EUR/USD

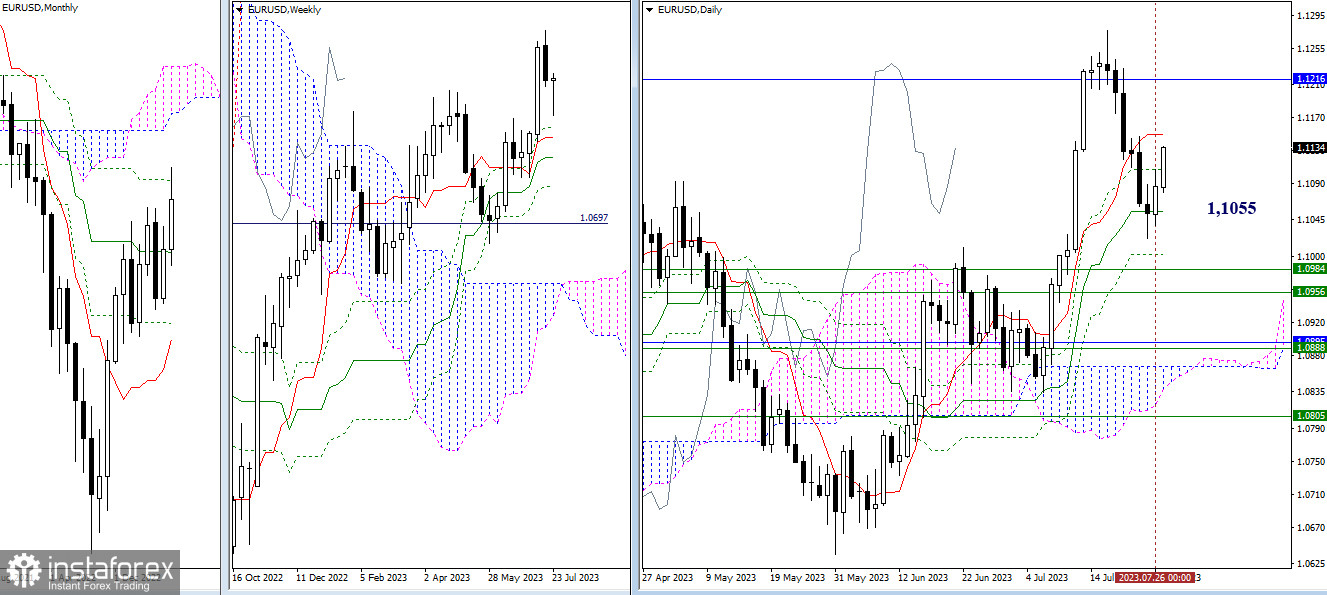

Higher timeframes

The support of the daily medium-term trend (1.1055) halted the decline, allowing buyers to start recovering their positions. The reference points for the development of this direction in the current situation are 1.1149 (daily short-term trend) - 1.1216 (monthly Fibo Kijun) - 1.1276 (high). Changing priorities and returning to the bearish market will first aim to return to the task of breaking through 1.1055, and after that, attention will be focused on weekly supports (1.0984 - 1.0956).

