Analysis of macroeconomic reports:

On July 28, there will be significant events in the European Union and the United States, particularly on macroeconomic reports. Germany will release data on GDP for the second quarter and inflation today. Although these reports are specific to only one country out of the 27 in the alliance, they are important. Given that the German economy is the strongest among them, the statistics from this country receive greater attention compared to Italy or Spain. A slight growth in GDP and a slight decrease in inflation are expected.

In the United States, data on personal income and spending of the American population will also be released today. These reports are considered secondary, but the personal consumption expenditure price index measures inflation. If this report shows a decline (slowing), it signals a potential decrease in inflation. Therefore, it is considered more significant. Additionally, the University of Michigan's consumer sentiment index will be released in America and may show a considerable increase again. The dollar has an excellent opportunity to build on its success on Thursday.

Analysis of fundamental events:

As for fundamental events, there is little to highlight today. Friday has yet to schedule any important speeches, but there is no doubt that there will be plenty of them next week. The ECB and Fed meetings are behind us, so the "silent mode" for representatives of both central banks' monetary committees is now over.

General conclusions:

A few highly important events will be on Friday, but sufficient statistics will be published to keep the market engaged. Today, the dollar may continue its rise, but for intraday trading, it doesn't matter much in which direction the price will move. The key is for the movement to be strong and trending.

Main rules of the trading system:

- The signal's strength is determined by the time it took to form the signal, whether it was a rebound or a level breakthrough. A shorter formation time indicates a stronger signal.

- If multiple trades were opened based on false signals near a particular level, all subsequent signals from that level should be disregarded.

- During a flat market, any currency pair may generate numerous false signals or none at all. When the first signs of a flat market appear, it is better to refrain from trading.

- Trading positions are opened between the start of the European session and the middle of the American session, and all trades should be closed manually.

