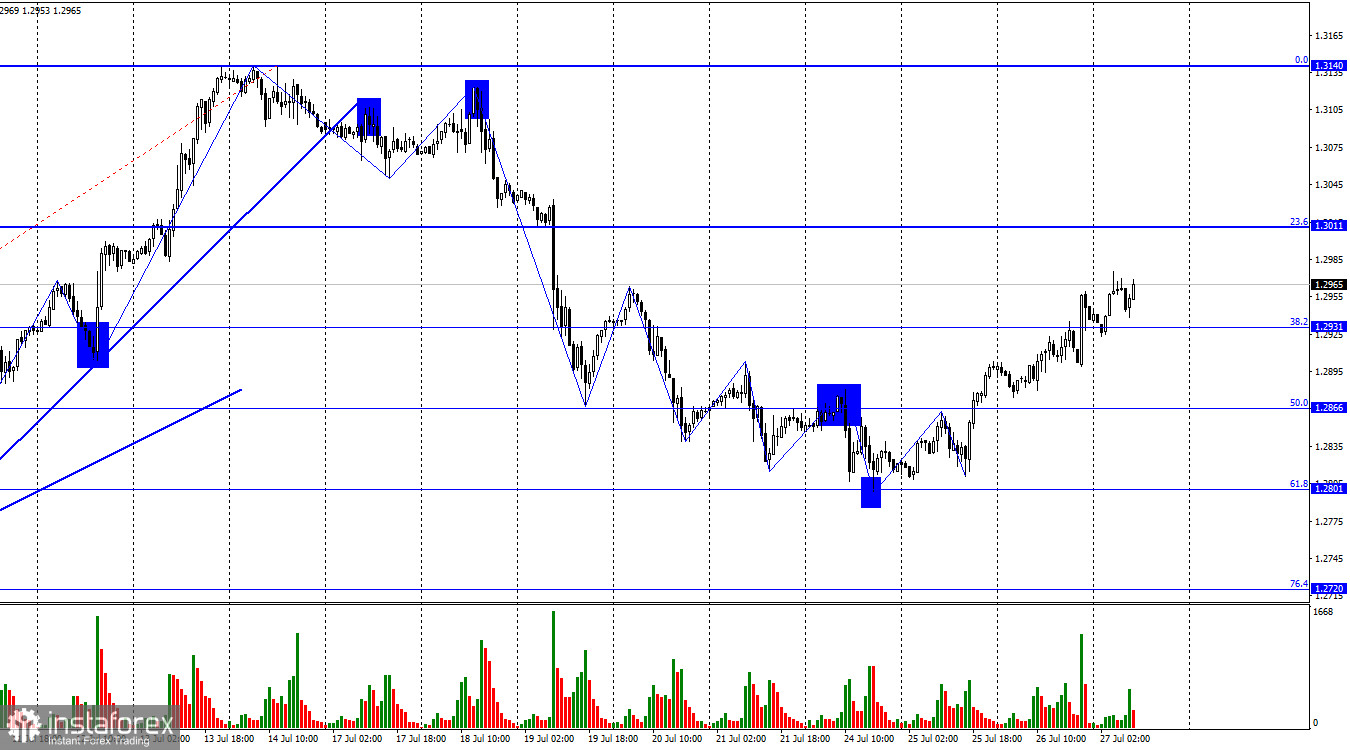

On July 27th, the GBP/USD pair continued its upward movement on the hourly chart and consolidated above the corrective level of 38.2% (1.2931). This indicates that the upward trend may persist toward the next Fibonacci level of 23.6% (1.3011). If there is a rebound from this level, it could favor the US dollar, leading to a slight decline towards 1.2931. However, if the pair closes above 1.3011, the chances of further growth towards the next corrective level of 0.0% (1.3140) will increase.