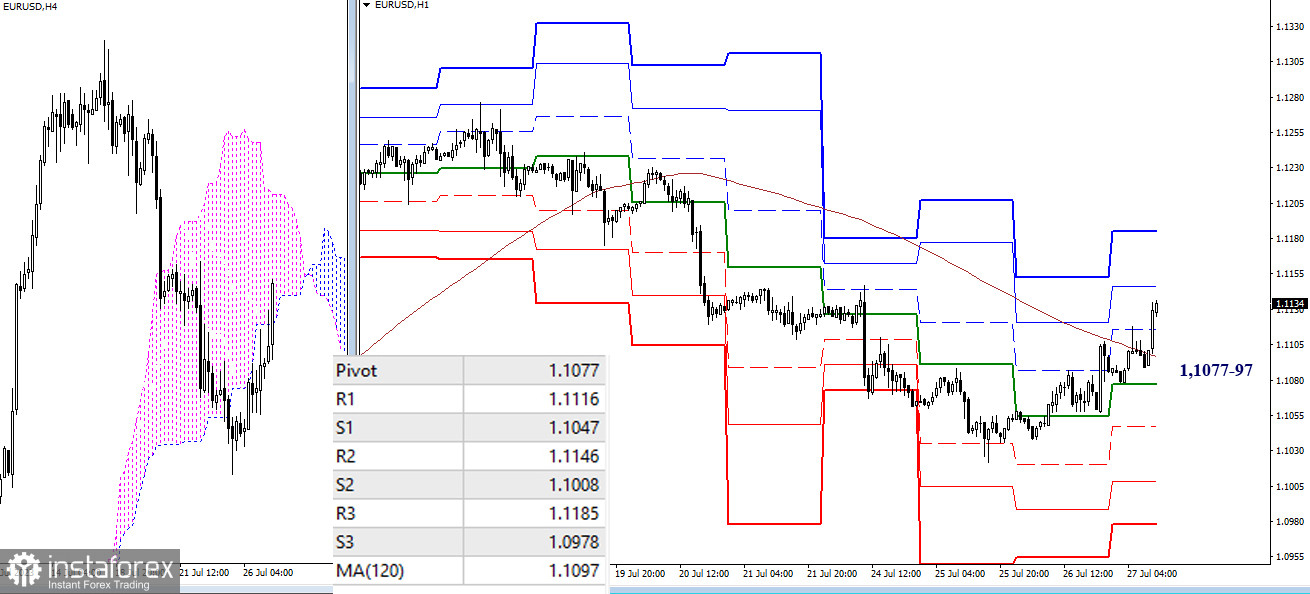

H4 - H1

Bullish players managed to overcome key levels of lower timeframes, which are now combining efforts within 1.1077–97 (central pivot point + weekly long-term trend). The next targets for intraday ascent today could be 1.1146 - 1.1185 (classic pivot points). A change in the balance of power may occur after returning below the key levels (1.1077-97). In this case, the downward targets will be the supports of classic pivot points (1.1047 - 1.1008 - 1.0978).