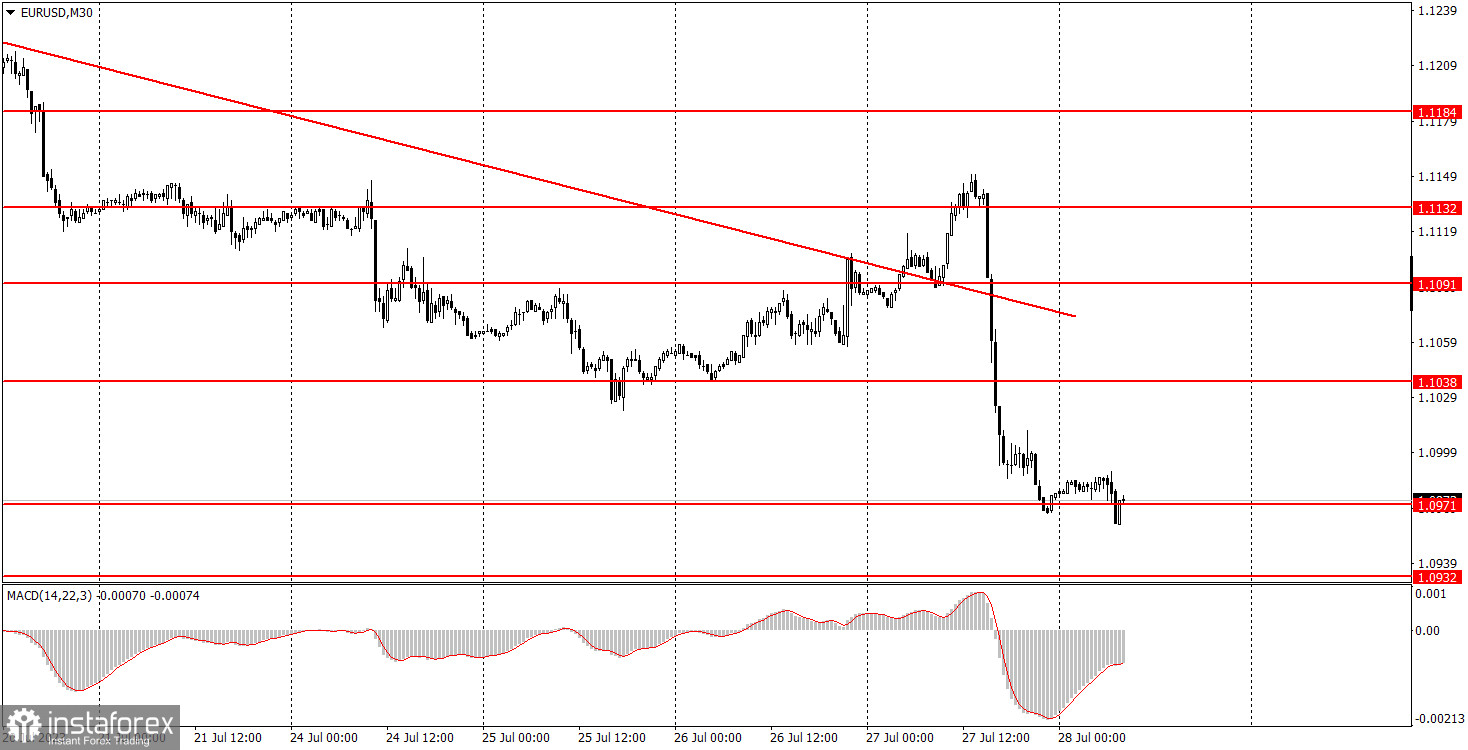

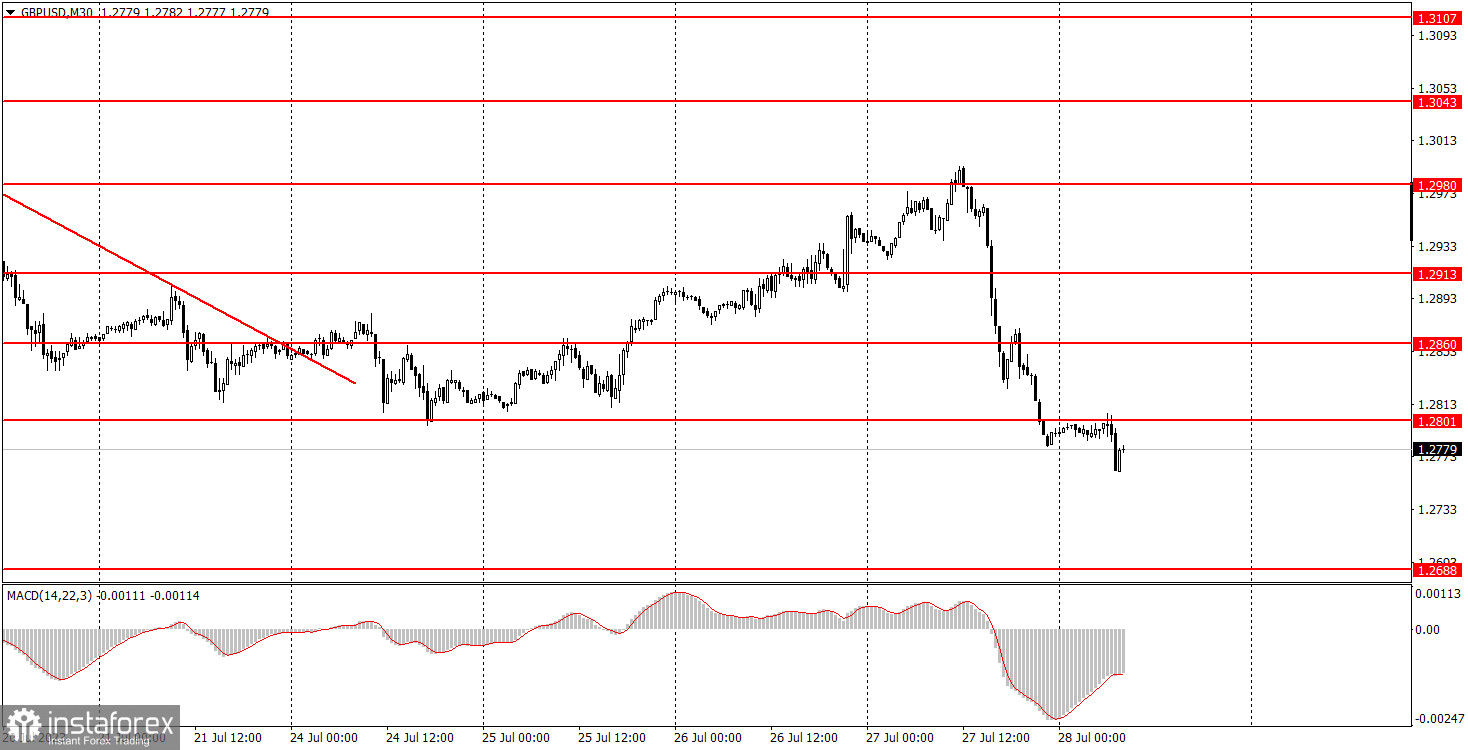

- In the 30-minute timeframe, trading signals based on the MACD indicator are valid only when there is good volatility and a confirmed trend supported by a trendline or channel.

- If two levels are located too close to each other (within 5 to 15 pips), they should be considered as a support or resistance zone.

Chart elements:

Support and resistance levels - these levels act as targets when initiating buy or sell positions. Take Profit levels can be placed around them.

Red lines - channels or trendlines that indicate the current trend and the preferred trading direction.

MACD indicator (14, 22, 3) - histogram and signal line - an additional indicator that can generate signals.

Important speeches and reports (always found in the news calendar) can significantly influence the movement of currency pairs. Therefore, it is advisable to trade with utmost caution during their release or consider exiting the market to avoid sudden price reversals against the prevailing trend.

Novice forex traders should remember that not all trades will be profitable. Developing a clear strategy and implementing proper money management is crucial for long-term trading success.