The Federal Reserve is ready to pull the trigger for the 11th consecutive time since the beginning of 2022 and raise the federal funds rate to 5.5%, the highest level since 2022. Will this shot of monetary restraint be the last one? Or will the FOMC's June forecast of borrowing costs rising to 5.75% be realized after all? The fate of forex dollar pairs, including EUR/USD, depends on this. It's no wonder investors are so concerned while the euro swings between hot and cold.

The decline of the regional currency contradicts the dynamics of the U.S. stock market. It is rising, with the Dow Jones index marking its longest 12-day winning streak since 2017. One more day and it will set a record since 1987. Normally, in such conditions, the global risk appetite helps EUR/USD. But not now. This proves that the strength of the main currency pair is not based on the strength of the U.S. dollar, but on the weakness of the euro. Indeed, disappointing statistics on business activity in the eurozone and the business climate in Germany have once again sparked discussions about a recession in the currency bloc. How can EUR/USD grow against such a backdrop?

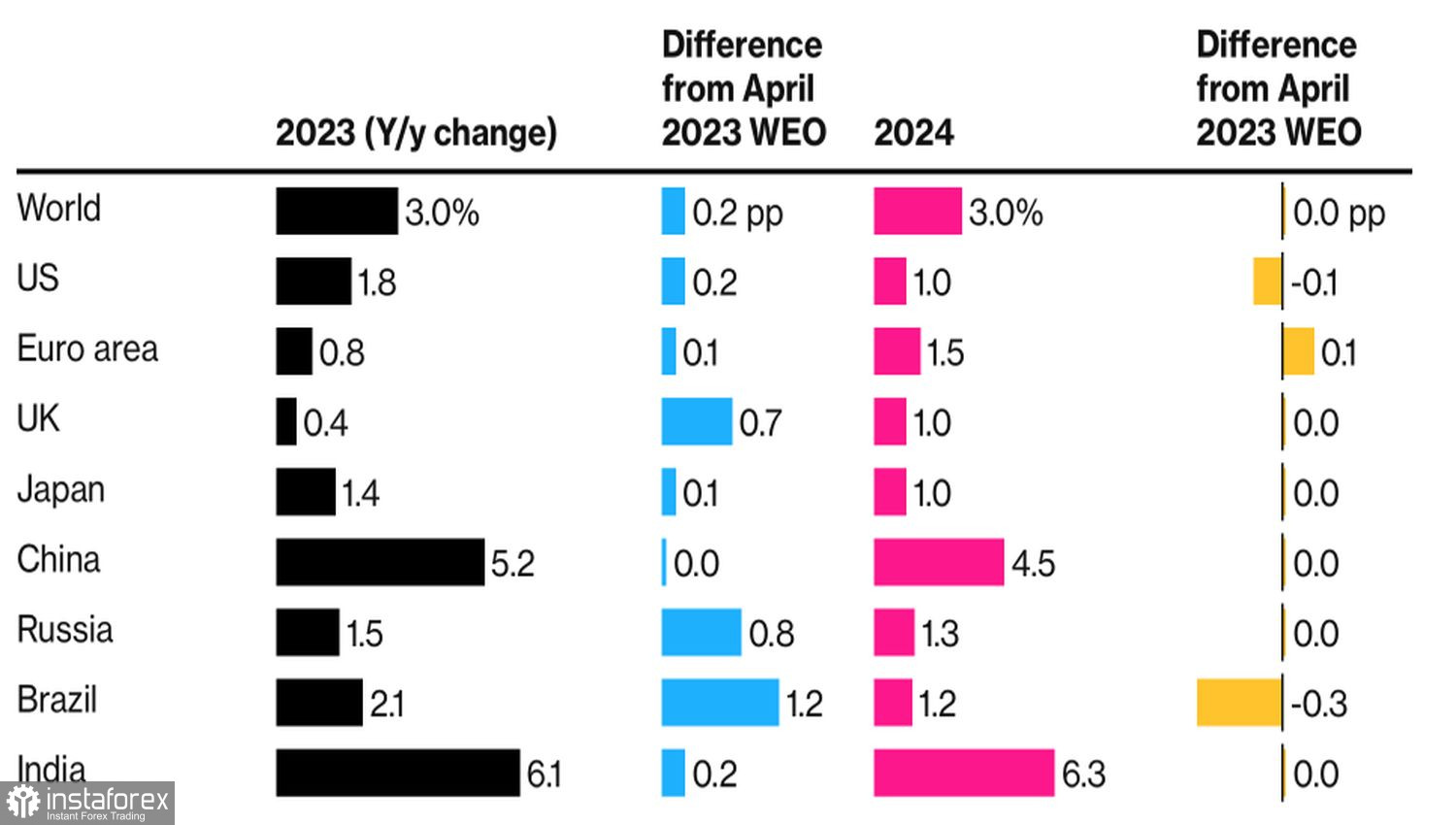

However, these surveys are based on the perceptions of purchasing managers, the German IFO Institute, and other organizations, and the actual situation may be different. In this regard, the IMF's upward revision of the eurozone's GDP forecast for 2023 from +0.7% to +0.8% supports the "bulls" for the regional currency. According to the authoritative organization, the currency bloc will expand faster than the USA in 2024. If so, the long-term prospects for EUR/USD are "bullish."