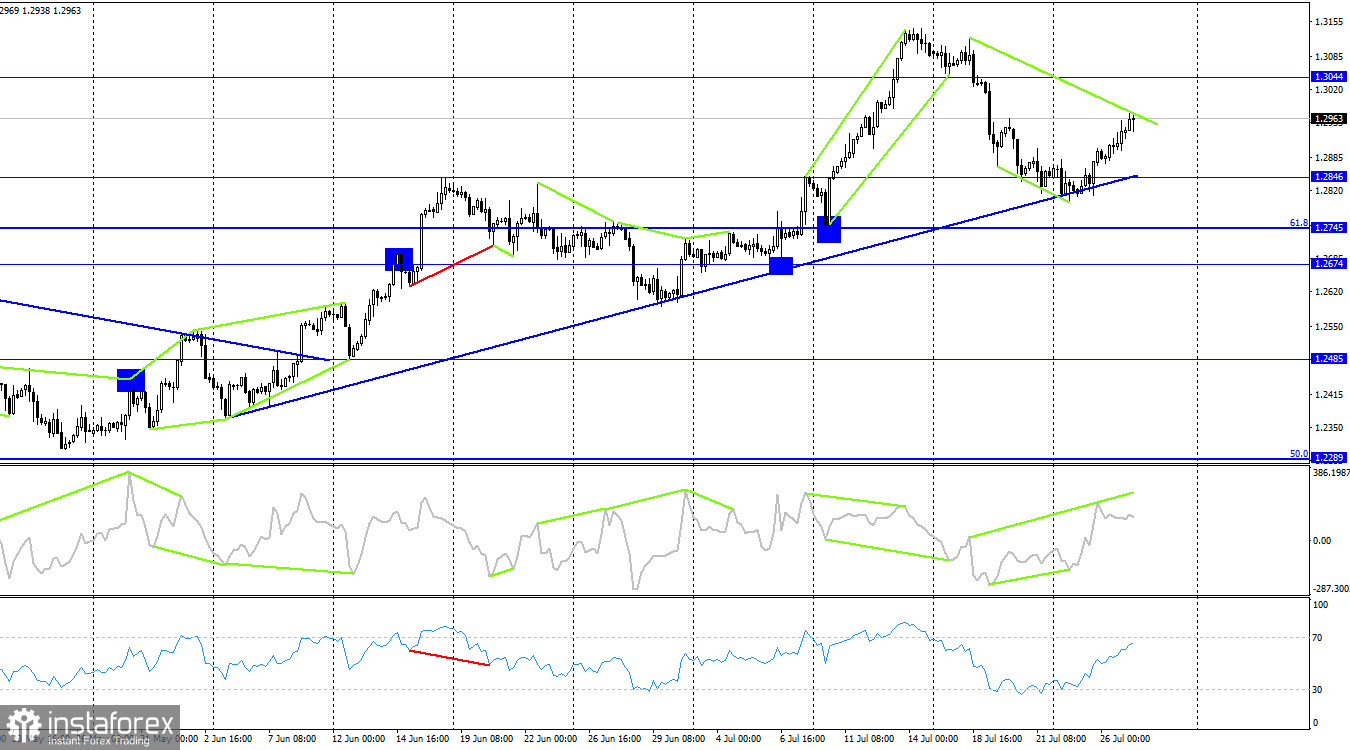

The waves indicated the end of the "bearish" trend a few days ago. A downward wave was formed but failed to break the previous low. Subsequently, the peak of this wave was breached, signaling a trend change to "bullish." Currently, there are no indications of this trend coming to an end.

Yesterday, Jerome Powell tried to maintain a "hawkish" tone for the Federal Reserve. During the press conference, he stated that the rate could be raised several times, depending on inflation and labor market data. However, the market either didn't fully believe the Federal Reserve chairman or had already factored in all the expected rate hikes for 2023, as the American dollar did not experience any significant surge in strength. Powell also mentioned that the American economy will not face a recession and that inflation will remain "above normal" until 2025.

However, this becomes irrelevant if the market is not inclined to buy the dollar. The ECB and Bank of England may raise their rates today and next week. If Lagarde and Bailey take a more "hawkish" stance, nothing will hinder the euro and the pound from continuing their ascent.

On the 4-hour chart, the pair experienced a rebound from the ascending trendline after forming a "bullish" divergence on the CCI indicator. As a result, a new upward trend has started towards 1.3044. At the same time, a "bearish" divergence is forming on the CCI indicator, which could lead to a reversal of the pair downward. However, waiting for confirmation below the trendline is advisable before selling positions. The upcoming days will play a crucial role in determining the future trend.

