On Wednesday, considering the planned fundamental events, the EUR/USD currency pair showed very weak trading activity. Apart from the announcement of the results regarding the Fed's interest rate and Jerome Powell's speech, there was nothing else of significance scheduled. However, as you would agree, this meeting of the American regulator was once considered a secondary event. Nonetheless, we observed a reaction similar to the business activity indices on Monday. But let's put aside discussions about the Fed's meeting for now and focus on the technical aspects and the upcoming ECB meeting, which will conclude in a few hours.

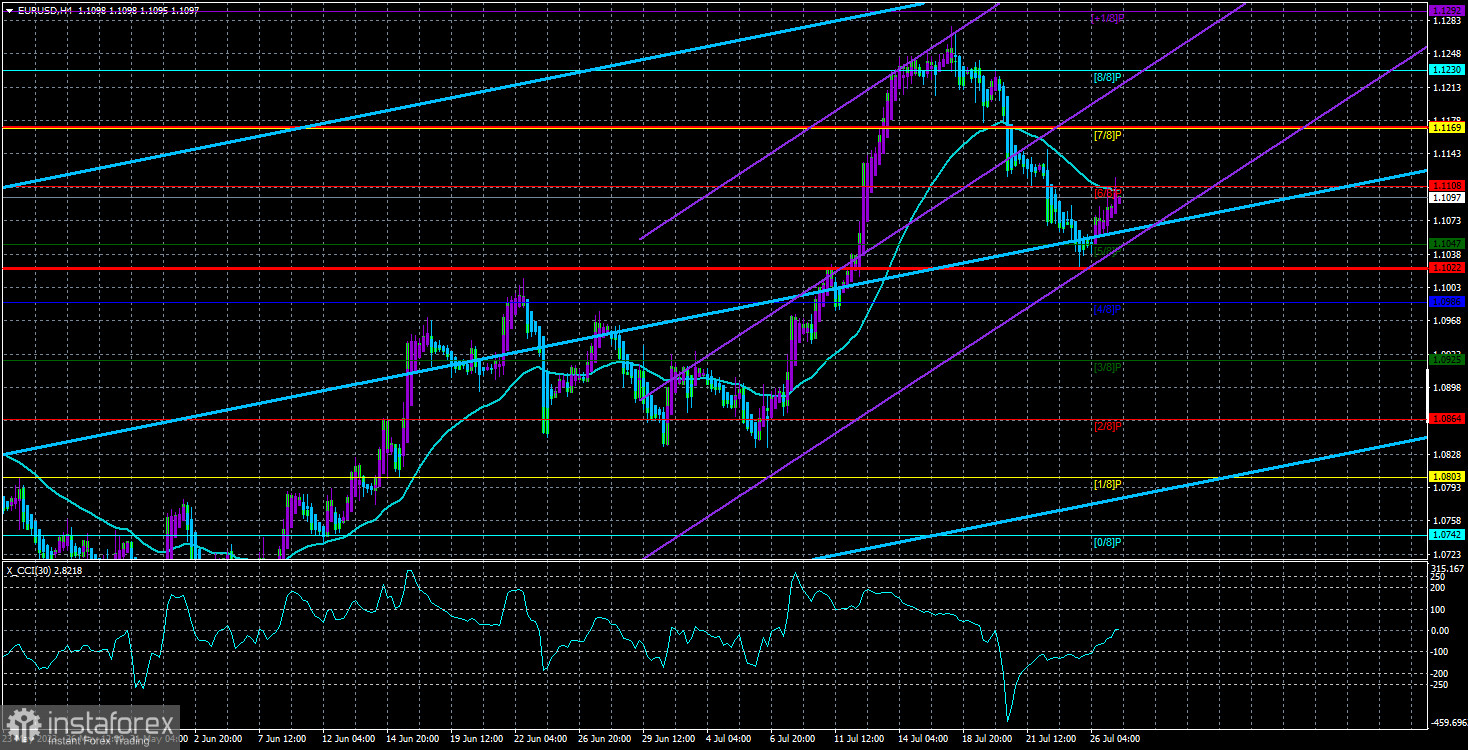

During the previous day, the US dollar experienced a slight depreciation. There is no need to be alarmed, as the pair remained below the moving average line, and Wednesday's volatility was relatively low. Therefore, we only witnessed a minor upward retracement, which may end today if Christine Lagarde's statements lack aggression. However, the oversold condition of the CCI indicator can be considered resolved. Of course, a new decline in the pair might lead to the CCI entering oversold territory again, significantly increasing the chances of resuming the upward trend.

Interestingly, despite the euro's two-week decline, it can also be seen as a simple retracement, evident in the 24-hour timeframe. Historically, the euro has been considered "medium-volatile." New trends tend to start slowly and hesitantly. Despite rising 1750 points in 10 months, we still see no reason for the euro to continue its growth. However, on the daily timeframe, the pair has yet to manage to surpass a critical line that was close. Consequently, we cannot definitively state that the upward trend is over.

Powell has indicated possible additional rate hikes, but what about Lagarde?

In just a few hours, what traders have known for a few months will become official. The European regulator will almost certainly raise the interest rate by 0.25%; logically, this decision is already factored into the market. Similar to the Fed's interest rate hike, which was already expected. Therefore, the market's primary focus will be Christine Lagarde's speech. Today, the rate will increase to 4.25%. Given the current level of inflation, there is no doubt that further tightening is necessary. However, in recent weeks, several of the ECB's monetary committee representatives have expressed doubts about raising rates in the autumn. This may indicate a shift towards the "two meetings - one rate hike" scheme, potentially leading to some pauses. Madame Lagarde is expected to address these questions.