***

GBP/USD

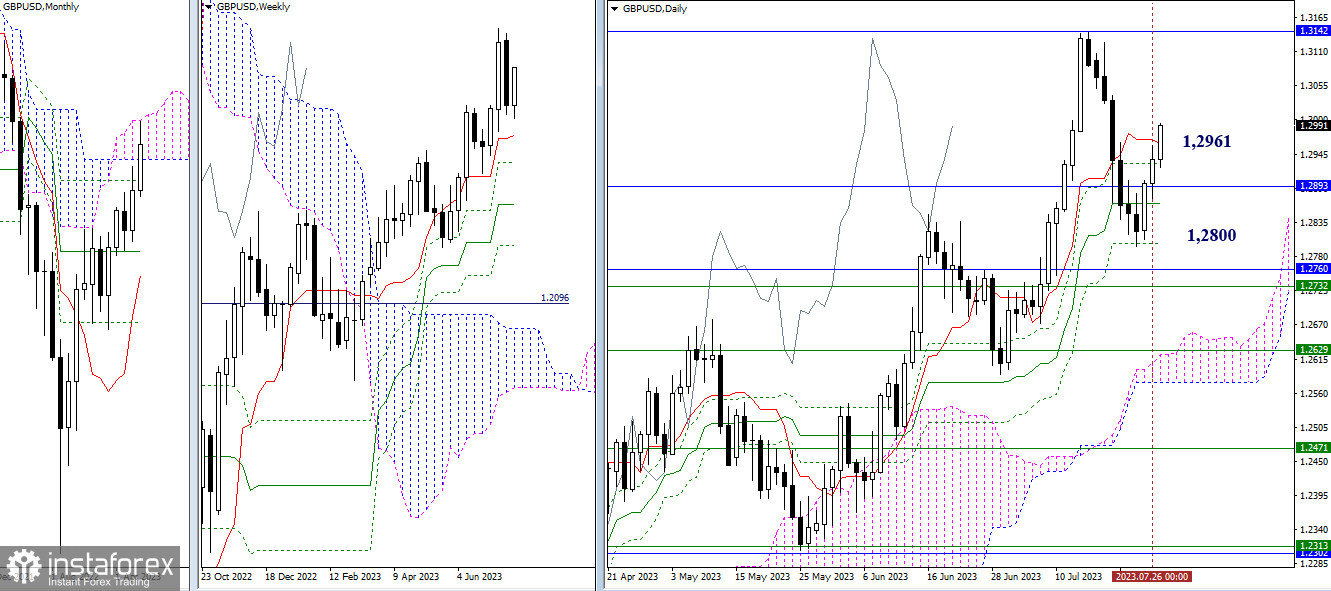

Higher timeframes

Bulls were able to bounce off the final support of the daily Ichimoku cross (1.2800). Today, they are testing the resistance of the daily short-term trend (1.2961). The next target is the upper boundary of the monthly cloud (1.3142). All the nearest levels of attraction and influence today retain their location, and in the event of another shift in sentiment, the pair will encounter support at 1.2931 - 1.2893 - 1.2866 - 1.2800.

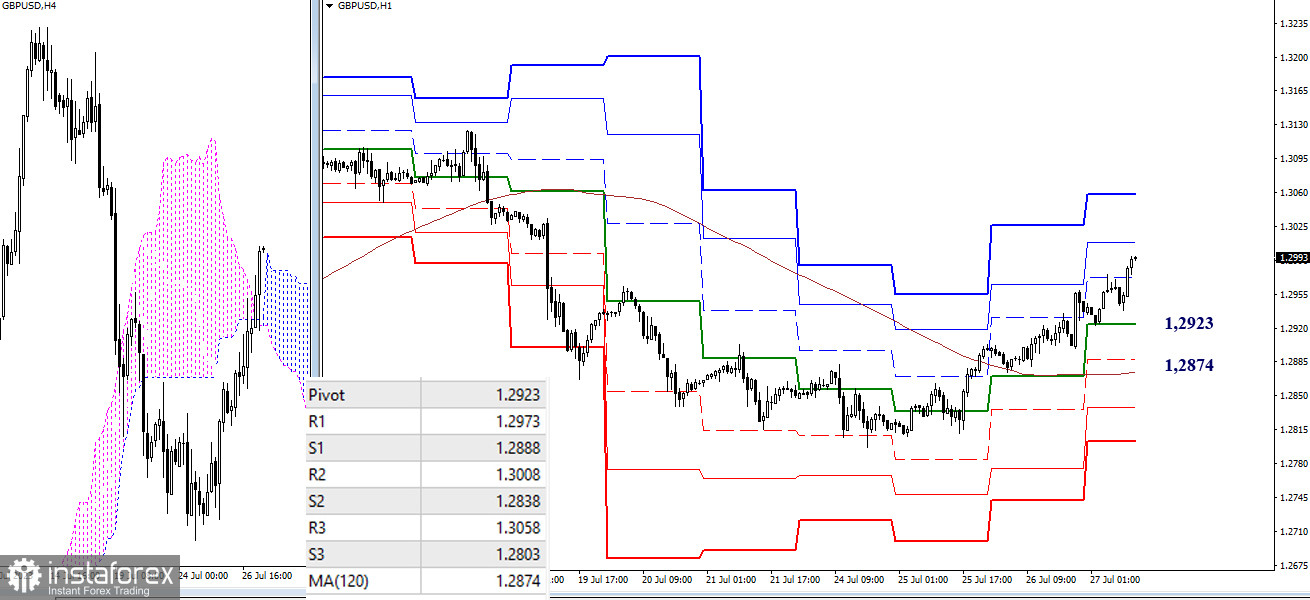

H4 - H1

On lower timeframes, bulls currently have the main advantage. Continuing their ascent, they may reach the final classic pivot points (1.3008 - 1.3058). If the initiative shifts to the opponent, the most important levels of support will be at 1.2923 (central pivot point of the day) and 1.2874 (weekly long-term trend). Consolidation below these levels and a reversal of the moving average could serve as a basis for changing the current balance of power.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)