Despite the strong blow dealt to the euro by the European Central Bank, there was a pullback on Friday. Yes, it was within the framework of a typical technical rebound, but during her press conference, ECB President Christine Lagarde spoke so much that an attempt to stabilize the market around the levels reached on Thursday seemed more realistic. Nevertheless, the rebound happened, and now investors can confidently focus on the GDP data of the eurozone published today.

Eurozone GDP Change

Of course, we are talking about preliminary estimates, but it is the first estimate that has the greatest impact. Subsequent ones may only make minor adjustments. According to forecasts, the pace of economic growth may slow down from 1.1% to 0.6%. These forecasts may be somewhat surprising at first, especially since even the German government has acknowledged the fact that the German economy is sliding into recession. However, we are not talking about Germany alone; we are talking about the entire eurozone, where economic decline has not yet begun in all countries, or to be more precise, practically nowhere. But the dynamics are clearly not comforting. It seems that a recession awaits all members of the currency bloc.

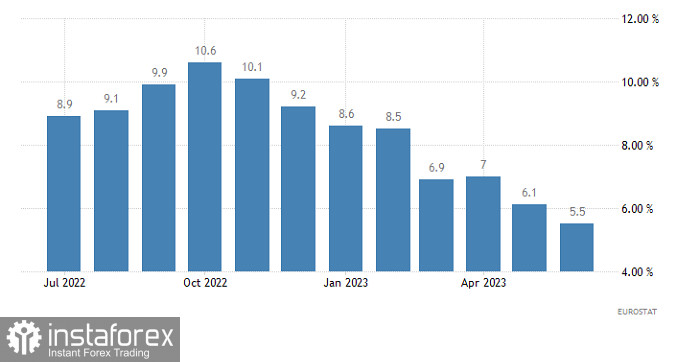

Inflation in the Eurozone

Simultaneously with the first GDP estimate, preliminary data on inflation will also be released, which is likely to slow down from 5.5% to 5.2%. This also does not bode well for the single European currency. It turns out that the pace of economic growth is slowing down along with the growth of consumer prices, which practically rules out the possibility of further interest rate hikes by the European Central Bank. Therefore, macroeconomic statistics should somewhat confirm the investors' concerns that arose immediately after Christine Lagarde's recent press conference. The euro is likely to go further down.