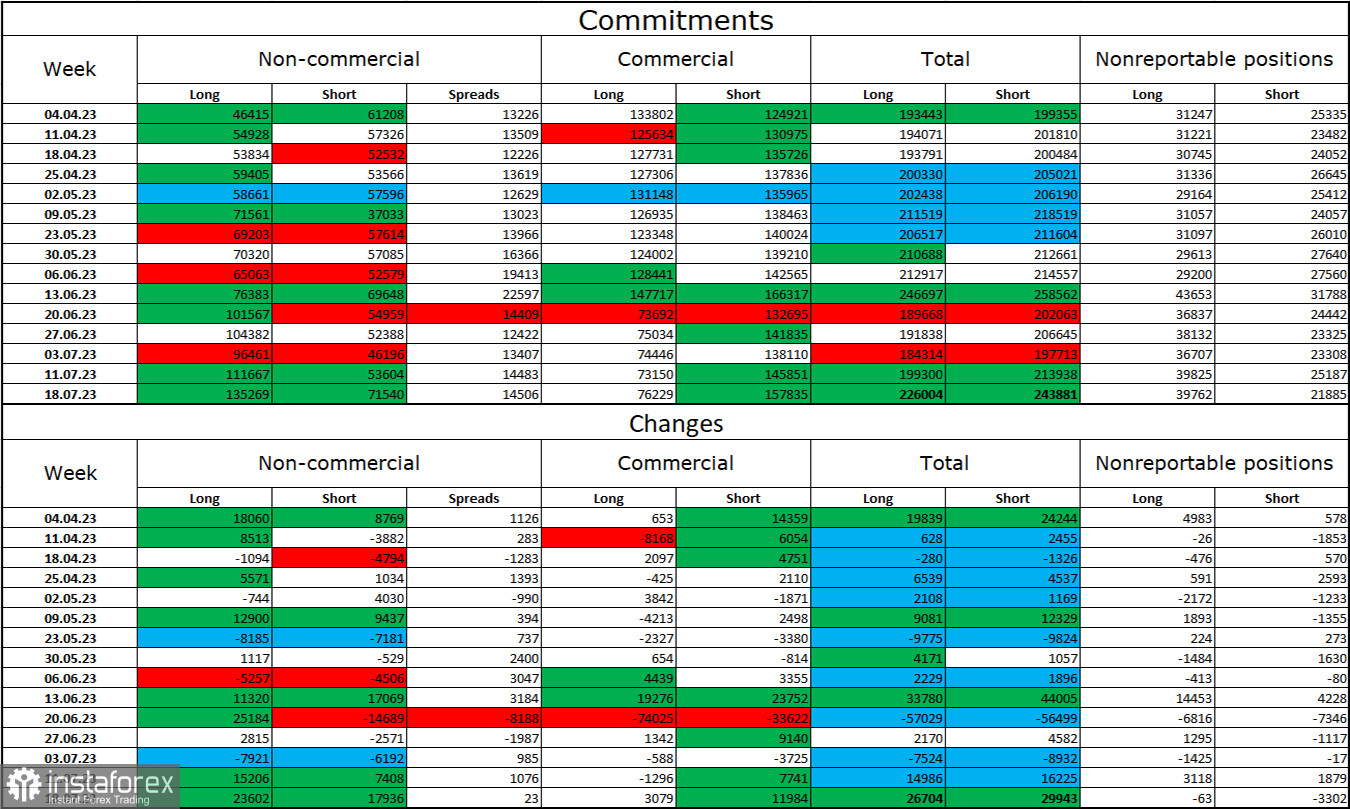

Commitments of Traders (COT) report:

During the recent reporting week, the sentiment of "Non-commercial" traders has turned more bullish. Speculators increased their long contracts by 23,602 units, while short contracts only saw a rise of 17,936. Major players maintain a firmly bullish sentiment, with a significant gap between the long and short contracts: 135 thousand versus 71 thousand. The British pound has favorable prospects for further growth. However, the information background from the UK is not consistently positive – bears may take the lead. Relying on the strong rise of the British pound is becoming increasingly challenging. The market is still neglecting many factors that support the dollar. At the same time, expectations of further rate hikes by the Bank of England primarily drove the pound's rise.

Economic Calendar for the US and UK:

US - Core Durable Goods Orders (12:30 UTC).

US - GDP for the second quarter (12:30 UTC).

US - Initial Jobless Claims (12:30 UTC).

Thursday's economic calendar includes three significant events. Although the US statistics are not likely to heavily impact the dollar, the ECB meeting could lead to a decline in the euro, which, in turn, may affect the pound. The background information could significantly influence the remaining part of the day.

Forecast for GBP/USD and Trader Advice:

I suggested closing GBP/USD sales after the target of 1.2801 was achieved and a rebound occurred. New sales could be considered a rebound from 1.3011, but they should be conservative due to the bullish trend. I recommended buying GBP/USD on a rebound from the level of 1.2801, with a target at the nearest level on the hourly chart. I also considered buying on a close above 1.2866 with a target of 1.2931. All targets have been achieved and exceeded. Currently, holding long positions with a target of 1.3011 is feasible.