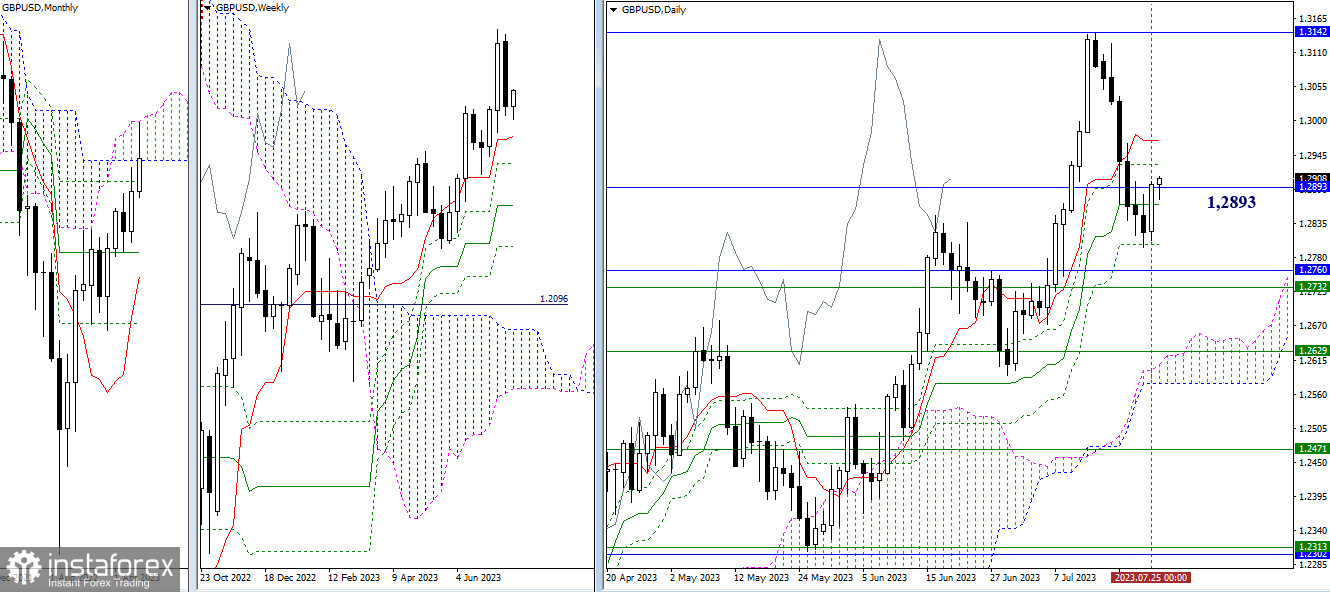

Higher timeframes

Having met the final support of the daily cross (1.2800), the pound experienced a rebound, closing the day above the lower boundary of the monthly cloud (1.2893). If the rebound continues, the first resistance levels to be encountered by bulls will be the daily resistances (1.2931 – 1.2969), and the main bullish target in this segment will once again become the upper boundary of the monthly cloud (1.3142). However, if the current rise is merely a retest of previously passed levels and bears return to the market soon, then after updating the low (1.2797), they will continue the decline and quite rapidly encounter the supports at 1.2732–60 (weekly short-term trend + monthly Fibo Kijun).

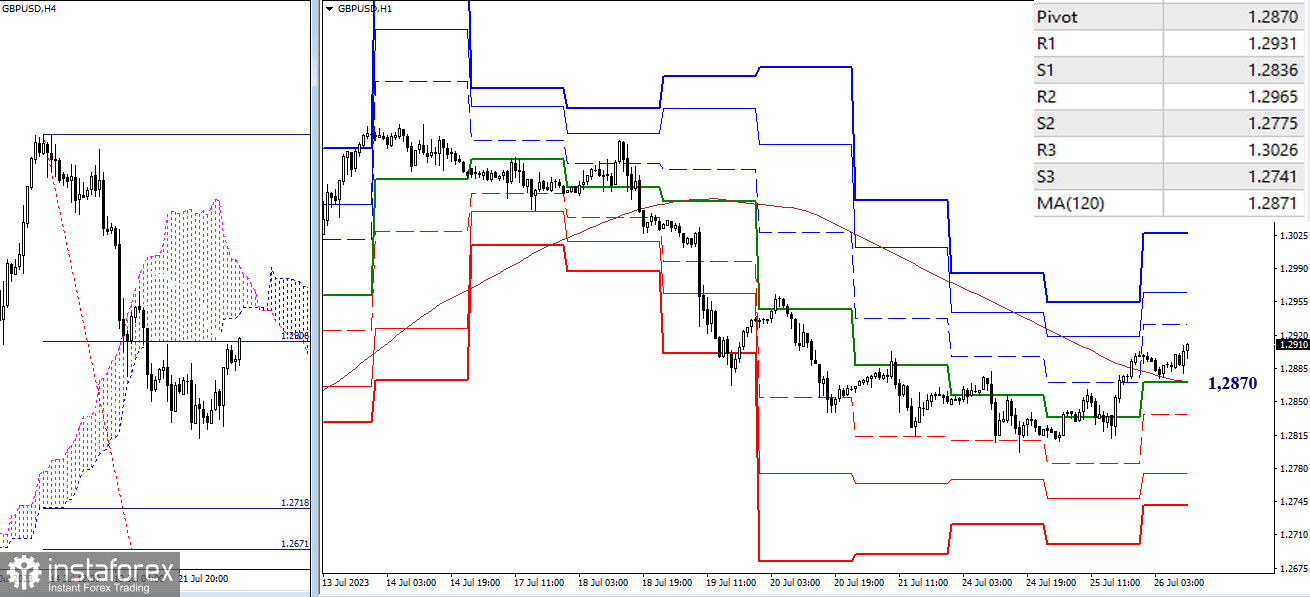

H4 – H1

Bulls have established themselves above the key levels of the lower timeframes, which today merge their efforts at the level of 1.2870 (central pivot point of the day + weekly long-term trend). For bullish players, the resistance levels within the day are the resistance levels of the classic pivot points (1.2931 – 1.2965 – 1.3026). If sentiment changes and the price falls below 1.2870, the support levels for continuing the decline will be the support levels of classic pivot points (1.2836 – 1.2775 – 1.2741).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)