There are several scenarios, and the market had no opportunity to anticipate any of them in advance.

Scenario 1: Lagarde states that the monetary policy tightening will continue both in the autumn and until inflation approaches the target level. This is the most "hawkish" scenario and could lead to a new euro rise.

Scenario 2: Lagarde hints that the rate has already risen high enough, resulting in only one rate hike in two meetings or pauses to avoid a recession in the Eurozone due to excessively restrictive policies. This scenario can be considered "dovish," and the euro may decline in response.

Scenario 3: Lagarde's rhetoric will lack specifics, and the ECB head will limit herself to statements like "everything will depend on incoming data." In this case, the market reaction may be nonexistent or similar to the one after Powell's speech yesterday.

Naturally, it is impossible to predict what Lagarde will say today. The most accurate conclusions about the ECB and Fed meetings should be drawn later in the evening, when the market thoroughly analyzes all the information received and, perhaps, acknowledges some of its mistakes. On the 4-hour timeframe, the euro has a decent chance of continuing its decline, even if we witness an increase today.

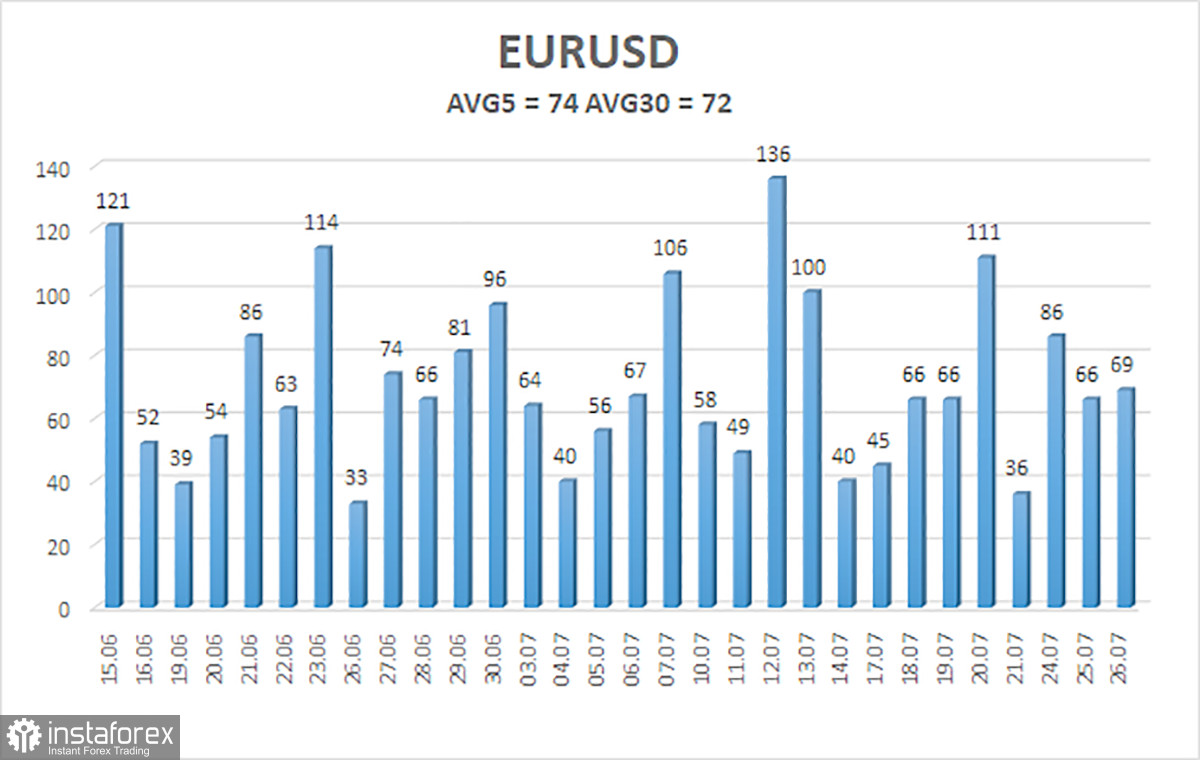

As of July 27th, the average volatility of the euro/dollar currency pair for the last five trading days is 74 points, categorized as "average." Therefore, on Thursday, we expect the pair to move between the levels of 1.1022 and 1.1170. A downward reversal of the Heiken Ashi indicator will indicate the possibility of resuming the downward trend.

Nearest support levels:

S1 - 1.1047

S2 - 1.0986

S3 - 1.0925

Nearest resistance levels:

R1 - 1.1108

R2 - 1.1169

R3 - 1.1230

Trading Recommendations:

The EUR/USD pair has initiated a correction and has encountered the moving average. Currently, traders may consider taking new short positions with targets at 1.1047 and 1.1022 in the event of a price rebound from the moving average. Long positions will only be relevant once the price establishes itself above the moving average line, with a target of 1.1169.

Explanation of the Indicators:

Linear Regression Channels - These assist in determining the present trend. If both channels are directed in the same direction, it indicates a strong trend.

Moving Average Line (settings 20.0, smoothed) - This determines the short-term trend and trading direction.

Murray Levels - These are target levels for price movements and corrections.

Volatility Levels (red lines) - These indicate the probable price channel the pair is expected to trade in the next day, based on current volatility indicators.

CCI Indicator - Its entry into the oversold zone (below -250) or the overbought zone (above +250) suggests an upcoming trend reversal in the opposite direction.