IMF's GDP forecasts for various countries in the world

Moreover, the International Monetary Fund has improved its assessments of the American and other economies, stating that Britain will avoid a recession and raising the global GDP forecast for 2023 to 3%. This is lower than the 3.5% in 2022 and the average of 3.8% over the last decade. However, it's far from 2%, which is usually associated with a downturn in one or more major world economies. The IMF looks optimistically towards the future. Considering the euro's status as a pro-cyclical currency, this is excellent news for EUR/USD.

On the other hand, the U.S. dollar is likely to weaken. If the Federal Reserve concludes its cycle of tightening monetary policy in July, investors will eventually raise the topic of a "dovish" pivot. If it doesn't, the return to times of rapid rate increases will not happen. The glory days of the USD index are in the past. While it might still show some strength in the short term, it will likely lose its previously gained positions in the long run.

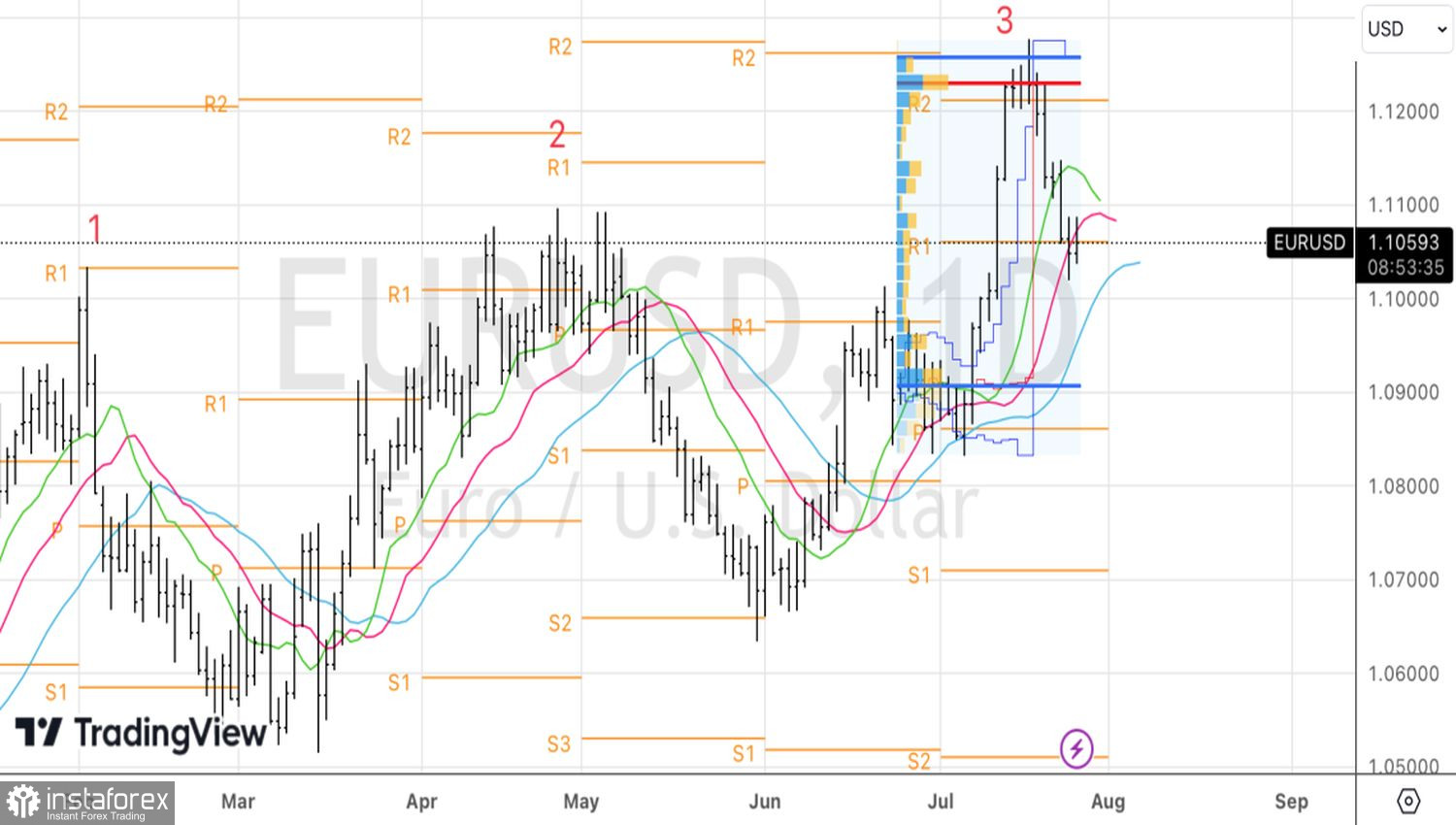

Technically, EUR/USD has not reached the critical level of 1.096, which corresponds to the low of the second Indian bar of the Three Indians pattern. This allows the "bulls" for the main currency pair to hope for a counterattack. Breaking the resistance at 1.109 will initiate it. However, holding long positions from this level should only be done if the day closes above it. Otherwise, we exit the market with minimal losses.