Yesterday evening, the Federal Reserve (FRS) announced the outcomes of its meeting, and today, the European Central Bank (ECB) followed suit. Both central banks raised interest rates by 25 basis points, and as a result, both currencies reacted with a decline to these decisions. Today, many analysts speculated that Powell's statements needed to be more specific, and there were no commitments to raise rates one or two more times. However, even a hint of future rate increases when the rate is already at 5.5% can be considered a hawkish statement.

So, what exactly did Powell say? He acknowledged the latest inflation report, which showed a decline to 3%, and mentioned that the US economy is no longer under the threat of a recession. However, he should have provided more detailed information about the regulator's future actions. Regarding the September meeting, Powell stated that the rate might be increased, but it would depend on the July and August data concerning the labor market and inflation. This suggests that the Fed chairman is open to one or even two more tightenings. What more do the dollar bulls need to boost the demand for the US currency? Would Powell's promise to raise the rate to 8% be sufficient?

Interestingly, there was no significant decrease in demand for the American currency either. Both pairs have seemingly entered a phase of building downward trend sections. If this is indeed the case, then what we need is an increase in the demand for the dollar, not a decline. Today, two reports from America, one might argue, rescued the US currency. The second-quarter GDP grew by 2.4% (while the market anticipated growth of 1.8%), and the volume of durable goods orders surpassed expectations by almost five times. All of this once again indicates the sound condition of the American economy.

With the approaching end of tightening in the UK and the EU, both pairs should be capable of forming at least descending sets of three waves, if not complete trend sections. The last 12 months have been exceptionally challenging for the US currency, and neither the hawkish statements from the Federal Reserve's Board of Governors, nor the regular rate hikes, or strong reports on the labor market and unemployment have helped the situation. Consequently, even if Powell had pledged to raise the rate five more times yesterday evening, the demand for the dollar could still have declined. Today, by the way, the ECB also raised rates, and yet the euro currency fell. However, two strong reports were released on Thursday in the US, which might have triggered a sudden fondness for the US currency.

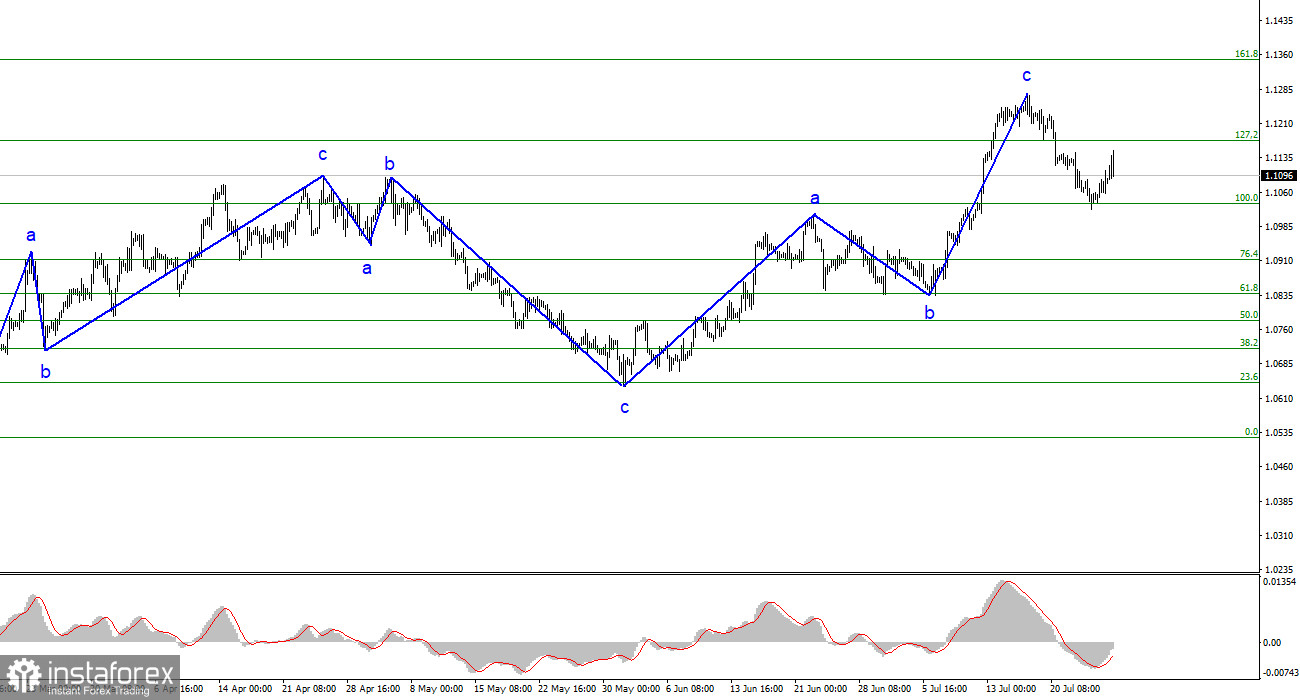

Based on the conducted analysis, the construction of the upward wave set is complete. I still consider targets in the range of 1.0500-1.0600 entirely feasible, and I recommend selling the pair with these targets in mind. The a-b-c structure looks well-formed and convincing, and closing below the 1.1172 level indirectly confirms the formation of a descending trend section. Therefore, I continue to advise selling the pair with targets located below the 1.1034 level. The construction of a new descending wave could have already started or will begin in the coming days.

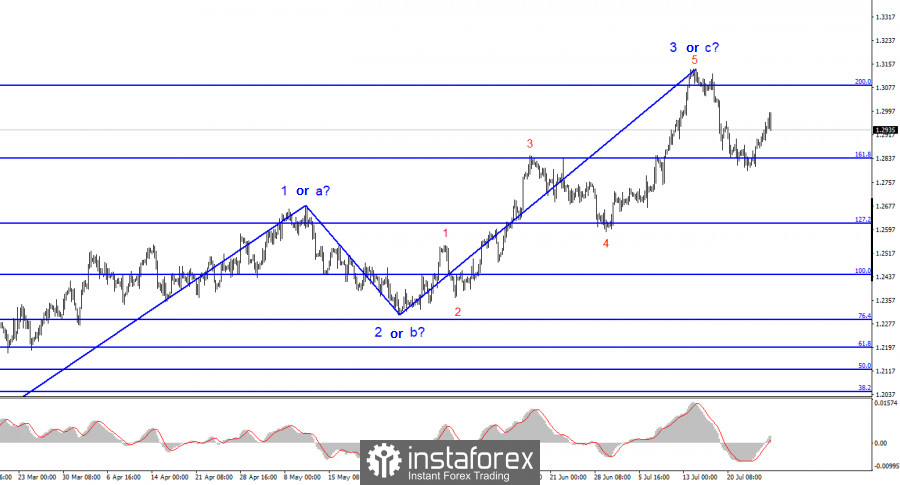

The wave pattern for the GBP/USD pair suggests a decline in the upcoming weeks. Readers could have taken sell positions with the successful breakthrough of the 1.3084 level (top-down), as I mentioned in my recent reviews. Although the 1.2840 level was not exceeded, the upward corrective wave may have already concluded. Consequently, I anticipate a resumption of the decline. The current wave has descended below the peak of wave 3 in 5, indicating the construction of a descending trend section. As a result, selling positions can be taken based on MACD signals "down" or any other reversal signals pointing downward.